20% Of The World Could Have Digital Cash In Three Years: BIS

While most traders and finance pros are distracted by the ongoing war between Wall Street and Wall Street Bets which sparked market moves and short squeezes which until last week were viewed as unthinkable, we should remember that for all its entertainment value the crusade of a few millions GenZers is a sideshow which can be shut down with the flick of a switch.

Indeed, tonight's main event, which saw the most heavily shorted stocks tumble the moment the r/WallStreetBets subreddit went dark (or rather "private") only to rebound once the forum reemerged, demonstrated just how easy it is for both Silicon Valley and Wall Street to silence these upstart voices and return to market to "normal." And all they have to do is to claim that there is "hate speech" on the forum - a truly shocking discovery within the testosterone-heavy world of male traders - as Discord did when it shut down the WSB server earlier today.

In any case, while we all keep an eye on what Gamestop does next, we should always remember that the people in charge are those that print the money, namely the world's central banks. And today, in all the chaos surrounding the latest most shorted meltups, there was some critical news which most missed yet which will have far greater consequences on the future of the world then where GME closes tomorrow.

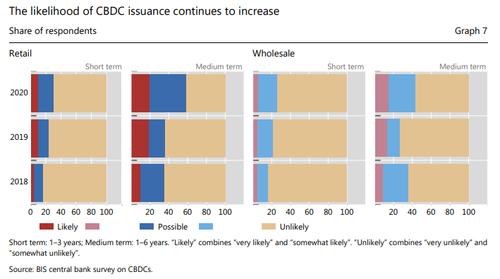

According to a survey conducted by the central banks' central bank, the Basel-based Bank for International Settlements (profiled in "Meet The Secretive Group That Runs The World"), central banks representing one-fifth of the world’s population are likely to issue their own digital currencies in the next three years.

The push for digital currencies - which as we - and DoubleLine - explained last year is the final move in the radical overhaul to the established monetary system and which will unleash far higher inflation - comes as authorities look to fend off the threat to their money-printing powers from bitcoin and efforts linked to Big Tech such as the Facebook-backed Diem, formerly Libra. In fact, just today, Agustin Carstens, the general manager of the BIS - condemned bitcoin as "a combination of a bubble, a Ponzi scheme and an environmental disaster" and said it was "piggybacking" on mainstream institutions and becoming a "threat to financial stability", an attempt to demonize Bitcoin as if it is somehow worse than central banking itself.

At the same time, central banks who have taken interest rates negative are looking at whether digital cash could be used to help implement the radical policy. Because in a world with trillions in paper money, the easiest way to circumvent punitive interest rates is simply to hold cash in one's safe. Digital currencies would promptly do away with that.

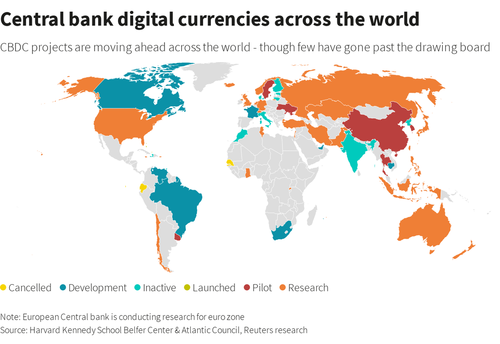

As Reuters reports, Wednesday’s BIS survey of 65 central banks showed 86% were exploring the benefits and drawbacks of digital currencies, with some testing possible designs. Translation: we are just years away from global implementation.

And while the survey showed that emerging and developing economy central banks are more likely than those in major economies to issue central bank digital currencies (CBDCs), the reality is that it is precisely the developed nations whose central banks are desperate for "blockchained" control over currency in circulation, and its digitalization, especially when another massive stimulus has to be unleashed. As we explained previously, such a digital deposit of dollars - which would circumvent the Treasury (and Congress) - by the Fed, is precisely what central banks hope to enact after the next financial crisis in order to spark a reflationary wave.

Indeed, as the survey also showed a number of bigger countries have also been testing the waters, with China the most advanced.

A fifth of central banks from major economies that responded to the survey said issuing digital currencies was “possible” in the short or medium term, up from only one last year. Expect this number to rise to 100% in the coming months.

Meanwhile, as we reported last year, the People’s Bank of China expanded a trial of a digital renminbi to its three largest urban regions, which together contain 400 million people, in August. ECB President Christine Lagarde said last week her bank was pushing on with its work on a digital euro, Sweden’s E-Krona is progressing and even Jerome Powell has said the Fed is carrying out experiments for a digital dollar.

To be sure, there are still hurdles to overcome, first and foremost the widespread resistance that would emerge once central banks declare paper currency void.

The BIS survey also showed that over a quarter of central banks do not currently have the authority to issue a CBDC and about 48% remain unsure, although both those numbers can easily move higher if the need was there. Separately, around 60% of banks see themselves as unlikely to issue any type of digital currency in the short or medium-term.

As a whole, though, “central banks are moving into more advanced stages of CBDC engagement, progressing from conceptual research to practical experimentation,” the survey said.

And while we wait for the catalyst that moves the global economy into a digital payment format, last October the Bahamas became the first country to launch a general purpose CBDC, known as the Sand Dollar. Many others will follow suit.

https://ift.tt/3t3gdHu

from ZeroHedge News https://ift.tt/3t3gdHu

via IFTTT

0 comments

Post a Comment