We Have Some Bad News For Gamestop Shorts

We have some bad news for GME shorts.

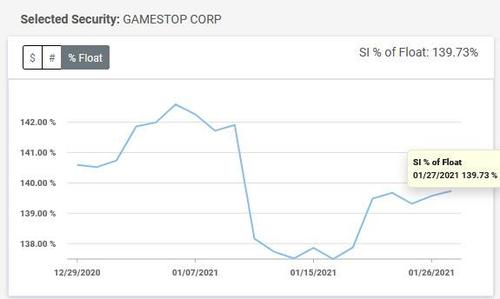

Despite the posturing that this or that hedge fund has covered its Gamestop exposure, new shorts have simply taken their place, and as Ihor Dusaniwsky, head of S3 Partners which provides daily short interest tracking in real-time notes, the short interest - after all the recent fireworks - is still a whopping 139.7%...

$GME short int is $10.64B; 71.88M shs shorted; 139.73% of Float; 58.29% S3 SI% Flt; 38% fee & rising. Shs shorted up +1.61M shs, +2.30%, over last 30 days & up +787K shs, +1.11%, last week. Shorts down -$23.82B in 2021 mark-to-market losses; down -$14.52B on today's +137% move. pic.twitter.com/950IgjofyQ

— Ihor Dusaniwsky (@ihors3) January 27, 2021

... which is actually the highest print in the past few days!

What is perhaps even more stunning is that after the borrow fee on GME shorts was around 30.6% earlier this week...

... it has since soared to 100% and in some cases as much as 250% for new shorts (existing shorts still pay "only" 30-50% borrow) according to Dusaniwsky. This means that it is now effectively suicidal to short GME (even if one can find the loaned shorts), as the cost of carrying the short is staggering, and it is equal to the nominal short every 5 months.

Seeing some new stock borrows going at over 100% fee and even hitting 250% fee today. https://t.co/vQqMMx3hhj

— Ihor Dusaniwsky (@ihors3) January 27, 2021

The high stock borrow fees only hastens and amplifies the eventual short squeeze that may occur. https://t.co/OYzOBHpJKw

— Ihor Dusaniwsky (@ihors3) January 27, 2021

And while the exploding cost to borrow is catastrophic, the real punchline, as we noted earlier this week, is that the primary catalyst behind the initial WallStreetBets raid in the first place - the company's massive short overhang - has not shrunk one bit (and has actually increased). In other words, as Dusaniwsky puts it, "This has been a long-buying rally and not a short squeeze rally!Panda face."

Translation: the real short covering hasn't even started yet!

It also means that the real parabolic move higher in GME has yet to come.

https://ift.tt/36ifVmr

from ZeroHedge News https://ift.tt/36ifVmr

via IFTTT

0 comments

Post a Comment