"Eventually, The Party Ends" - Buffett Releases Annual Letter, Repurchases 5% Of BRK Shares In 2020

Warren Buffett, published his annual letter to Berkshire Hathaway shareholders on Saturday. The billionaire has been updating his shareholders in the same format for more than six decades.

The 90-year-old began on a slightly dour - clearly political - tone:

"We retain our constitutional aspiration of becoming 'a more perfect union.' Progress on that front has been slow, uneven and often discouraging. We have, however, moved forward and will continue to do so,"

But then the "Oracle of Omaha" rotated wisely back to 'f**k yeah Murica' mode:

"Today, many people forge similar miracles throughout the world, creating a spread of prosperity that benefits all of humanity. In its brief 232 years of existence, however, there has been no incubator for unleashing human potential like America," Buffett wrote.

"Despite some severe interruptions, our country's economic progress has been breathtaking."

"Our unwavering conclusion: Never bet against America," he said.

Here are some of the key points outlined in the letter to shareholders:

On the stock market:

"Investing illusions can continue for a surprisingly long time. Wall Street loves the fees that deal-making generates, and the press loves the stories that colorful promoters provide."

"Eventually, of course, the party ends, and many business 'emperors' are found to have no clothes."

On the bond market:

"Bonds are not the place to be these days ... Fixed-income investors worldwide – whether pension funds, insurance companies or retirees – face a bleak future."

On the economy:

"Despite some severe interruptions, our country’s economic progress has been breathtaking."

On the energy markets:

"[O]ur country’s electric utilities need a massive makeover in which the ultimate costs will be staggering."

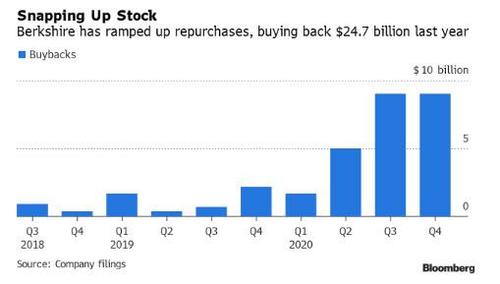

Notably, after buying back a record $9 billion of its own shares in Q3, Berkshire was unable to find attractively priced investments, and continued the buyback spree repurchasing a similar amount in Q4, bringing its annual buyback for 2020 to a record $24.7 billion. "Berkshire made no sizable acquisitions and operating earnings fell 9% We did, though, increase Berkshire’s per-share intrinsic value by both retaining earnings and repurchasing about 5% of our shares."

And unable to find better investments, Buffeett has continued to repurchase its own stock, :

“Berkshire has repurchased more shares since year-end, and is likely to further reduce its share count in the future. That action increased your ownership in all of Berkshire’s businesses by 5.2% without requiring you to so much as touch your wallet.”

The letter comes days after the Vice Chairman of Berkshire Hathaway Charlie Munger sounded off about the "wild speculation" in markets.

"I hate this luring of people into engaging in speculative orgies. [Robinhood] may call it investing, but that's all bullshit," Munger said on Thursday.

"It's really just wild speculation, like casino gambling or racetrack betting. There's a long history of destructive capitalism, these trading orgies whooped up by the people who profit from them."

Munger will be on stage with Buffett at the annual meeting to answer questions in May - we're assuming he will continue his spat with Robinhood.

Read the entire letter below:

https://ift.tt/3kurbBN

from ZeroHedge News https://ift.tt/3kurbBN

via IFTTT

0 comments

Post a Comment