Crypto Carnage Continues As 'Whale Wars' Rage

The crypto market is continuing to suffer significant losses this weekend as rate-hike-anxiety in the stock market, driving big-tech/growth stocks into the ground, is spilling over into other high momentum markets. But a 'whale war' may be the biggest immediate driver as institutions, HODL Whales, and miners battle one another.

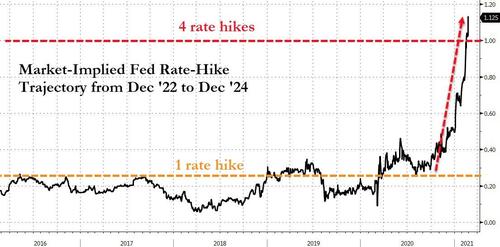

As market expectations for rate-hikes (amid soaring inflation) have soared...

Source: Bloomberg

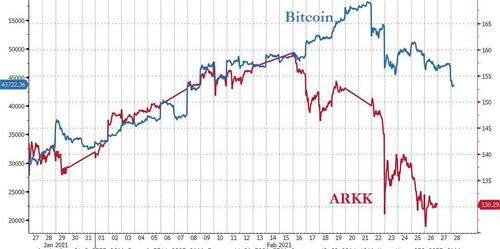

That has hit high growth, high momentum stocks...

Source: Bloomberg

And Cathie Wood's recent demise is not helping...

Source: Bloomberg

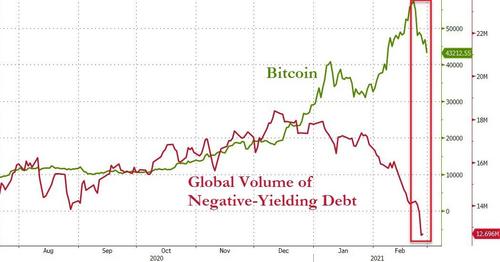

And reduced the size of global negative-yielding debt (reducing the attractiveness of zero-yielding crypto)...

Source: Bloomberg

That anxiety has weighed directly on crypto with bitcoin back below $45,000 for the 3rd time in the last week (back to levels seen when Elon Musk announced Tesla's big BTC holdings)...

Source: Bloomberg

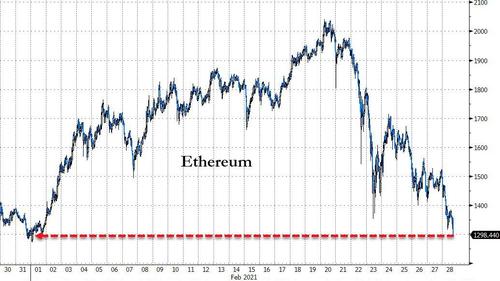

But Ethereum is getting monkey-hammered, back below $1300 for the first time since January...

Source: Bloomberg

But the relative underperformance of ETH has erased all of the 2021 'DeFi Boom' gains over BTC...

So it’s all red today. But we’re all in it for the technology, right?

Source: Bloomberg

But, away from the inter-market spillovers, Crypto-news-flash.com reports that as CryptoQuant CEO Ki Young Ju discussed, a whale war is currently raging between US institutional investors, BTC whales, and miners over “who got the real power.”

US institutional investors are giving a clear “buy” signal through Coinbase outflows as well as the Coinbase price premium.

BTC whales are also in a buying mood at current levels as evidenced by BTC reserve and stablecoin inflow transactions.

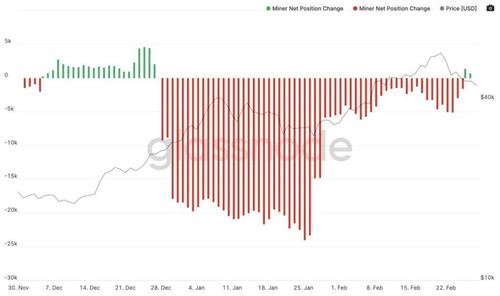

However, once again the mining sector seems to have a different opinion. As Ju elicited, miner outflows and miner to exchange flows are giving a clear “Sell” signal.

It's a whale war, and you know who got the real power.

— Ki Young Ju 주기영 (@ki_young_ju) February 28, 2021

US Institutional Investors

- Coinbase Outflow = 🟢STRONG BUY

- Coinbase Premium = 🟢BUY

BTC Whales

- BTC Reserve = 🟢BUY

- Stablecoin Inflow TXs = 🟢BUY

Miners

- Miner Outflows = 🔴 SELL

- Miner to Exchange Flows = 🔴 SELL pic.twitter.com/fhVBp8qocm

Mining pool owners, such as F2Pool, who have been the focus of attention in recent weeks, are not to blame, however, as Ju points out. The outflows come “from affiliated miners who have participated in the mining pool at least once.”

But as Moskovski Capital analyst and CEO Lex Moskovski first observed yesterday, the trend may be turning. After Friday became the first day in two months (since December 27) when miners’ position change turned positive, the trend was confirmed yesterday (Saturday) as well. Moskovski shared the chart below from Glassnode and stated:

Miner pools are still accumulating on aggregate. Yesterday there was another positive MNPC. Despite some selling pressure today the outlook is still positive.

Source: https://twitter.com/mskvsk/status/1365919940121931777

Even though it seems that the war conjured up by Ju could end, this is not yet reflected in the Bitcoin price at the moment. Therefore, all eyes could possibly be on tomorrow, Monday, when institutional investors return. As technical analyst Josh Rager noted, Sunday and Monday are notorious for large price moves.

So it’s all red today. But we’re all in it for the technology, right?

All red today. But we are all in it for the technology, right?

— CZ 🔶 Binance (@cz_binance) February 28, 2021

https://ift.tt/3uFmvxP

from ZeroHedge News https://ift.tt/3uFmvxP

via IFTTT

0 comments

Post a Comment