"It's Bananas" - 72% Of US Homebuyers Say Pandemic Disrupted Plans

Americans have been fascinated by market trends during the pandemic era, as everything from bitcoin, to baseball cards, is seeing prices rise, and central bankers like Jerome Powell have been repeatedly forced to swat away questions about asset bubbles.

And one of the most interesting markets - perhaps because millions have been confined almost exclusively to their homes during the quarantines and repeated waves of COVID-19 - has been real estate, as urban markets have seen their luster fade, while suburban areas are suddenly hot again.

The other day, the LA Times and other media outlets published a story explaining how falling rents in San Francisco are starting to draw tenants back from nearby Oakland. In fact, some parts of San Francisco are actually cheaper than parts of Oakland now.

Even on a foggy San Francisco morning, the view from Scott Simmons' 25th-floor apartment stretches from downtown to Golden Gate Park. The home of the 42-year-old tech worker is also spacious for a one-bedroom, featuring hardwood floors, new appliances and granite countertops.

A year ago, when he was sharing a two-bedroom place with his brother, Simmons couldn’t have imagined living in an apartment like this one. But last fall, when Simmons heard about big rent declines during the COVID-19 pandemic, he discovered he could get way more for his money in the heart of San Francisco than in the neighborhood where he was doubling up in Oakland.

"It’s bananas," Simmons said. "I never thought I was going to be someone who was going to have a nice view. It’s a luxury."

In a survey from Improve.net in partnership with CraftJack found that the pandemic had a serious impact on prospective homeowners and their ability to move ahead with plans to buy. According to the survey, 72% of prospective buyers- basically everyone in the Gen Z and Millennial generations - among the sample of Americans surveyed said that the outbreak of COVID-19 had disrupted their plans to buy. Here's a breakdown of the study's highlights.

-

72% of prospective homebuyers said their savings plan for a home has been disrupted by the COVID-19 pandemic.

-

54% of prospective homebuyers report that their moving and home buying plans have changed during the pandemic (30% have accelerated vs 24% have slowed or been put on hold).

-

52% say their interest in types of homes and locations has changed as a direct result of the pandemic.

-

On the bright side, 54% of millennials and Gen Zers report being more motivated to become homeowners, as a direct result of the pandemic.

-

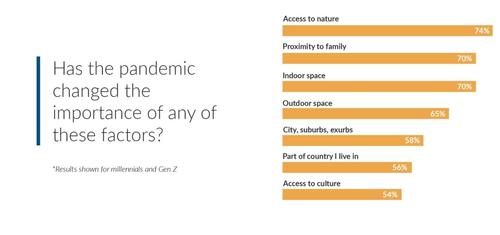

The top home buying factors that have been impacted by the pandemic: 1. Access to nature 2. Proximity to family 3. Indoor space 4. Outdoor space 5. Home location.

-

36% of city residents say they value suburban living more than they did before the pandemic.

Read the full writeup from Improve.net below:

During the coronavirus pandemic, millions of Americans have felt their relationship with their home tested. Whether it’s because of remote learning, remote work, or simply having nowhere else to go, both space and functionality have been pushed to their limits for so many of us.

Many have embarked on home improvement projects to optimize their space - and used our home service cost estimator to see what they can afford - but sometimes making a change means more. Many Americans find themselves reflecting on long-term priorities and recalibrating their homeowner ideals.

In this study, we explore how attitudes, ideals, and needs have shifted for homeowners and aspiring homeowners alike. No doubt, a spirit of change is in the air. In fact, 79 percent of those we surveyed said all the change forced by the pandemic has inspired them to make other changes in their lives that may never have occurred.

We began by asking people about moving plans and buying plans. Four in 10 say their plans haven’t changed, but a majority of people report things have changed. Thirty-six percent say they either didn’t plan to move and now they’re moving, or their previous moving plans have accelerated.

Similarly, 30 percent report that homebuying plans have either materialized or accelerated. But an almost equal amount have said plans are slowing down or are on hold. On top of that, 72 percent of millennials and Gen Zers - basically everyone under 40 years old - who have been saving to buy a home say their savings plans have been disrupted by the pandemic.

That aside, the future looks bright for the real estate market as 54 percent of millennials and Gen Zers say they feel more motivated than ever to become homeowners, as a direct result of the pandemic. Across all generations, 52 percent say their interest in certain types of homes and/or locations has shifted since the beginning of the pandemic.

One of the things we were most curious about is how priorities have changed with respect to where and how people live. We were particularly interested to learn about the experience of younger people, those who either don’t yet own homes or are early in their homeownership journey.

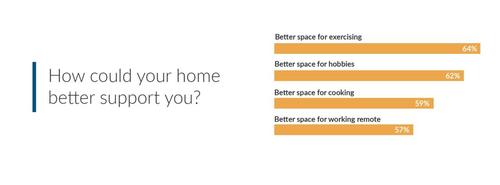

We also asked people how well their homes are functioning for them, and in what ways they wish their space better supported their current lifestyles. Spoiler alert: contrary to much of the attention its been given, home office space is not the top priority right now.

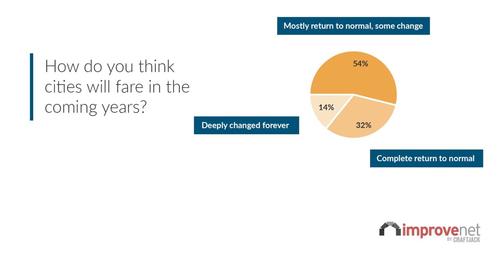

Finally, we waded into the city versus suburbs debate. Even though many people are entrenched on this topic and have strong preferences, we sensed that attitudes have softened as a result of the pandemic. They have - at least one in three people say their opinion of city living has lessened over the past year and almost four in 10 say they feel more strongly about the suburbs.

We also asked both urbanites and suburbanites what they thought of the long-term prospect for big cities.

* * *

Source: Improve.net

https://ift.tt/2MrRaNV

from ZeroHedge News https://ift.tt/2MrRaNV

via IFTTT

0 comments

Post a Comment