OPEC+ Agrees To Boost Output After Saudi-UAE Reach Production Compromise

Two weeks after OPEC+ seemed on the verge of yet another collapse when UAE balked at the latest OPEC+ output deal which all other oil exporters agreed to except the small Gulf nation, the oil producing cartel and its Russia-led oil-producing allies agreed to gradually add more oil supplies to the market, ending a two-week spat between Saudi Arabia and the United Arab Emirates.

The 19th OPEC and non-OPEC Ministerial Meeting has commenced via videoconference under the Chairmanship of HRH Prince Abdul Aziz Bin Salman, Saudi Arabia’s Minister of Energy and Co-Chair HE Alexander Novak, Russian Deputy Prime Minister, together with ... pic.twitter.com/RyjMQIpMj8

— OPEC (@OPECSecretariat) July 18, 2021

"Opec plus is here to stay" said Saudi Prince Abdulaziz bin Salman shortly after noon in Vienna, when the oil-producing group agreed to add new oil in modest installments over many months, underscoring the still-uncertain speed of the world’s economic recovery. Much of the developing world, where demand growth for oil had been strongest pre-pandemic, is still fighting surging Covid-19 cases.

Sunday’s oil deal calls for OPEC+ to increase production by 400,000 barrels a day each month beginning August through the latter part of 2022. The deal seeks to unwind all the 5.8mmb/d in output cuts that were made at the start of the pandemic, when economies were shuttering and demand sputtering and when WTI briefly traded at a deeply negative price, although Prince Abdulaziz cautioned that the new monthly mechanism allows OPEC+ to pause or even reverse the production hikes if there is a collapse in demand.

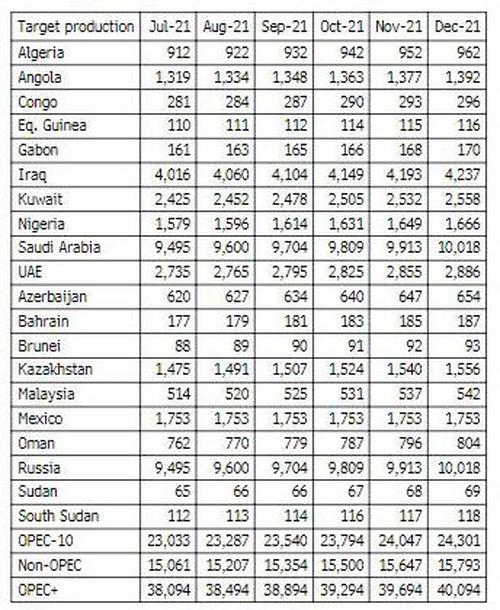

The table below shows the individual oil output targets for OPEC+ countries for the rest of this year, following the group’s agreement to raise total supplies by 400k b/d each month from August. The figures are in thousands of barrels a day.

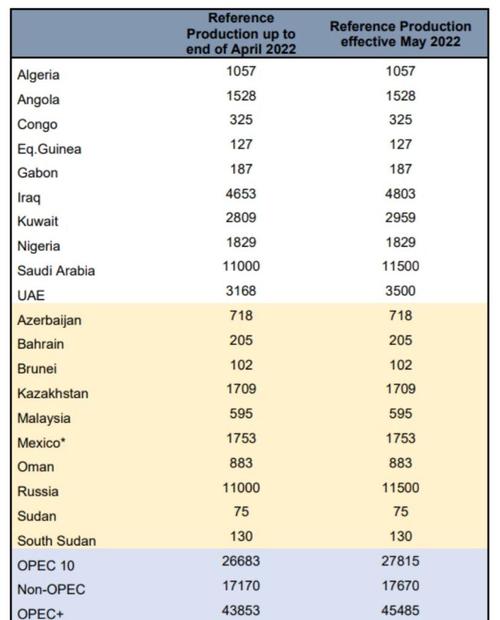

The agreement also gives the UAE and several other countries higher baselines against which their production cuts are measured, starting in May 2022, according to a statement from the group.

Aside for the revised baselines, today's deal is generally in line with one struck earlier this month, but whose final agreement was blocked for over two weeks after the United Arab Emirates asked for its production quota inside the group to be reassessed. It was eager to pump more crude than its allotment, after investing heavily in its oil fields. Last week, OPEC leader Saudi Arabia reached a compromise with the U.A.E. last week, agreeing to eventually boost that quota.

OPEC said the U.A.E.’s base line would go up by about 332,000 barrels a day to 3.5 million b/d. Saudi Arabia and Russia, two of the world’s biggest producers alongside the U.S., will each get their baseline lifted by 500,000 barrels a day. Overall, the group’s estimated production capacity by May 2022 will be raised by 1.63 million barrels a day.

The revised individual baselines are shown in the table below, in thousands of barrels a day:

The deal goes into effect next month, in time for August delivery plans, with the group saying it would reassess market conditions in December.

Early last year, OPEC+ slashed 9.7 million barrels a day of its collective output, equivalent to about 10% of 2019 demand. It has restored about 4 million barrels of that. Sunday’s deal calls for the remainder of those cuts to be unwound through late next year. In its first 2022 forecasts for the global oil market, OPEC said last week it expects the world’s appetite for crude to rise by 3.3 million barrels a day to average 99.9 million barrels a day next year. That is about the level of demand pre-pandemic.

As the WSJ notes, the compromise between Saudi Arabia and the U.A.E. patched up for now what had turned into an acrimonious and public spat between two of OPEC’s closest traditional allies. While Saudi Arabia is far and away the bigger producer and regional power, the U.A.E. is one of just a few OPEC members with substantial spare capacity - barrels it can turn on and off quickly.

The prospect of an OPEC deal and a gradual return of supplies had already led to a drop in oil prices, which have recovered strongly this year. Brent, the international benchmark, and West Texas Intermediate have both fallen about 5% in recent days, as hope for an OPEC deal grew. Brent closed above $73 a barrel and WTI finished above $71 a barrel Friday, both off recent, multiyear highs. However, a big reason for the drop was fears of another OPEC+ cartel collapse, sparking a production free-for-all. Now that that risk is out of the way and OPEC+ is planning on only a gradual increase in output while keeping minor producers happy with revised baselines, it is likely that oil prices will move sharply higher - according to Goldman and Citi - absent another global plunge in oil demand, which however is unlikely absent a new round of covid-linked shutdowns.

As Bloomberg notes, the multifaceted agreement means several things for the oil market. It gives consumers a clearer view of how quickly OPEC+ will restore the 5.8 million barrels a day of production it’s still withholding, since making deep cuts last year in the initial stages of the pandemic. Additionally, the baseline adjustments won’t alter the pace of the 400,000 barrel-a-day monthly output increases when they take effect next year, Prince Abdulaziz said. The group will continue to meet every month, including a review of the market in December, and could adjust the schedule if required, he said.

“The monthly meetings and the December review tell you that that is all amendable,” said Bill Farren-Price, a director at research firm Enverus. “So oil bulls should read this as positive -- OPEC+ supply management continues." The only question is how long before US shale producers ramp up their own production to take advantage of the higher oil prices.

Today's accord also resolves longstanding grievances that caused tensions within OPEC+ since late 2020, which culminated earlier this month when the UAE blocked an agreement earlier this month, arguing that the way its quota was calculated was unfair because it didn’t reflect a costly expansion in the country’s industry. The spat was particularly bitter, and the tensions go beyond oil diplomacy amid growing economic rivalry between Abu Dhabi and Riyadh. Ministers of each country used media interviews to make their case, stirring memories of the 2020 Saudi-Russia price war, and also past threats from the UAE to leave the cartel.

With a successful deal in the bag, both countries emphasized the strength and friendliness of their relationship.

“The UAE is committed to this group and will always work with it,” Energy Minister Suhail Al-Mazrouei told reporters after the meeting. He thanked Saudi Arabia and Russia for keeping OPEC+ together and fostering a constructive dialog that enabled a deal.

Upon announcement of the deal, Saudi oil prince Abdulaziz was full of joy, saying “Let’s call it a day and have a festive day!”

https://ift.tt/3iqEene

from ZeroHedge News https://ift.tt/3iqEene

via IFTTT

0 comments

Post a Comment