Goldman Cuts China's Q3 GDP Growth To 0% As A Result Of Growing Energy Crisis

It's not just Europe that is suffering the mother of all commodity and energy price shocks: slowly but surely a similar fate is befalling China, where a perfect storm of increased regulation, extremely tight global energy supply, the escalating trade spat with Australia, surging coal prices and a crackdown on carbon has led to energy shortages first at factories and manufacturers and more recently, mass blackouts hitting tens of millions of residents in at least three Chinese provinces (as we discussed earlier).

In our commentary to China's growing energy problem we said that "while the blackouts starting to hit household power usage are at most an inconvenience, if one which may soon result in even more civil unrest if these are not contained, a bigger worry is that the already snarled supply chains could get even more broken, leading to even greater supply-disruption driven inflation."

But there's more than just supply chains: as Goldman's China strategist Hui Shan writes in a note published late on Monday, "the recent sharp cuts to production in a range of high-energy-intensity industries add to the already significant downside pressures in the growth outlook."

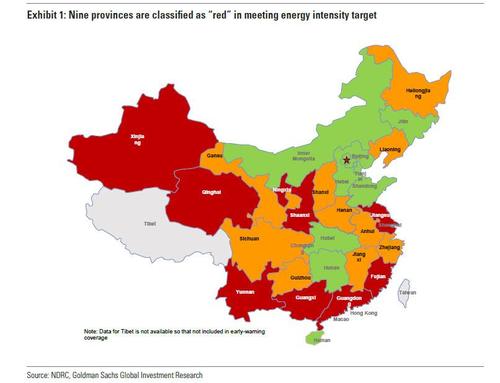

While the Goldman strategist explains more in detail further, the production cuts are due primarily to increased regulatory pressure on provinces to meet energy use targets for 2021 but also reflect surging energy prices in some cases. He notes that the NDRC issued ratings in mid-August showing nine provinces as performing poorly based on H1 energy usage, and reportedly intensified its efforts to bring underperformers into line in mid-September.

Based on the number of provinces (9 in NDRC ‘red’ classification) and share of industrial activity affected (Goldman estimates 44%), as well as informed assumptions about the extent of the cutbacks, the bank has estimated the hit to industrial production and overall economic activity for the remainder of the year. The bank's initial estimate is roughly a 1 percentage-point annualized hit to Q3 GDP growth and double this impact on Q4 growth. The bank then also adjusted its fiscal deficit estimates to reflect a smaller augmented deficit

for 2021 (11.0%, vs 11.6% previously), accounted for by a lower deficit in the second half of the year: "This trims our growth assumption by about 25bp in Q3 and 50bp in Q4, given a relatively low multiplier and typical lags."

Putting it all together, Goldman's new growth forecasts for Q3 shrink to flat, or 0% qoq (4.8% yoy), for Q4 to 6% qoq ann (3.2% yoy), and for 2021 as a whole to 7.8% (down from 5.1%, 4.1%, and 8.2% yoy previously.) Here, Goldman caveats that "considerable uncertainty" remains with respect to the fourth quarter, with both upside and downside risks relating principally to the government’s approach to managing the Evergrande stresses, the strictness of environmental target enforcement and the degree of policy easing. In short, how Beijing responds will impact the forecast. Regardless of said response, however, Goldman also takes down its 2022 GDP growth forecast to 5.5% yoy, well below China's new redline in the 6% range.

* * *

Elaborating further, Goldman writes that in recent weeks markets have been focused on developments with respect to Evergrande, its real estate development business, and risks to the broader Chinese property sector. The downward pressures on property sales and construction have added to a myriad of other headwinds for the economy including a relatively tight macro policy stance (epitomized by a balanced official fiscal budget in H1), Covid-related restrictions to counter local outbreaks, and regulatory tightening across a range of other sectors.

To this, we can now add a "new but tightening" constraint on growth from increased regulatory pressure to meet environmental targets for energy consumption and energy intensity (the so-called “dual controls”). As part of the country’s longer-term goal to reach peak carbon emissions by 2030, policymakers formulated shorter term targets for 2021 in March’s Government Work Report – including a 3% reduction in energy intensity of GDP this year. The National Development and Reform Commission (NDRC) monitors these at the provincial level on a quarterly basis. In August, it released a report classifying 9 provinces as category “red” – having missed their H1 targets, including Qinghai, Ningxia, Guangxi, Guangdong, Fujian, Xinjiang, Yunnan, Shaanxi and Jiangsu (Exhibit 1). Another 10 provinces were classified as “yellow”. In mid-September, the NDRC published a plan for “dual controls” and was reported to pressure provinces that had lagged behind to curb energy use.

Why did the energy use targets become binding so soon after being implemented?

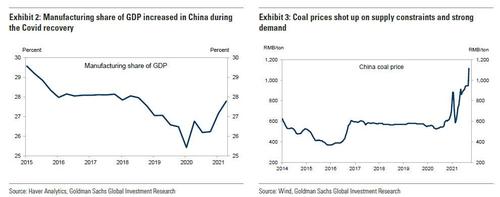

While it presumably was not the intention of policymakers to provoke a sharp tightening, at least when the goals were initially formulated, the peculiar nature of the Covid shock has made the economy more energy-intensive, at least temporarily. The boom in exports has boosted energy-intensive manufacturing industries (Exhibit 2), while Covid-related restrictions have primarily affected interaction-intensive service businesses. Meanwhile, efforts to reduce coal-fired related emissions and a reduction in coal imports have affected supply levels at least on the margin, contributing to the sharp increase in prices discussed earlier.

What follows below is Goldman's attempt to quantify the impact of these production cutbacks on growth in Q3 and Q4.

First, quantifying the impact of energy-related production cuts.

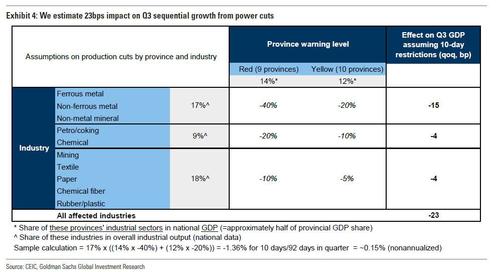

Given the uncertainty associated with the degree and duration of production cuts, Goldman has made a number of simplifying assumptions to size the impact on GDP. Exhibit 4 displays these assumptions and calculations.

First, the bank categorizes affected regions by their 1H 21 energy control ratings given by the NDRC. For the nine provinces where the rating is red, the local governments need to aggressively reduce energy consumption to meet the year-end target and we assume the largest production cuts in those provinces. This means even more pain is coming.

Second, Goldman divides industries by their energy intensity. For ferrous metals, non-ferrous metals and non-metal mineral products, the NDRC labels them as “high energy intensity” sectors and they are also cited most frequently in the news related to the latest power cuts (see here for example). Therefore, the bank assumes the sharpest production cuts (20-40%) in these three industries. Petroleum, coking & nuclear fuel and chemical material & product are also labeled as “high energy intensity” sectors, and are likely to suffer medium levels of production cuts (10-20%). Mining, textile, paper making, chemical fiber and rubber & plastic product require significant energy inputs and have been quoted in news articles as well. Goldman assumes 5-10% of production cuts depending on the province for these industries.

Altogether, Goldman expects the 10 days of production cuts at the end of September to reduce real GDP growth by nearly one percentage point (annualized) in Q3. The rightmost column in Exhibit 4 shows the hit to the level of GDP in Q3 for each set of industries; these sum to 23bp, and given this is a quarter-on-quarter change, the annualized change is slightly less than one percentage point (92bp).

Assuming the production cuts continue in Q4 and affect 10 days per month, they would reduce Q4 real GDP growth by about 1.8% sequentially. Here, Goldman hands out the usual caveats: namely that there is a great deal of uncertainty in our estimates. On the one hand, the bank assumes no places outside of the red and yellow provinces and no industries beyond the 10 industries mentioned above are affected, which will likely underestimate the actual production impact. On the other hand, affected companies may resort to shifting maintenance timing in response to power cuts and production may increase in provinces with non-binding energy caps, leading to less damage to overall growth.

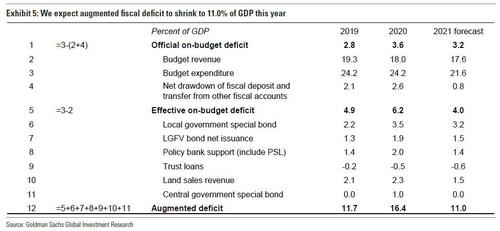

Cutting fiscal deficit forecast

After Chinese authorities quickly unwound the macro policy easing deployed in the first half of 2020, credit growth decelerated, excess liquidity was drained, and the fiscal deficit declined. In fact, fiscal policy normalized so quickly that the country ran an official deficit of zero in the first half of the year. Goldman had expected some reduction in the overall fiscal deficit, but the tighter-than-expected H1 caused the bank to revise its deficit estimate for 2021 lower. While there has been some fiscal easing in July and August, this partly reflects typical seasonal patterns and the deficit is tracking below these downwardly-revised estimates. Significant off-budget elements of the augmented deficit including policy bank lending, trust lending, and land sales are tracking below the bank's forecasts, and the latter in particular seems likely to continue to underperform given the ongoing property market tightening and failed land auctions seen in recent months. On the other hand, local government special bond issuance has accelerated somewhat but remains below the pace needed to fully utilize this year’s quota. Therefore, Goldman is revising a second time, and moving its forecast for the full-year augmented deficit to 11.0% from 11.6% previously.

Adjusting the new second-half deficit forecasts 1.2% lower and applying a multiplier of 0.2 (as well as a modest lag to some spending), Goldman now estimates an impact on qoq annualized growth of roughly -1/4pp in Q3 and -1/2pp in Q4.

The new GDP growth forecasts

Combining these new estimates for the impact of supply-side cuts to energy-intensive production and slightly less support from fiscal policy, Goldman cuts its growth forecasts for:

- Q3 to 0% (qoq annualized), from +1.3% previously,

- Q4 to 6.0% annualized, from 8.5% previously.

As a result, Goldman's year-over-year forecasts are now just 4.8% for Q3, 3.2% for Q4, and 7.8% for 2021 as a whole.

Finally, the lower starting point for early 2022 activity pulls the growth forecast for that year down one tenth, to 5.5%, despite modestly stronger sequential growth as restrictions become less binding and policy eases.

Uncertainties and policy response

While the third quarter is nearly over, uncertainty around the Q4 pace remains very large, and a lot of this comes down to the stance of both macro and regulatory policy, i.e., Beijing's reponse. Key drivers of the Q4 outcome will include the timing and extent of:

- government measures to stabilize housing sector activity and stretch out the deleveraging in the property sector,

- any temporary relaxation of regulatory pressures to meet energy use targets, and/or

- macro policy support.

Each of these factors could materialize on either the positive or negative side relative to these new reduced growth forecasts.

https://ift.tt/3m67IZC

from ZeroHedge News https://ift.tt/3m67IZC

via IFTTT

0 comments

Post a Comment