More Than Half Of China's Provinces Are Now 'Rationing' Electricity, Governors Demand More Coal Imports To Resolve Crisis

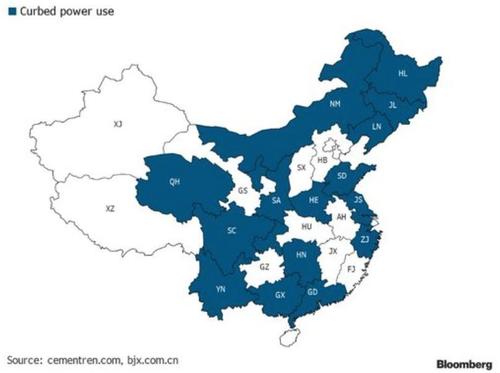

At least 20 Chinese provinces and regions making up more than 66% of the country’s GDP have announced some form of power cuts. Guangdong province, the southern industrial hub, is cutting ~10% of its peak power demand...

And as the severe power crunch hits major industrial hubs in China's northeastern heartland, top political leaders face mounting pressure from businesses and citizens to solve the crisis through increasing coal imports to keep the lights on and factories humming.

Reuters spoke with Han Jun, governor of the northeastern province of Jilin, who said new coal suppliers are needed from Russia, Mongolia, and Indonesia. He added the province would also need to acquire coal mining contracts in the neighboring region of Inner Mongolia to ensure adequate supply.

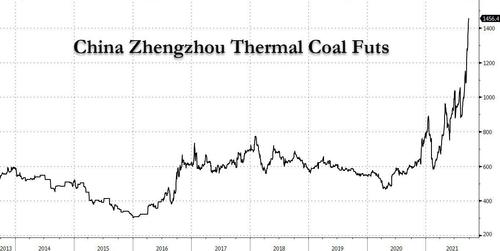

Jilin is one of the ten provinces that have been hit hard by the power crunch. The government has rationed power to energy-intensive heavy industries like steel, cement, and aluminum plants to solve the problem, but that has yet to work. Power plants are also facing a surge in thermal coal prices and are unwilling to pass on to consumers.

Han said companies must satisfy their "social responsibilities" and "overcome the difficulties" caused by elevated coal prices.

On Sunday, top suppliers of Apple and Tesla reported they had suspended operations as the government limited power to their factories. The power crunch is becoming an international issue that may cause additional headaches for global supply chains, especially when US importers are ordering goods ahead of the holiday season.

Goldman Sachs told clients this week that as much as 44% of China's industrial activity has been affected by the power crunch. Therefore the bank slashed 2021 GDP growth forecasts for the year to 7.8%, from the previous 8.2%. Also, S&P Global Ratings cut its 2021 GDP forecast due to rising uncertainties in the country.

There are several reasons for the surge in thermal coal, among them already extremely tight energy supply globally (already seen in Europen markets); the sharp economic rebound post-COVID lockdowns that have boosted demand from households and businesses; a warm summer which led to increased air condition consumption across China; the escalating trade spat with Australia that has dwindled coal trade, and Chinese power plants ramping up power purchases to ensure winter coal supply. There's also Beijing's pursuit of curbing carbon emissions to ensure the skies at the Winter Olympics in Beijing next February are clear, along with Xi's international commitment to de-carbonizing the economy.

Short-term relief for the country would be importing more coal for power generation and temporarily abandon Xi's carbon emission curbs to get the energy situation under control.

John Kemp, a Reuters commodity market analyst and reporter, points out the energy shortage resulting in soaring coal, gas, and oil prices is a worldwide phenomenon, occurring primarily in Europe and Asia at the moment.

There's no timeline on how long the power crunch will last. As we noted above, increasing coal imports to feed fossil fuel power plants is the country's only solution besides its attempt to shut down energy-intensive industries that will paralyze its economy and disrupt the global supply chain even more.

https://ift.tt/3oova6S

from ZeroHedge News https://ift.tt/3oova6S

via IFTTT

0 comments

Post a Comment