Morgan Stanley Dismisses Market's "Strong Rebound", Remains Bearish On Coming Earnings Disappointment

For just a few hours last Monday, Morgan Stanley's chief economist felt vindicated: with stocks tumbling on Evergrande default fears, Wilson emerged from his faux-bull cocoon (having raised his year-end S&P price target from 3,900 to 4,000 in August in a note that reeked of disgust with what he was being told to do) and warned that an "Ice is coming", referring to a 20% drop in stocks as opposed to the more modest 10% correction envisioned in his "fire" scenario, saying that "the "ice" scenario is starting to look more likely, and could result in a more destructive outcome – i.e. a 20%+ correction", a drop he expects will take place some time this fall.

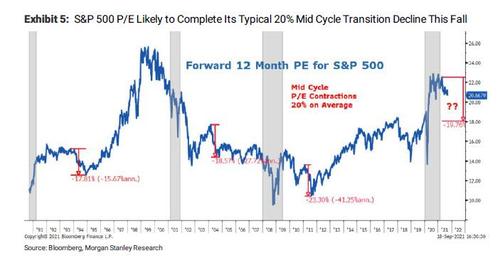

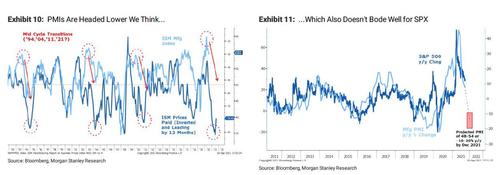

Wilson also predicted that with earnings growth and PMIs set to drop, it would adversely impact forward PE multiples and by extension the S&P.

Well, what a difference 7 days makes: with Evergrande default fears now long forgotten amid still unconfirmed speculation that China will somehow make it all better and nationalize the troubled developer with little to no offshore contagion, the S&P is almost 150 points from its "Evergrande Monday" lows and once again pushing back toward all time highs (even if with a major rotation in the leadership as tech stocks are now sliding, having been replaced by value, cyclical and reopening names) in the process yet again foiling Wilson's bearish visions.

So has the market's sharp post-opex bounce changed the mind of the chief strategist that this seemingly invincible market will never go down again more than just a token 5% move?

Today we got the answer in Wilson's latest weekly warm-up not, in which he makes it clear that his bearish outlook remains, and as he explains, "our process tells us the risk-reward remains unattractive at the index level given slowing growth and rising rates. Meanwhile, price action can be interpreted bullishly or bearishly. With 3Q earnings season likely to bring a much more muted outcome, we remain defensive in our positioning."

We'll get to why in a second, but first Wilson - realizing that he would get a criticism for what many viewed as a premature victory lap - spends the first few paragraphs of his latest note going over the details of his analytical process. This is how he lays it out:

Our equity strategy process has several key components. Most importantly, we focus on the fundamentals of growth and valuation to determine whether the overall market is attractive and which sectors and stocks look the best/worst. The rate of change on growth is more important than the absolute level, and we use a market-based equity risk premium framework that works well as long as you apply the correct regime when using it. In that regard, we’re an avid student of market cycles and believe historical analogs can be helpful. For example, the mid cycle transition narrative that has worked so well this year is derived directly from our study of historical economic and market cycles.

The final component we spend a lot of time on is price. While most would call this technical analysis, we’d like to think we do it a little bit differently. Markets aren’t always efficient, but we believe they are often very good leading indicators for the fundamentals—the ultimate driver of value. This is especially true if one looks at the internal movements and relative strength of individual securities. In short, we find these internals to be much more helpful than simply looking at the major averages.

This year, we think the process has lived up to its promise quite well with the price action lining up nicely with the fundamental backdrop. In short, the large cap quality leadership since March is signaling what we believe is about to happen—i.e., decelerating growth and tightening financial conditions. The question for investors is whether the price action has fully discounted those outcomes.

With that disclosure in hand, and with the clear understanding that at least in his view investors are not discounting any adverse outcomes at this point, Wilson proceeds to discuss the recent market action, noting that stocks "sold off hard last Monday on concerns about the Evergrande bankruptcy" and while he adds that it is the Morgan Stanley "house view" that it likely won’t lead to a major financial contagion, "it will probably weigh on China growth for the next few quarters which means that the growth deceleration we are expecting could be a bit worse."

The other reason Wilson suggests was behind the market weakness early last week "likely had to do with concern about the Fed articulating its plans to taper asset purchases later this year and perhaps even move up the timing of rate hikes to next year. On that score, the Fed did not disappoint as they pretty much told us to expect the taper to begin in December. The surprise was the speed in which they expect to be done tapering—by mid 2022. This is about a quarter sooner than the market had been anticipating and does move up the odds for a rate hike in 2022."

Curiously last week's rally happened in the aftermath of the market's perplexing kneejerk response to the Fed meeting on Wednesday, when stocks rallied even as bonds sold off sharply, particularly at the back end. Real 10-year yields were up 11bps in 2 days and are now up 31bps in just 8 weeks (Exhibit 1). That according to Wilson is "tightening of financial conditions for sure" and should weigh on PEs overall but it also has big implications for what should work at the sector/style level (Exhibit 2).

In short, Wilson digs in and claims that higher real rates should mean lower P/Es overall which likely means lower S&P 500, thus validating his bearish view which still sees the S&P dropping some 20% from its current perch to hit 4,000 by year end. However, he concedes, "it may also mean value over growth and small caps over Nasdaq even as the overall equity market goes lower."

Which brings us to the key question we spent quite some time discussing last week, namely why did stocks rally so much into the end of the week on what Wilson says are odds that growth will decelerate more than expected from Evergrande and financial conditions may tighten faster?

Here Wilson is at least honest - as he puts it - and says "we’re not sure but we think this may be a time when the markets are playing tricks on investors and even setting a bit of a trap." Actually it's simpler than that and has to do with the gamma reversal and technical flows we pointed out last week, but one has to be a "greek geek" - like Nomura's Charlie McElligott - to get that.

The other explanation proposed by Wilson is "that investors were somewhat positioned for bad news going into the Fed meeting and the actual event simply served as a relief that it didn’t lead lower prices. This price action drove many investors to chase on Thursday for fear of missing out. In short, don’t underestimate the power of price to determine how investors interpret the facts. Just like negative price action can get people to sell the lows, positive price action can force people to buy", he concludes.

Whatever the reason for the initial bounce, it quickly accelerated and there was "a lot of excitement last Thursday when stocks rallied sharply back above the 50 day moving average, a key barometer for many and a key level of support throughout this year for the S&P 500." That this happened when the 50DMA was broken "on near record levels of volume in both the cash and derivatives markets" only punctuated the strength of the rebound. By Friday, that moving average had been reclaimed and closed above it for the week, an important technical win as even Wilson admits. However, he then adds, from his vantage point, "the very well defined uptrend that has been established over the past year was broken and not reclaimed. Instead, it looks like the rally from Wednesday to Friday was simply "filling the gap" created from Monday's break."

His conclusion on upcoming market action will hardly come as a surprise to those who have followed Wilson's progressive pessimism across 2021: pointing to the market's inability to recover its prior trendline, he says "this leaves the technical picture very uncertain in our view and one can now break either way. With our fundamental view skewing poorly at the moment, we lean to the bearish outcome."

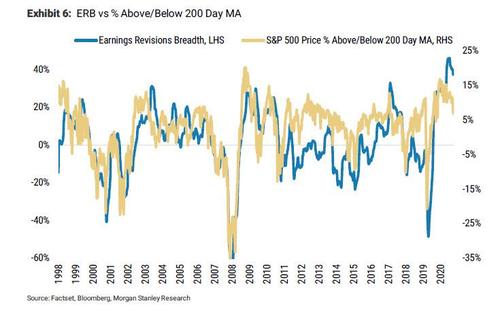

Getting back to his process, Wilson then says that he has high conviction that "earnings growth is likely to decelerate more than what the current consensus is forecasting." Furthermore, he thinks the market is starting to agree with that view and points to market breadth as a good leading indicator for earnings revision breadth where he says "direction is clear" and pointing to the newly shrinking market breadth, he reminds readers that earnings revision breadth is a good leading indicator for the overall market.

It will therefore hardly come as a surprise that with Wilson still clearly bearish, his advice to clients is "don’t get too caught up in last week’s strong rebound from Monday’s sharp sell off" which he views as a clean break of the uptrend and a filling of the gap created from Monday's crack. And with the technical picture murky, "that's a time to trust the fundamental and cycle analyses which suggest lower equity prices ahead" and as growth decelerates and financial conditions tighten, valuations are likely to fall from their lofty levels.

* * *

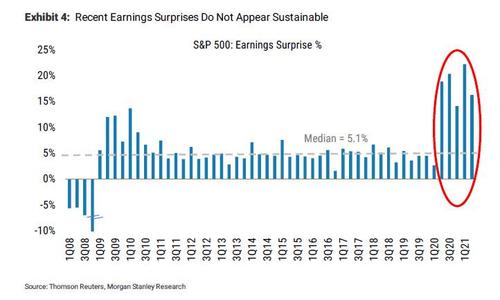

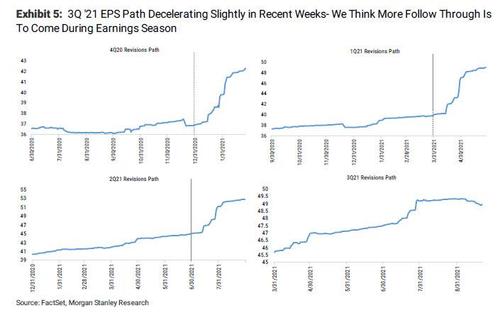

With all that in mind, Wilson goes back to his core fundamental thesis which is simple: after a blockbuster Q2 season, earnings are set to drop substantially as a result of the margin compression we discussed most recently over the weekend, to wit:

Since the second quarter of 2020 earnings results have come in much higher than consensus forecasts. Earnings beats ranged from 14% - 22% over this period while the median beat rate since 2008 is only 5%...We do not think companies will continue to beat at such an unprecedented rate and believe 3Q could see a material change in the more recent trend as supply chain issues and labor shortages pose a risk to both top line and margins.

We looked at how 3Q earnings estimate revisions have trended at the industry group and sector level. Significant cuts have occurred in insurance, capital goods and transportation. Consumer Durables is the only area that has seen significant positive revisions at the industry group level. 3Q S&P 500 estimates have fallen by 77 bps over past 4 weeks. We expect more downside.

No surprises there, as the margin compression story is a familiar one ("Margins Crushed As Producer Prices Explode At Record Pace In July"). To Wilson, however, this is the story and one which the market refuses to even consider:

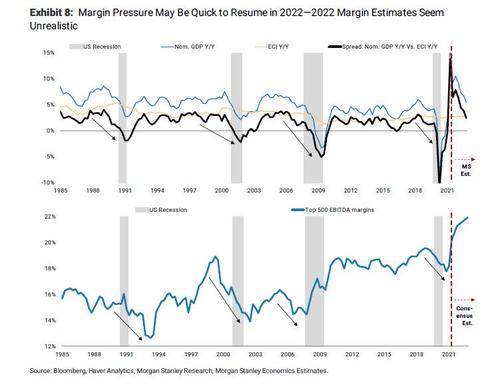

2022 consensus margin estimates are historically lofty...we examine the risks to margins in coming quarters through two different top down approaches. The spread between GDP growth and wage growth correlates fairly closely with operating margins over time. Based on our economists' estimates, this spread should decelerate in coming quarters, which suggests margins should contract, not expand as bottom-up consensus expects.

Further, corporate transcript mentions of "cost pressures" and related terms are historically elevated. When this has happened in the past, margins have consolidated.

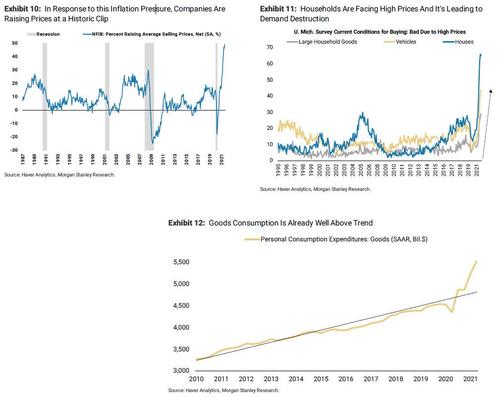

Wilson's final bearish point is that companies are reaching the limit on how much of rising input costs they can pass on to consumers. As he puts it, while "many investors that we speak to are optimistic about corporates' ability to pass on cost through pricing and protect margins" he would caution that "prices in several consumer end markets are already at a level that is inhibiting demand. We think the risk of this dynamic (high prices leading to demand destruction) spreading to other areas of consumer demand is especially elevated because goods consumption is already so far above trend—in other words, high prices are that much more of a deterrent given households have already overconsumed in many areas."

Translation: absent another multi-trillion stimmy - and thanks to the chaos in the democratic party we know one is unlikely to come - Wilson's call for a 20% drop in stocks in the next few months remains intact.

https://ift.tt/3AS2CpW

from ZeroHedge News https://ift.tt/3AS2CpW

via IFTTT

0 comments

Post a Comment