China Junk Bond Yields Hit All Time High As Property Default Contagion Spreads, Home Sales Plunge 32%

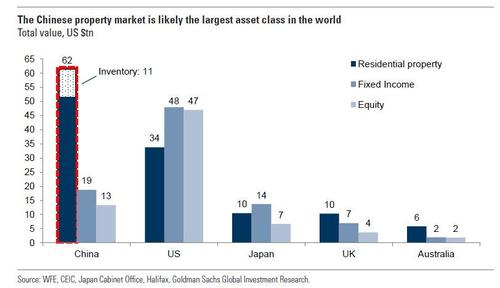

It may seem like ancient history now, with the S&P obliviously plowing ever higher, but just over a month ago stocks briefly panicked over fears that China's property market, the largest single asset-class in the world according to Goldman...

... was about to implode as a result of a domino effect of Evergrande's upcoming bankruptcy. And while US equities have clearly moved on since then, the contagion within China's property sector has spread widely, and in the first two days of November, the selloff in Chinese developers’ debt has deepened with one of the 20 biggest developers joining a host of firms looking to dodge defaults as debt crises effectively shut them out of the overseas financing market.

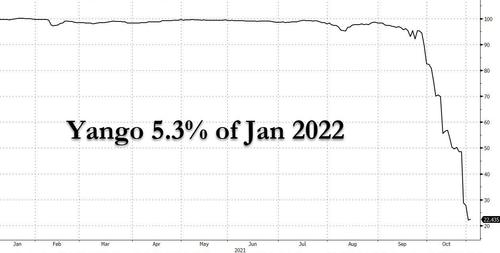

Yango Group became the latest developer trying to improve its liquidity and avoid default by delaying near-term bond payments, Bloomberg reported. The Shanghai-based builder, which ranked as the 18th biggest in the nation by contracted sales, is seeking to extend three of its dollar notes as “existing internal resources may be insufficient,” according to a stock exchange filing.

The company’s warning of a possible default is intensifying investor concerns that developers are caught in a negative credit loop as refinancing risks prompting firms to curb spending and reduce sales. Yango shares fell as much as 9% Monday in Shenzhen, hitting a seven-year low. Several of its onshore bonds plunged to record lows, prompting trading halts. The 5.3% bonds due Jan 2022 , which were trading above 90 just one month ago (during the peak of the Evergrande crisis) closed at an all time low of 22 cents on the dollar.

Not surprisingly, Chinese rating agency Golden Credit Rating cut Yango Group’s credit rating to AA+ from AAA, citing mounting pressure on debt repayment, according to a statement to Shenzhen stock exchange. Yango’s outlook was cut to negative from stable by Golden Credit and Dagong Global Credit: statement. This is after the bonds lost 80% of their value in just over a month.

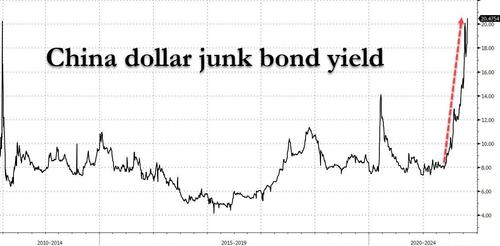

The relentless contagion inside China's property sector pushed the country's dollar high-yield bonds to fall for a ninth straight day Tuesday after tumbling nearly 9 cents on the dollar in October, closing out the worst two-month slide in a decade. The average yield in the dollar junk bond index touched a record 21.5% on Tuesday, surpassing even the Sept 2011 repo crisis highs.

Yuzhou Group Holdings Co.’s bond due 2025 tumbled 11.6 cents to 38 cents, on pace for its biggest drop in since March, while Sunac China Holdings Ltd.’s note due 2026 fell 5.3 cents to 65.5 cents.

Amid the carnage, more property firms have been scrambling to avoid missing debt deadlines recently, as the government clampdown on the real estate sector and a liquidity crisis at Evergrande make it tougher for firms to roll over their dollar debt. Other recent examples include Xinyuan Real Estate which last month secured approval on an exchange offer for a bond.

“We will see more of such offers or even defaults in coming weeks and months,” according to Eddie Chia, portfolio manager at China Life Franklin.

“Yango is a top developer that had normal operations, albeit slightly more leverage, but clearly it is threatened by a confidence crisis,” he said. “The other developers in the dollar bond market are much smaller than Yango, and most issuers cannot survive if the market is closed.”

Of course, extending payment deadlines is just a temporary solution; without the underlying cash flow the inevitable default becomes just a question of timing. Still, some investors are betting that granting reprieves now will allow firms to improve their liquidity when the primary market re-opens for China’s riskier borrowers, though it’s unclear when that may happen.Fitch Ratings highlighted that Xinyuan’s default risks remain high, for instance, even after it raised its issuer default rating on the firm to CC from restricted default.

Unfortunately, it's not looking good for the core business: in fact it's looking downright terrible - China’s top 100 developers saw new-home sales fall 32% from a year earlier in October, according to China Real Estate Information Corp. after a similar slump in September.

More than 80% of the developers saw property sales decline year over year last month, with 44 developers recording drops of more than 30% and 37 developers saw home sales decline on both month-on-month and year-on-year basis, the latest data showed prompting analysts to say it’s almost certain that the housing market will cool further and the outlook for developers’ sales in the fourth quarter is not optimistic.

Among the 29 major cities monitored by CRIC, residential property sales by floor space fell by 3% in October from a month earlier, sliding 22% from the same period last year and down 12% from the same period in 2019. In particular, home sales in the 25 tier-2 and tier-3 cities declined 4% month over month in October and dropped 23% from a year earlier, showed the data.

Despite the chill, 32 developers managed to achieve sales of more than 100 billion yuan in the first ten months of the year, six more than the same period last year, and 148 developers’ revenue for the 10-month period exceeded 10 billion yuan, according to data from China Index Academy, one of the largest independent real estate research firms in China.

As Yuan Talk notes, Country Garden ranked the top with 676.1 billion yuan home sales in the first ten months of the year, followed by Vanke, Sunac and Poly, according to China Index Academy. The top four developers’ total home sales during the period reached 2.17 trillion yuan.

The top 32 developers’ home sales growing by an average of 10.6 per cent year over year, while the average growth for 23 developers with 50 – 100 billion yuan sales in January – October was at 17.5 per cent, 28 developers with 30 – 50 billion sales at 21.3 per cent and 34 developers with sales at 20 – 30 billion yuan at 24.3 per cent and developers with sales at 10 – 20 billion yuan at 21.3 per cent, according to data from China Index Academy.

Separate data from China Index Academy showed that property developers’ bond issuance reached 13 billion yuan in October, only about 40 per cent of the 32.8 billion yuan in September. Their offshore bond issuance fell significantly to only 8.427 billion yuan.

If local companies are locked out of the bond market their defaults are virtually assured: with cash from operations collapsing, if they are unable to roll over upcoming maturities into new debt, a default tsunami is virtually assured.

Meanwhile, amid rising scrutiny over China’s weakest players, not all firms will be able to secure bond extensions. Modern Land China failed to repay either the principal or interest on a $250 million bond late last month after it earlier terminated a proposal to extend the bond’s maturity by three months.

The lack of government assistance means much more pain is in store: after at least four builders defaulted last month, limited access to refinancing channels has threatened a wave of delinquencies: some of China’s worst-performing dollar junk bond borrowers have some $2 billion in onshore and offshore bond payments due November. And as investors focus on who files next, here are the developers with payments due this week:

- Scenery Journey Ltd. $41.9 million coupon on note due 2022: Nov. 6

- Scenery Journey $40.6 million coupon on note due 2023: Nov. 6

- Zhenro Properties Group Ltd. $13.7 million coupon on note due 2023: Nov. 6

- Central China Real Estate Ltd. $7.79 million coupon on note due 2023: Nov. 7

Amid a growing panic that not a single developer will be able to meat their obligations, some firms are loudly telegraphing their ability to meet debt obligations writes Bloomberg's Sofia Horta e Costa. On Monday, Zhenro Properties Group said it informed a bond trustee it will redeem its 5.95% dollar notes early in full on Nov. 16. Central China Real Estate on Tuesday said it has remitted funds to a trustee for payment of its 6.75% dollar bonds, which are due Nov. 8.

And while creditors of these companies can breathe a sigh of relief that their next coupon payments are incoming, we doubt they will hang around for the next one with the situation across China's property sector as dire as it was during the depths of the global financial crisis and getting worse with every month.

https://ift.tt/3k03hiS

from ZeroHedge News https://ift.tt/3k03hiS

via IFTTT

0 comments

Post a Comment