Tesla Buying-Panic Driven By Institutional Momentum Bias, JPMorgan Quants Warn

While Tesla has been making headlines for over a week with its stunning surge above $1 trillion market-cap and seemingly endless willingness to rip shorts' faces off day after day (amid 'weaponized gamma' squeezes), JPMorgan's quant strategist Peng Cheng wrote in a brief note on market structure that, while TSLA-talk dominated WallStreetBets's Reddit pages, it was institutional investors that made up the “vast majority” of the recent surge.

As even Jim (never seen a rallying stocks I didn't like) Cramer exclaimed: “I’ve actually never seen a stock go up endlessly on nothing.”

So what was driving it?

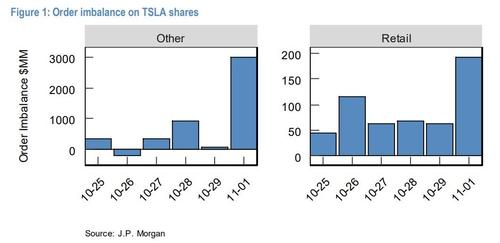

On the cash equity order flow side, Peng writes that strong buying pressure came from both retail and non-retail market orders (Figure 1).

While retail flow has been reliably persistent, totaling $544MM since Oct 25, non-retail orders make up the vast majority of the imbalance, registering $4.5B of net buying by our estimates. It is worth noting that we observe close to $3B of net buying on Nov 1 from non-retail investors.

However, Peng also notes that JPMorgan has shown previously that non-retail market orders tend to carry a Momentum bias; and since the observation coincided with the beginning of the month, JPMorgan believes the strong buying flow could be due to momentum portfolio rebalancing.

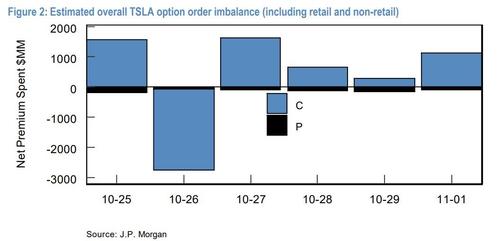

On the options side of the market, Peng points out that much of the imbalance is concentrated on call options.

As seen in Figure 2 above, with the exception of Oct 26, there has been a strong call buying interest by option traders (including retail and non-retail). In total $2.6B of net premium were spent on buying call options, while put options were net sold for a premium of $660MM.

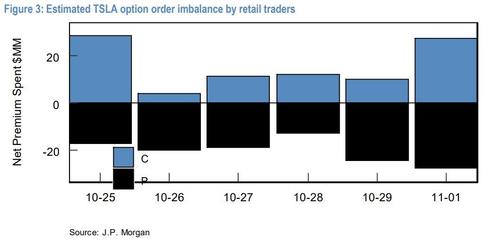

Once again, JPMorgan points out that retail investors make up a relatively small percentage of the volume (Figure 3).

Interestingly, Peng points out that retail traders appear to be more willing to sell puts compared with the other market participants, due to monetizing the high implied volatility, thereby exhibiting a more balanced gamma preference.

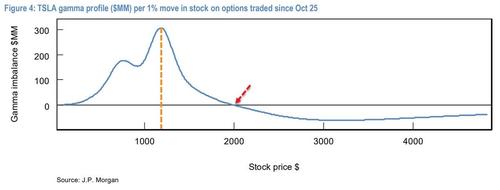

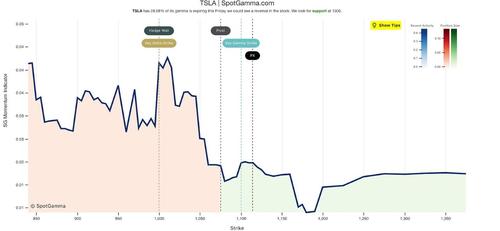

Using the aggregated option order imbalance, Figure 4 shows the estimated gamma supply/demand across a range of spot prices. Peng estimates that end clients are net long gamma and dealers are net short gamma for stock prices below $2000, with the peak gamma likely to occur at around $1184 (+$308MM per 1% move in stock price).

Importantly, this gamma profile includes options traded only since Oct 25, and do not reflect trades previous to those dates.

So it would seem, jealous and tired of the outsized and 'easy' returns being bragged about by every freshly-minted TikTok trading guru, the old dogs of institutional trading have learned the new tricks of retail's Reddit crowd and are executing in size.

So given JPMorgan's view that this latest round of strong buying from institutions "could be due to momentum portfolio rebalancing," the question is, what happens next since momo-players are notoriously not diamond-hands.

After today's weakness (triggered by Musk's tweet on the Hertz order), SpotGamma suggests that it's likely that volatility continues into the most serious part of the decay process which is expected to occur mid-week.

Given that there is a large base of overall gamma (not just the post-Oct 25th gamma illustrated above by JPMorgan) at the $1,100 strike still, SpotGamma sees this level acting as short-term support on any consolidation into the November 5 expiry, for which we see the $1,200 strike being most favored, now.

However, SpotGamma founder Brent Kochuba cautions readers: "These rampant moves are appearing to be more widespread, and we believe this invokes instability that usually ends badly."

https://ift.tt/3mCsZeF

from ZeroHedge News https://ift.tt/3mCsZeF

via IFTTT

0 comments

Post a Comment