Jack Dorsey, Elon Musk Slam Web 3.0... But What Is It

A curious schism is developing within America's tech oligarchy when it comes to "web 3.0" (and it key draw, the Metaverse) with former Twitter CEO Jack Dorsey going on a lengthy rant overnight to voice his displeasure with so-called Web3 technology and the involvement of venture capital firms like Andreessen Horowitz. Dorsey told his millions of followers that "you don't own web 3" and that "the VCs and their LPs do. It will never escape their incentives. It’s ultimately a centralized entity with a different label."

You don’t own “web3.”

— jack⚡️ (@jack) December 21, 2021

The VCs and their LPs do. It will never escape their incentives. It’s ultimately a centralized entity with a different label.

Know what you’re getting into…

In a subsequent tweet, Jack also said that "I have nothing to do with “web3”. WSJ and others need names and photos to generate clicks."

Moments later, Elon Musk - the world's richest man - also got involved when he tweeted "Has anyone seen web3? I can’t find it."

Has anyone seen web3? I can’t find it.

— Elon Musk (@elonmusk) December 21, 2021

This led to a back and forth between Musk and Dorsey...

m something something

— Elon Musk (@elonmusk) December 21, 2021

Jack then explained that while against web 3.0, he is really promoting his own protocol Bluesky, why he said is "not owned by itself or VCs."

No it’s not, and no it’s not. Twitter is advancing a protocol not owned by itself or VCs, @bluesky

— jack⚡️ (@jack) December 21, 2021

Earlier in the day, Dorsey, whose Block Inc. company includes Spiral, a project “aimed at making bitcoin the planet’s preferred currency,” tweeted in response to musical artist Cardi B that Bitcoin will replace the U.S. dollar. The series of tweets and responses from the former Twitter boss on Monday stirred disagreement and debate on the service, with a16z General Partner and Ethereum supporter, Chris Dixon, offering an olive branch by saying he is “a huge fan” of Dorsey and “hoped we can eventually bring him around to ETH and other blockchains.”

“It’s critical we focus our energy on truly secure and resilient technologies owned by the mass of people, not individuals or institutions,” Dorsey responded.

The followed a tweet in which Dixon rehashed a familiar quote by Gandhi which prompted a testy reaction by Jack.

You’re a fund determined to be a media empire that can’t be ignored…not Gandhi.

— jack⚡️ (@jack) December 21, 2021

Ok, but what exactly is everyone arguing over?

define web3 right now pic.twitter.com/fqIJfgF1pG

— Neeraj K. Agrawal (@NeerajKA) December 21, 2021

A simple definition comes from Bloomberg which notes that "Web3, the still hazy term for blockchain-based, decentralized systems and tech that are meant to replace the internet as we know it, has garnered much attention and funding this year, with Andreessen Horowitz being among its loudest cheerleaders. Trading of non-fungible tokens, or NFTs, on the Ethereum and Solana blockchains has been the most visible manifestation, with many companies now investing in the development of decentralized apps as well as games for those platforms."

For those who find that insufficient, here is a lengthier definition taken from a Goldman research report "Framing the Future of Web 3.0 - Metaverse Edition" published last week (the full note is available to professional subscribers in the usual place). We excerpt key sections below:

Framing the Future of Web 3.0 - Metaverse Edition (excerpts)

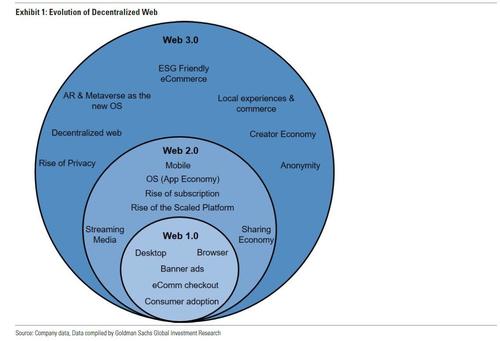

The global Internet is in the middle to late innings of the innovation curve of Web 2.0 (the shift from desktop to mobile computing & from local to cloud storage) and the “leaders” of this wave of the Internet are now firmly established. In framing the next wave of computing (Web 3.0), we see the potential for dramatic shifts in industry structure (decentralized, more local/niche/targeted) that could impact current investor perceptions of platform moat/strength, industry input costs, possible headwinds to monetization driven by personalization and potential for shifting media & commerce trends.

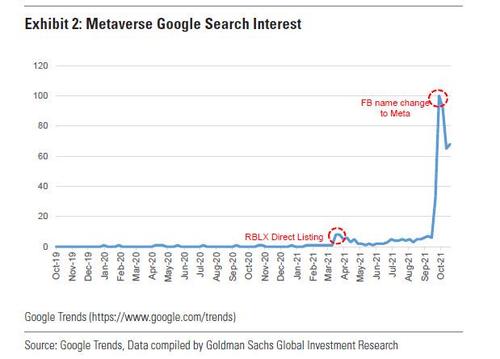

One element of Web 3.0 that has recently captured a lot of media & investor attention is the “Metaverse” (driven by RBLX public listing & FB renaming to Meta Platforms). In the report, we examine how the gaming/media landscape has already shown some key elements as to how the Metaverse might evolve and how themes such as decentralized web activity & virtual experiences could become hallmarks of many of the next wave of computing in Web 3.0. In terms of stocks under coverage, we highlight Meta Platforms (FB), Snap (SNAP) & Roblox (RBLX) as key Buy-rated stocks exposed to this multi-yr theme.

Looking forward, we see a multi-yr period of investment ahead as companies position for computing needs, hardware/software development & test/learn on use cases for consumer & enterprise. For example, we est. FB will invest ~5% of its mkt cap over the next 3 yrs (or $39bn) toward these efforts and that, YTD, the private mkt (across gaming, online games, AR, & virtual world categories) has seen ~$10.4bn of capital raised. In terms of scale of potential investments, we frame a range of outcomes from ~$135bn to ~$1.35tn. Looking beyond the investment cycle to monetization & economic activity, we provide a scenario analysis around what % of the global digital economy might shift towards the virtual world & also apply a range of how the Metaverse may expand the TAM for digital goods/services. Using mkt data on the global digital economy as a % of total GDP (~17% or ~$15tn in ‘21), we frame a range of potential outcomes from ~$2.6-12tn (or ~$8tn at the midpoint), representing a shift of 15% & 33% (respectively) of the digital economy towards the virtual world and 2.5% & 25% (respectively) mkt expansion. While the range is quite broad, we acknowledge that we are still 15 yrs into Web 2.0 and expect the timing of Web 3.0 will be similar, if not longer, in duration.

Framing the Transition to Web 3.0

In our view, the global Internet is in the middle to late innings of the innovation curve of Web 2.0 (the shift from desktop to mobile computing & from local to cloud storage) and the “leaders” of this wave of the Internet are now firmly established. The defining characteristics of a Web 2.0 “leader” are scale of users, utility-like nature of mobile/desktop applications/services (if not a family or ecosystem of apps) & low to no distribution costs (companies have gained broad based familiarity with some turning into verbs). As seen in the figure below, we see dramatic shifts in the industry trends in Web 3.0 (decentralized, more local/niche/targeted, etc) that could impact current investor perceptions of platform moat/strength, industry input costs, possible headwinds to monetization driven by personalization and potential for shifting media and commerce trends as we transition to Web 3.0.

So what form might “Web 3.0” take? We lay out a few key principles:

- Likely more control by the user of their data (including data residing on-device);

- Likely a more micro focus - a mean reversion on scale (either in end market being tackled or in relationship between the platform and the user);

- The rise of individual as creator & creator monetizing their content more directly with “fans”;

- Increasingly decentralized (with the possible breakdown of the mobile operating system/app store distribution model over the next 5-10 years ); &

- Flexibility (if not innovation) on payment mechanisms aimed at a mix of themes, including decentralized privacy and anti-establishment.

As with any new wave of computing, in our opinion, the disruption that it causes is likely to be more impactful on current industry dynamics than outside forces (e.g., potential regulation).

What is the Metaverse?

In the early ‘90s, Neal Stephenson first coined the phrase “Metaverse” in his science fiction novel, Snow Crash. Decades later, industry investor/analyst Matthew Ball raised awareness around the phrase “Metaverse” in a series of essays that was focused on the present/future of Epic Games (owner of Fortnite). Both of these thinkers have set a benchmark of themes which investors could envision key elements of the industry shifting from Web 2.0 to Web 3.0. Large tech platforms (which benefited from the rise of mobile computing apps) now look toward augmented reality as the next computing platform shift. Along those lines, repositioning key consumer/enterprise offerings to evolving media consumption applications (gaming, avatars, attending sports/concerts, exercise) seems like the next logical shift in consumption patterns that will likely drive platform unit economic shifts and create new leader/laggard status among industry players.

One interesting aspect of this evolution is the inter-connectivity of such a computing landscape and the possible erosion of the walled garden elements of the mobile computing wave. While there remain key friction points to solve such as hardware form factor (especially cost curve), broadband connectivity and mass appeal use cases, most investors and tech operators (probably most notable is Mark Zuckerberg’s focus at Meta Platforms and the broader gaming industry) are planning and investing toward platform evolution in this direction.

Over the past 12 months, the term Metaverse began to gain traction shortly after Roblox’s direct listing in March and more meaningfully saw higher levels of Google Search interest during the Q3 ‘21 earnings season as various management teams discussed elements of their business within the future Metaverse. More significantly, Meta Platforms (formerly Facebook) changed its name to reflect CEO Mark Zuckerberg’s vision of Meta’s role within the Metaverse. That said, the term has taken on many forms/definitions with commonalities/ themes around virtual experiences, interoperability, creator community, immersive, and many other elements.

Similar to elements within Web 2.0 around the iPhone/iOS, we view augmented reality & virtual reality as technology enabling the Metaverse whereby services, content, and more are all layered on top and accessed/consumed through the mergence of virtual 3-D and physical experiences. However, below we outline how US internet & gamingcompanies are defining the term.

Meta Platforms

CEO of Meta Platforms, Mark Zuckerberg views the Metaverse as a successor to mobile internet that will:

(1) Elevate physical world experiences. Through mixed reality and physical-world experiences, the Metaverse will magnify the feeling of presence. Currently, there are multiple use cases of AR (including Spark AR) that serve as a template for the future of Metaverse applications, specifically how businesses have utilized AR to enable consumers to virtually see how certain furniture fits within their home or try on makeup/glasses. In the future, Zuckerberg envisions a world in which many physical objects (e.g., TV, computers, etc.) can simply be holograms designed by creators and consumers will use AR glasses to optimize the physical world and VR to be fully submerged in the virtual world.

(2) Be co-created & built responsibly. Similar to a lot of other US TMT companies,Zuckerberg believes that many entities will work together to build the Metaverse(including businesses, creators, policymakers, entrepreneurs, etc.) with integrity, safety,and privacy at the center of its foundation. To support this framework, open standards and interoperability are also core to the Metaverse with new forms of governance likely to emerge.

Zuckerberg believes the Metaverse is coming within the next 10 years, but expects that in the near-term, consumers will first experience the Metaverse through 2D apps, citing examples within commerce (buying physical or digital products) or entertainment (hosting a mixed-reality experience with consumers buying a ticket for in-person or virtual event). Similar to what we saw with the mobile internet, consumer adoption of AR & VR will be a driving factor in business opportunities.

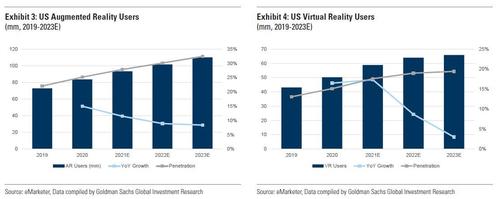

In order to better understand the timeline around the Metaverse opportunity, we look at eMarketer data to assess what current penetration rates are and forward growth assumptions for both AR and VR. While AR represents a larger opportunity when compared to VR, we highlight that penetration rates still remain low with AR users expected to be ~28% of the US population and VR users at ~18% in 2021. We also note that AR numbers are likely to be inflated as they include any individual that experiences AR content as least once per month via any device (e.g., anyone with an Apple/Android device who uses an AR feature in the app, such as AR in Snapchat). With the pandemic removing a lot of physical experiences, the AR and VR market saw strong growth in 2020. Going forward, we expect that technological advances (such as 5G, edge computing) coupled with more use cases (beyond gaming, social media, entertainment) are likely to drive consumer adoption. That said, the low penetration rates in the next 2 years are a key indicator around the timing of the Metaverse opportunity.

- Roblox

CEO of Roblox, David Baszucki, views the Metaverse as a virtual universe that is persistent and shared where platforms connect people from different realms of life and enables them to communicate in a new way through the combination of technology and high-fidelity communication, borrowing from mobile gaming and the entertainment industry. Baszucki has often referred to Roblox as a human co-experience that predicates on the following fundamentals: identity, social, immersive, low friction, variety, anywhere, economy, and civility.

- Epic Games

CEO of Epic Games, Tim Sweeney, envisions the Metaverse as an expansive, communal, & virtual world where people can interact with brands, intellectual properties, and each other with experiences spanning across all categories (beyond gaming). Similar to others, Sweeney believes that individuals will build the Metaverse through user-generated content and there must be a free & fair economy in which all users can partake, make money, and be rewarded. Additionally, every participant (from an individual to a brand to a major developer) must participate on equal terms. Aside from the underlying technology, Sweeney believes that opening up walled gardens and applying industry standards and laws will be pivotal to the Metaverse.

- Niantic Labs

CEO of Niantic Labs, John Hanke, has labeled the Metaverse as a “dystopian nightmare” (link) and is focused on building a better reality by enhancing the physical world through augmented reality, which he has labeled as “real-world Metaverse” in an effort to differentiate it from the virtual video game version. At the core of Hanke’s thesis is data, information, services, and interactive creations where digital meets physical. To Hanke, the key technical challenges in achieving his goal are synchronizing millions of users globally (“shared state”) and tying these users to the physical world, which he believes represents the larger challenge of the two.

- Nvidia

CEO of Nvidia Jensen Huang has defined the Metaverse as a 3D extension of the internet today and expects the virtual economy to be much larger than the real-world economy. In an effort to build the Metaverse, Huang is focused on the Omniverse at Nvidia which is a platform centered on collaboration and simulation, enhancing existing workflows by creating virtual worlds. As an example, Ericsson has partnered with Nvidia using the Omniverse to build virtual cities that replicate physical cities in an effort to accurately simulate 5G cells and the environment, optimizing for performance and coverage.

What is the cost?

Looking back at the shift from Web 1.0 to Web 2.0, there were various cost components tied to Web 2.0 that all built on Web 1.0. Similarly, there will be significant costs tied to Web 3.0 that build upon Web 2.0 infrastructure. Given the complexity involved in quantifying the investments needed, we look at Meta Platforms’ recent segment disclosures for Facebook Reality Labs as a way to better understand what level of costs are required to support the build-out of the Metaverse.

With Meta’s last earnings report, management announced plans to break out reporting by two separate segments, Family of Apps and Facebook Reality Labs which will include augmented and virtual reality related hardware and software content. Management guided Facebook Reality Labs to be a $10bn headwind to total consolidated EBIT in 2021. As can be seen in Exhibit 5, we model investments grow from $10bn in 2021 to $13bn in 2022 & $16bn in 2023 which are driven by investments against VR & AR hardware products, content development costs, a potential interoperable OS layer, & development models for new creative tools.

More specifically, Meta intends to invest in:

- Data center infrastructure. Over the past decade, Meta has invested ~$17bn against 14 data centers in the US and ~$4.1bn against 4 data centers internationally,amounting to ~$21.3bn. Meta’s President of Infrastructure & Data Centers, TomFurlong, has stated that they have 48 active buildings and another 47 buildingsunder construction, signaling 70 additional buildings in the coming years, of whichwe would expect the vast majority to support Meta’s Metaverse efforts.

- Further iterations of VR and AR Products + Content. In 2014, Facebook acquired Oculus for ~$2bn as its first foray into virtual reality products. From 2014 to 2016, Meta had invested $250mm into VR content and committed an additional ~$250mm to fund future content projects. During the 2017 Connect event, CEO Mark Zuckerberg commented that it plans to invest $3bn+ over the next decade against VR products. Since then, Meta Platforms has meaningfully accelerated its investments, purchasing 6 VR content studios in the past 2 years.

- Hiring talent. As of March 31, 2021, roughly 10,000 employees have been focused non building out Meta’s augmented and virtual reality efforts, representing nearly 1/6of Meta’s employee base. During the last earnings call, management announced their goal to double this by hiring an additional 10,000 employees in Europe for itsFacebook Reality Labs segment over the next five years.

- Responsibility. In late September 2021, Meta announced plans to invest ~$50mm in several global partnerships over the next two years in order to ensure Metaverserelated products are being developed responsibly. To date, Meta has announced ~18partnerships that are focused on ensuring responsibility across a few key ares:economic opportunity, privacy, safety & integrity, and equity & inclusion.

- Content Creators. During the 2021 Connect event, Meta announced that it will create a ~$150mm fund to help train and develop the next generation of creators.Specifically, these investments will focus on Metaverse creators’ skillset,high-quality training content, increasing global access to Meta technologies, and responsible research. In addition to Meta’s ~$150mm VR/AR learning fund for creators, Meta has also recently announced a ~$10mm creator fund to support Horizon. Meta will distribute these funds through community competitions offering up to ~$10k for the top 3 winners, its Creator Accelerator Program which will launch in early 2022, and partnerships for funded opportunities. Going forward, we expect that Meta will continue to invest against the opportunity to expand content that will likely help drive consumer adoption.

While we forecast that Meta Platforms’ will invest ~5% of its market cap over the next 3 years (or ~$39bn) based on company commentary, we highlight that Meta is only one of many companies that are investing against this long-term opportunity. That said, we take a look at other public companies investing against Metaverse as well as funding within the private markets and provide an illustrative scenario analysis around the total potential spend against this opportunity in the coming years. Looking at the underlying holdings of the META ETF, we calculate the market cap of each company and apply a percentage to the total market cap of ~$12,500tn. In addition, we look at the private market across gaming, online games, augmented reality, and virtual world categories - during 2021, ~$10.4bn of capital has been raised so far across 612 deals (up from ~$5.9bn in 2020). As can be seen in Exhibit 6, there are a range of potential outcomes with ~$135bn of investments at the low end to ~$1.35tn at the high end - however, we view the more likely scenario as ranging from ~$135-700bn based on our assumption that Meta Platforms investments over the next three years (as a percentage of market cap) will be the largest.

What are the potential use cases and TAM?

Current State of Virtual Reality: Examining Oculus

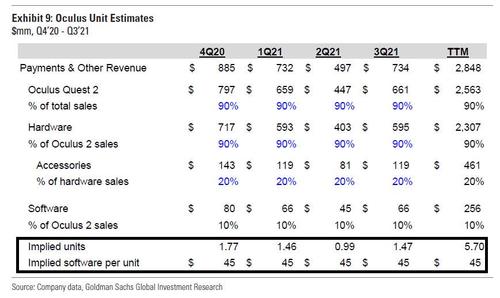

In March 2014, Meta Platforms acquired Oculus for $2.4bn as a way to gain a footprint in the virtual reality landscape. Following the acquisition, Meta Platforms launched Oculus Rift (the first consumer model) in March 2016 at a starting price of $599, followed by Oculus Go in May 2018 (with a starting price of $199). In May 2019, Meta Platforms debuted Oculus Quest which would replace Oculus Rift for a starting price of $399. Since then, Meta Platforms released a new version of Oculus Quest, with a starting price of $299, the lowest price within the competitive landscape. As can be seen below, Oculus Quest 2 (which will later be renamed to Meta Quest 2) has resulted in significant YoY growth rates for Meta Platforms’ payments & other revenue segment, whereby consumer hardware represents the vast majority based on our estimates. That said, we see the hardware’s price point of $299 as being a key contributor in driving wider consumer adoption.

While Meta Platforms has not disclosed the units sold for Oculus Quest 2, we provide our unit estimates to date below. Assuming that Oculus 2 represents ~90% (based on FB’s 10-Q that the YoY increase in FB’s Other revenue segment is entirely driven by sales of consumer hardware) of Meta’s payments and other revenues since launch with ~90% (also based on the 10-Q that it is all driven by sales in consumer hardware product) of that revenue going towards hardware unit sales & accessories, we arrive at ~$2.3bn in hardware & accessories sales since inception. We then assume that accessories represent ~20% (assuming that for every one unit, there is 1 accessory purchase at an ASP of ~$80, based on the accessories listed on the website) of these sales, which would imply Oculus Quest 2 sold ~1.8mm units in Q4 ‘20 and has sold through ~5.7mm units (using an ASP of $324 which represents ~75% of units being sold at $299 and ~25% at $399) - this compares to Omdia estimates of ~2.3mm units being sold in Q4 ‘20 with expectations for ~6.6mm units to be sold in 2021. Based on these assumptions, the total spend on content per unit is ~$45. For comparison, PlayStation VR was released in 2016 and reached ~5mm units by 12/31/2019, highlighting the strong consumer adoption Oculus Quest 2 has seen to date.

The Gaming Industry: Setting the Stage for What’s Ahead

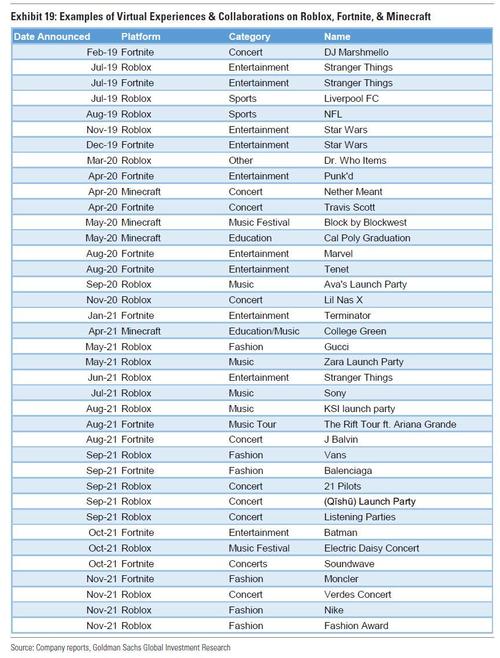

Prior to COVID-19, video games were already starting to blur the lines between virtual and physical events & activities as demonstrated by in-game events in Fortnite and Roblox (e.g., Star Wars: The Rise of Skywalker, DJ Marshmello concert, Weezer album debut), professional eSports players partnering with celebrities on Twitch (e.g., Drake and Ninja playing Fortnite), and Take-Two’s online casino in Grand Theft Auto where gamers could gamble real money. As a result of these in-game events and activities, these key franchises saw user base expansion and increased levels of engagement, consumption, and ultimately monetization. And on the other hand, these events allowed content creators to connect with the next generation in a new forum that boasts high levels of engagement.

During COVID-19, social restrictions placed an importance on the need to have virtual events and connections, resulting in the social acceptance of virtual existence. During the pandemic, video games, streaming platforms, and communication apps allowed consumers to digitally connect with one another, with cancelled in-person graduations ceremonies, weddings, and many other significant life events taking place via Minecraft, Roblox, and other platforms. These examples demonstrated the many use cases video game platforms can offer. Prior to COVID-19, many of the platforms were more in an experimental phase in terms of integrating live events. During COVID-19, we saw a wave of consumers creating their own virtual worlds in an effort to replicate physical worlds. Coming out of COVID-19, we are now seeing platforms invest in a greater sense of presence and individuality (e.g., gamer’s avatar connecting directly with an artist in Roblox) in an effort to further blur the lines between virtual and physical existence.

Large and Growing Market Makes Gaming an Attractive Platform to Connect with Others

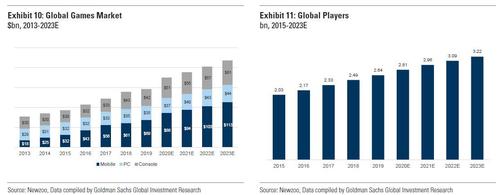

The video games market was approximately $175bn in 2020, marking a 13% 3-year CAGR (2017-20), and is projected to grow at an 8% 3-year CAGR (2020-23), according to growth of 11% over the same time period. In addition, we note that the global player base is estimated to grow to ~3.22bn by 2023 (according to Newzoo) from 2.03bn in 2015 driven by a growing installed base of smartphones, the rollout of 5G, and a new generation of gamers adapting mobile games coupled with a growing number of high-quality games made for mobile. We note that COVID-19 accelerated many of the long-term tailwinds as many consumers turned to video games as a way to connect with others virtually.

Breaking Down Walled Gardens Unlocks the Digital Transformation and Monetization of Long-Tailed Engagement

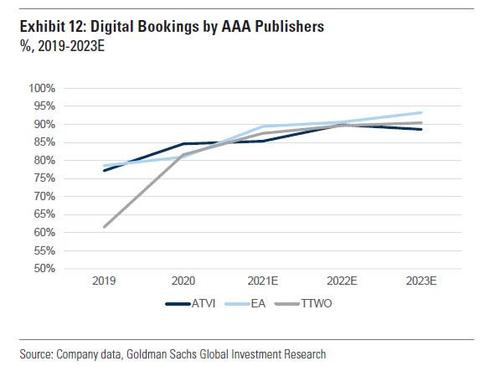

Looking back on the history of video games, traditional games were typically purchased with an upfront fee of ~$60 with players only allowed to play with others based on the player’s platform (e.g., Xbox vs. Playstation). In 2017, Fortnite was released as a free-to-play Battle Royale game that was cross-platform (by Sep 2018), which opened up the addressable market and drove a myriad of competitive and social elements given the ability to play with other players regardless of the platform - all of these elements allowed Epic Games to create an ecosystem in which they can promote live services (e.g., monetize skins that have no direct impact on game play) and host virtual events (e.g., Ariana Grande) for gamers to connect with each other as well as the artist. Since then, the business model across video game companies has transformed from physical unit sales for premium games to in-game content (events, competitions, skins, etc.) layered on top of premium games and monetized through various forms (premium, in-game purchases, advertising, battle/season passes), which has led to the rise of virtual currency. Furthermore, live streaming platforms (e.g., Twitch) and eSports have also driven long-tail engagement around key gaming franchises as an additional way to interact with other gamers, further strengthening the community and expanding the economic opportunity (through tips, sponsorship, advertising, etc.). Over time, AAA publishers have increasingly focused on developing in-game content to drive engagement and ultimately monetization - as can be seen below, the vast majority of AAA publishers has seen an increasing mix towards digital revenues (vs. physical).

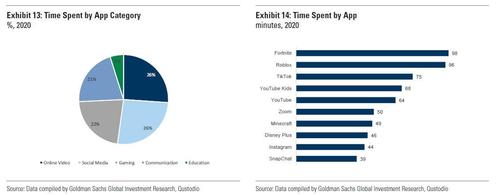

Next Generation of Users Places Importance on Social Elements and Virtual Worlds Within Gaming

Looking at how the next generation of users spends their digital time in 2020 across the US, UK, Spain, online video and social media both represent ~26% of screen time at ~45 minutes, with gaming falling closely behind at ~22% of screen time or ~38 minutes. However, when looking at the top apps by time spent, Fortnite and Roblox rank first and second with more than an hour and a half spent in the games, both of which are open environment multi-player games, signaling the value the younger generation places on social elements and virtual worlds within gaming.

Emergence of Virtual Experiences and Widespread Gamer Adoption Highlights the Opportunity Ahead

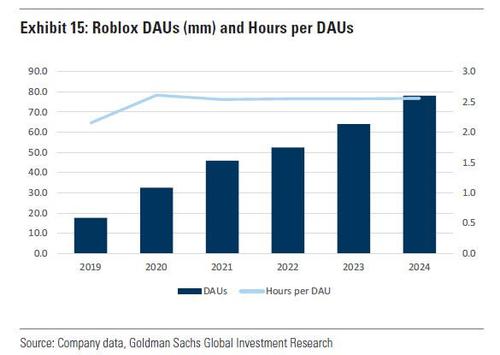

Looking at Roblox specifically, the company currently has ~47mm DAUs with expectations to grow to ~78mm by 2024 consuming ~2.6 hours per DAU per day of “experiences”. Roblox monetizes its user base through the sale of its virtual currency, Robux (R$), which can be used to enhance game experiences, customize a player’s avatar, or acquire development resources. Developers are compensated in Robux, which can be exchanged for fiat currency or spent back into the platform. As laid out in Goldman Sachs initiation (link), Roblox’s platform includes content developed by individual creators and video game studios, as well as non-endemic businesses such as film/TV studios (e.g., Warner Bros, Netflix) and musical artists (e.g., Lil Nas X) demonstrating the use cases for non-gaming general entertainment.

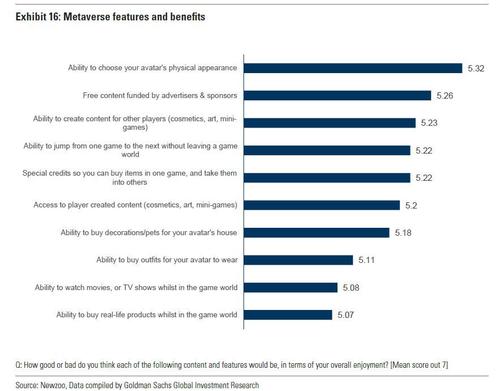

According to a survey conducted by Newzoo, consumers view the ability to choose their avatar’s physical appearance as a key feature in terms of driving overall enjoyment within the metaverse, followed by free content funded by advertisers & sponsors, and ability to create content for other players. These are all elements that Roblox has been investing behind in order to enhance the users’ virtual experience.

Investing in Virtual Identity Through User-Generated Avatars

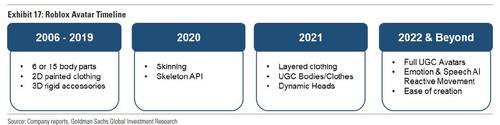

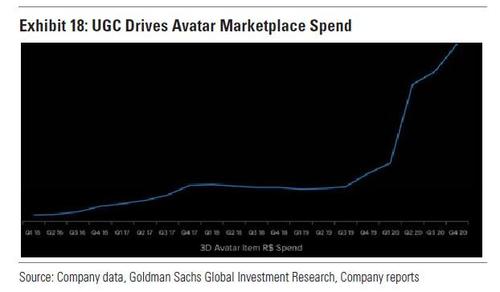

While the Roblox marketplace (where gamers can purchase clothing accessories and simulated gestures for their avatar) only represents ~25% of total revenue, Roblox is investing heavily in the avatar marketplace by improving fidelity (e.g., layered clothing, facial animations, photorealistic skin meshes) in an effort to enhance the feeling of presence & individuality among the gamer base. Despite representing the minority of revenue, avatars are a key element of the Roblox experience as 20% of users change their avatars daily - the more personalized a gamer’s avatar is, the more engaged they are, the more invested they are in the platform, and the more time they spend.

Prior to 2019, Roblox developed all content sold within the avatar marketplace in-house. Roblox then shifted to a user-generated content (UGC) model in 2019, which it trialed with a select group of Roblox developers. Notably, Roblox experienced a 250% increase in avatar marketplace transactions upon turning the avatar marketplace over to the developer community. Currently, the marketplace is open to ~500 developers who release ~350 items per week representing ~65% of all 3D avatar item sales. Going forward, Roblox plans to continue to invest behind UGC items by opening new items to UGC creation including layered clothing and avatar body & faces. Following that, Roblox will enable every new item type on the platform to be UGC and will also look to open up the current closed list of ~500 developers to all users (similar to how anyone can develop a Roblox experience). Over the long-term, management envisions a fully decentralized model whereby various brands and creators can build their own stores to sell virtual goods to consumers to further build out their virtual identity and beyond that, management also envisions a world in which consumers can virtually buy anything that you could in real life (e.g., pets, art, houses, cars, etc.) further expanding one’s identity within the Metaverse.

Real-Life Use Cases Beyond Gaming Signify Potential for Other Categories

In a Web 2.0 world, we have already seen open-environment games (e.g., Roblox, Fortnite, Minecraft) start to create and develop “Metaverse”-like experiences for all constituents, starting with Fortnite hosting an in-game concert with DJ Marshmello which had ~11mm concurrent players in attendance and nearly 27mm views on YouTube. Since then, Roblox, Epic Games, Microsoft, and many other companies have continued to build and create immersive virtual experiences by partnering with brands, musicians and labels, and educational institutions as can be seen below.

There is much more in the full Web 3.0 report available to professional subs.

https://ift.tt/3J5is5f

from ZeroHedge News https://ift.tt/3J5is5f

via IFTTT

0 comments

Post a Comment