Morgan Stanley: Our "Ice" Scenario Will Be Worse Than Most Expect

While the message from the Fed last week was widely telegraphed even if it was somewhat more hawkish than most had expected, Morgan Stanley's Michael Wilson writes that it also confirmed the fact the Fed is beginning what could be "a very long process of removing monetary accommodation from markets that have become dependent on it."

And while most of the major stock indices in the US remain near, or at all time highs, the damage beneath the surface suggests markets have been discounting this shift by the Fed for months, the chief equity strategist writes. In fact, Wilson believes it began shortly after the Jackson Hole meeting in late August when Chair Powell first suggested tapering of asset purchases would commence before year end, a message he officially confirmed at the Fed's September meeting. As noted, this fact hasn't been lost on markets over the past month as rotations away from the most speculative assets have been historic in terms of the speed and velocity.

In fact, Wilson argues that the markets began discounting this eventual withdrawal of accommodation way back in February when the rate of change in the Fed's balance sheet rolled over hard and back-end rates started to price in the inflation that was on the horizon. The questions now, the MS strategist notes, is "whether it's been fully discounted, what's still vulnerable and where can investors find positive returns?"

Needless to say, with a 2022 year-end price of 4,400, the answer is negative and as Wilson notes, he remains concerned about valuation all year with a particular focus on it in Q1 when he favored cyclicals and reopening plays. Since then, the most expensively priced equities have faltered as shown in the second chart above, and have yet to recover even though long term interest rates have come back down leaving real 10 -year yields near all time lows! This jibes with Wilson's view that the re-rating is now happening via the equity risk premium (ERP) channel rather than rates as the equity market is smart enough to know that using current levels of either nominal or real rates to discount cash flows far in the future may be a colossal mistake given the pace of inflation and the Fed's changing reaction function. "This re-rating in ERPs could have much further to go," Wilson warns.

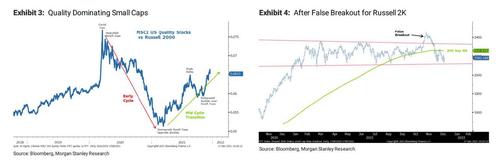

That said, Wilson has also favored quality since mid-March when he made his mid-cycle transition call and downgraded small caps. He then doubled down on that call in his year ahead outlook after small caps inexplicably rallied in October only to end in a false breakout that trapped a lot of capital at all time highs. The Russell 2000 has now definitively broken its 200 day moving average and sits precariously close to the lower end of its well defined trading range. Given the outlook for a continued difficult operating environment for most companies, Wilson thinks the odds are rising that "the small cap index breaks down, not up."

Fast forwarding to today, the quality trade is now taking on a different complexion. In Morgan Stanley's year-ahead outlook the bank recommended investors focus more on large cap defensive quality rather than growth quality. This recommendation was based on the view that "the Fed and other central banks would begin to take away the punch bowl at an accelerated pace and that tapering is tightening for markets, if not the economy."

Needless to say, growth stocks would be more vulnerable to that tapering than defensive ones given their much higher valuations. Since November 15th the market has de-rated growth stocks as shown above. More importantly, as shown below, defensive stocks have been the best performers by far — in line with Wilson's recommendation. This preference for defense, according to the MS strategist, is due to both Fire (central bank tightening) and the oncoming Ice (growth slowdown) that could be worse than most expect. Two of the bank's overweight sectors (Healthcare and REITs) have been the top performers and it continues to favor both. Staples are also looking more interesting where Staples are favored over Discretionary (see below for more on this trade).

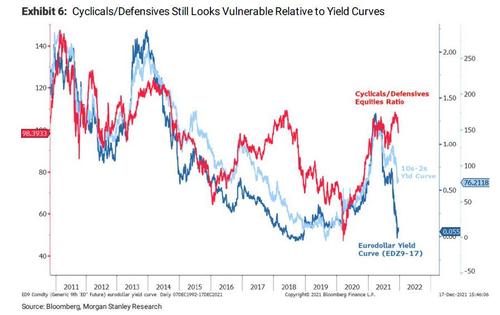

Given this set up, it's not surprising that cyclicals have underperformed defensives during this stretch. However, in contrast to views of most investors, Wilson thinks cyclicals still look vulnerable if the Ice scenario gains more traction. Importantly, the cyclicals/defensive equity pair is significantly trailing the signals from the yield curve - either the curve needs to re-steepen sharply or defensives will continue to lead and outperform cyclicals.

Which brings us to another critical question - why is the yield curve flattening so aggressively if the economy is - as one reads in the "independent" mainstream media, on fire? Most investors think this is mostly due to Omicron but the yield curve topped in March and hasn't looked back since. This jibes with Wilson's view that the rate of change on growth is in a cyclical downturn that is independent of the virus and its variants. This latest compression in the curve suggests it's going to get worse before it bottoms.

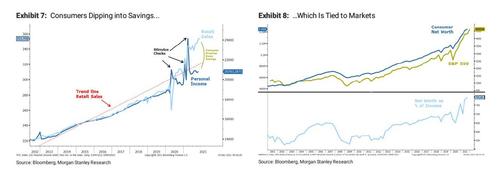

In short, the MS strategist is concerned that the Ice will turn out to be chillier than most expect is increasing. And while Omicron is part of that concern in the near term for certain activities, Wilson is more focused on the risk of supply picking up just as consumption is fading from a payback in demand, higher prices and demand destruction. Keep in mind that consumer confidence remains at recessionary levels mainly due to higher inflation and that is expected to start to show up in consumption in Q1. In fact, as we reported last week, November retail sales faded after an earlier than normal holiday shopping period ramped in October.

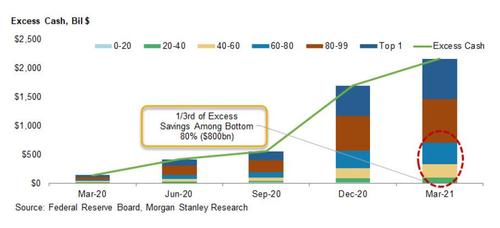

Yet even despite these disappointing sales numbers, they remain well above trend in personal income, suggesting the consumer has been dipping into the large savings built up during the pandemic from both stimulus checks and asset price increases.

This new found wealth, as we noted before, remains large but concentrated in the upper quartile income cohort. Now, with the Build Back Better bill in jeopardy of not passing at all, these lower end consumers are likely to struggle, while the wealthy decide to reign in consumption if asset prices continue to falter.

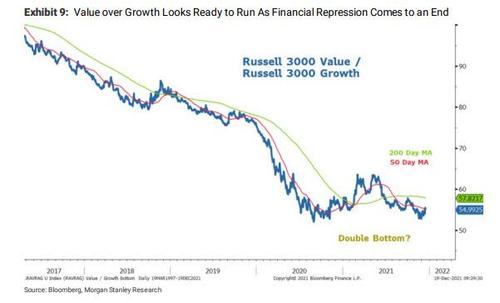

Finally, one month ago when he published his year-ahead outlook, Wilson had a slight bias for value over growth mostly on the view that growth looked more vulnerable to Fed tightening rather than value looking attractive in absolute terms. Furthermore, value is essentially a barbell of cyclicals and defensives. As noted above, the strategist likes defensives but not cyclicals at the moment which means as a whole, value is more of a neutral than an overweight. Since then, value underperformed growth by a few percentage points but in the past few weeks has regained all of that underperformance...

... with defensives doing the heavy lifting. In short, value over growth makes even more sense now than when Wilson published his outlook on November 15th - most of this performance should come from value simply holding up better than the major averages as valuations continue to fall and earnings revisions breadth decelerates further especially among overvalued growth pockets.

The catalyst for such a major change of trend is peak monetary accommodation which has been the primary tailwind for growth over value since the end of the Great Financial Crisis.

As Wilson concludes, and as he discussed in his outlook, "this is the beginning of the end of financial repression; and while it will take years to completely exit like in the 1940s, equity markets will start to discount it well in advance via the equity risk premium, in our view. That disproportionately favors value over growth."

https://ift.tt/3Fg18Il

from ZeroHedge News https://ift.tt/3Fg18Il

via IFTTT

0 comments

Post a Comment