Oil Market Year In Review: The Big Storage Unwind Of 2021 And Looking Forward

By Ryan Fitzmaurice of Rabobank

Summary

-

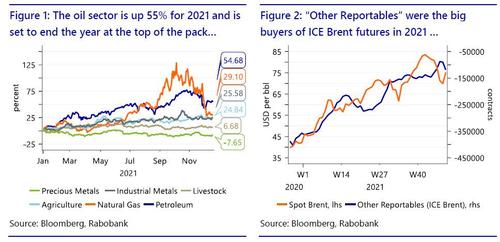

Oil is set to end the year at the top of the pack with respect to commodity sector returns

-

A group of traders categorized as “Other Reportables” were the big buyers of Brent this year

-

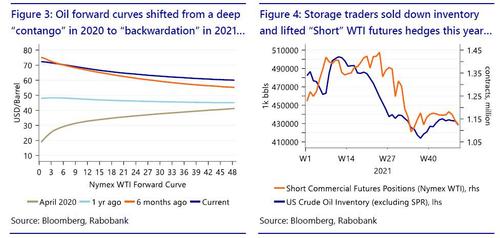

Unwind trades related to storage plays were a key driver of WTI positioning and price in 2021

Top of the pack

As we approach the final trading days of 2021, we felt now was a good time to review the oil price formation this past year as well as the key drivers behind the historic annual gains.

Ironically, the impressive gains come on the heels of a terrible 2020 which saw oil prices trade into the low teens and even briefly negative in the case of WTI. As it stands though, the petroleum sector is up 55% for 2021 and is set to end the year at the top of the pack with respect to commodity sector returns. Further to that end, this year will mark the largest annual gain for the Brent crude index since the late 1990s. Interestingly, the aggressive buyers behind this year’s rally are not the usual suspects as money managers were net sellers of oil futures over the course of the year. That’s not to say money managers were bearish crude oil, as that was not necessarily the case either. In fact, the commonly used quantitative signals were heavily weighted toward the bullish end of the spectrum for much of the year, such as oil trend, momentum, and carry.

On the flip side, the US Dollar strongly appreciated, and oil market volatility was elevated at different points in time, causing asset managers to reduce oil futures holdings to compensate for the currency and volatility shifts. As it turns out, a lesser-known group of speculators categorized as “Other Reportables” were the big buyers of ICE Brent futures this year. For reference, this category of trader has emerged as a powerful market force in recent years and has distinctly different trading behavior from the heavily momentum-driven managed money category. Nonetheless, “Other Reportables” bought an impressive 250k contracts over the past 52 weeks, taking the other side of the managed money liquidation selling, in addition to all the selling from swap dealers and commercial interests. As for the Nymex WTI contract, it was a slightly different scenario with commercial storage trade unwinds dominating the buying interest throughout most of the year while both money managers and “Other Reportables” were net sellers of the US benchmark.

The big storage unwind of 2021

As we just noted, commercial storage traders were the big buyers of the Nymex WTI contract in 2021. This was not just a 2021 story though and to fully understand one needs to goes further back in time to the dark days of the early pandemic when oil prices were crashing on the threat of breaching physical storage limits amid widespread lockdowns and even a brief OPEC market share war. At the time, oil calendar spreads were in “contango” and blowing out to historic proportions, creating an enormous opportunity for those market participants with the right storage and logistical assets. In essence, an extremely attractive and virtually risk-free return could be made by storing physical crude oil, given the ability to sell futures forward, effectively locking in a huge spread above the cost of financing and leasing fees. Naturally, storage filled up fast in that environment, nearly reaching maximum capacity at the peak. Importantly, a great deal of futures were sold forward to hedge this enormous build up in inventory. In fact, this hedging pressure undoubtedly contributed to the selloff witnessed during that period. As we now know though, conditions changed rapidly in 2021, and a huge drawdown in crude stocks occurred as global economies reopened and as crude supplies tightened as a result of OPEC+ discipline.

Furthermore, the forward curves for both crude oil benchmarks shifted from a historic “contango” in 2020, to a strong “backwardation” in 2021, as can be seen in Figure 3. This abrupt shift in fundamentals and curve structure reversed the favorable conditions for storing oil and, as such, commercial traders sold down inventory and unwound “short” hedges in the futures market for much of the year. In fact, this dynamic can be seen in Figure 4 with the CFTC Commercial “Short” positioning for Nymex WTI being reduced in conjunction with the inventory draws. Furthermore, the shift from a deep “contango” to a rather steep “backwardation” dramatically improved the backdrop for oil and commodity index investors as a result of the attractive roll-yield on offer for much of 2021. Further to that end, the WTI index is up 55% on the year, with the increase in spot prices accounting for roughly 46% of the gains and with roll-yield adding a meaningful 9% or so depending on the exact timing of rolls. As is clear from this year, roll-yield is a significant contributor to commodity futures market returns and its long-term impacts cannot be overstated.

Looking Forward

Looking forward, oil markets are heading into 2022 with strong momentum, trend, and carry signals as it currently stands. Further to that end, money managers have plenty of dry power at hand to buy oil futures following a year of net liquidation, as a result of a stronger US Dollar and elevated market volatility.

As such, we expect these two factors to play an outsized role for oil markets in the coming year and a reversal in either or both should lead to increased oil buying from money managers. In addition, inflation concerns were a key driver of a resurgence in commodity index flows in 2021, and we suspect this trend to continue well into 2022 and beyond.

https://ift.tt/33SLJjd

from ZeroHedge News https://ift.tt/33SLJjd

via IFTTT

0 comments

Post a Comment