Erdogan Reiterates Commitment To 'Islamic' Rate-Cut Plan, Threatens Turkish Business Lobby Over Dissent

Having seen his nation's currency continue its collapse (losing half its value in the last three months), despite shutting down stock trading last week and proposing huge fines for any form of "hoarding", Turkish President Recep Tayyip Erdogan addressed the nation in a public statement, invoking religion as behind his decision to buck economic orthodoxy and cut rates into hyperinflation.

Referring to Islamic proscriptions on usury as a basis for his new policy push, Erdogan clarified 'his' policy: “What is it? We are lowering interest rates. Don’t expect anything else from me."

“As a Muslim, I’ll continue to do what is required by nas,” Erdogan said, using an Arabic word used in Turkish to refer to Islamic teachings.

More fundamentally speaking, as Bloomberg notes, the president believes Turkey can free itself from reliance on foreign capital flows by abandoning policies that prioritized higher interest rates and strong inflows. At the heart of his ideas is a belief that lower interest rates will also curb consumer price growth - the exact opposite of the consensus view among the world’s central bankers.

The response to Erdogan's latest statement is more of the same - selling the lira...

The leader blamed the collapse of the currency on an "economic siege", reiterating that he wouldn't back down from his plan (to drive his nation into hyperinflation?).

“Of course, we know the impact from price increases on people’s daily lives. We are of course aware of the instability caused by the lira’s fluctuations and its impact on prices,” Erdogan said.

“But we will put up resistance against these. I announce from here: there is no backing down.”

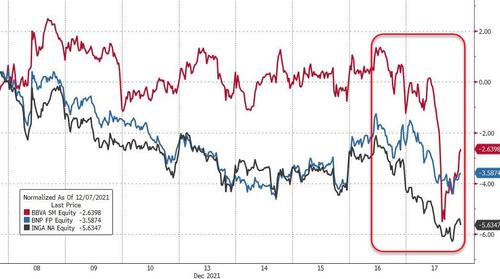

As we recently noted, at the height of the last big wave of Turkey’s ongoing crisis, in August 2018, the European Central Bank issued a warning about the potential impact the plummeting lira could have on Euro Area banks heavily exposed to Turkey’s economy via large amounts in loans — much of them in euros — through banks they acquired in Turkey. The central bank was worried that Turkish borrowers might not be hedged against the lira’s weakness and would begin to default on foreign currency loans, which accounted for 40% of the Turkish banking sector’s assets.

In the end, the contagion risks were largely contained. Many Turkish banks ended up agreeing to restructure the debts of their corporate clients, particularly the large ones. At the same time, the Erdogan government used state-owned lenders to bail out millions of cash-strapped consumers by restructuring their consumer loans, many of them foreign denominated, and credit card debt.

But concerns are once again on the rise about European banks’ exposure to Turkey.

As one might expect, it's not just banks that are fearful, Erdogan's recent actions sparked anger among Turkish business owners, with several associations calling for measures to stabilize the lira’s exchange rate. Scandalously, in such an increasingly totalitarian state, key business group Tusiad urged the government to abandon the current policy stance, citing recent market turmoil as proof that the experimental model is bound to fail.

But speaking truth to power in Istanbul is not welcomed and Erdogan threatened those critical of him directly that "they won’t be able to challenge the government.”

“You are working to put in power a government that you can exploit. This nation will not allow you to do that,” he added.

https://ift.tt/3pcJm3e

from ZeroHedge News https://ift.tt/3pcJm3e

via IFTTT

0 comments

Post a Comment