Goldman Admits Saudi-China Oil-Trade Signals 'Erosion' Of Dollar Reserve Status

Following The Wall Street Journal's recent report that Saudi Arabia is considering pricing some of its oil sales to China in Yuan, the question of the dollar's status as global reserve currency has bubbled back to 'top of mind' for many longer-term investors.

As Goldman Sachs' Farouk Soussa notes in a report today, these steps are not entirely surprising: over time, currency choice tends to be driven in part by economic ties and partly by geopolitical alliances, and China has become a more important economic partner as its economy develops and imports more oil, while at the same time geopolitical developments perhaps demonstrate the attractiveness of a more diversified currency set.

There are still important barriers to making a large shift, but the petrodollar has been a key underpinning to the Dollar’s reserve status over the last 50 years, so developments in this sphere are important to watch.

China’s importance to Saudi Arabia as an export market has risen in parallel with the Kingdom’s dependence on Chinese imports and investment; but, as Goldman notes, the increased frequency of use of financial sanctions by the United States as a foreign policy tool is arguably creating an incentive for third countries to diversify away from a perceived over-reliance on Dollar-denominated trade.

Relations between Saudi and the United States have also been on a downward trajectory since the start of this century. A long series of policy differences (from the invasion of Iraq to the potentially imminent revival of the JCPOA with Iran) and diminished US foreign policy interests in the region are leading Riyadh to seek political and security alliances with other world powers, including the Chinese.

In our view, this reinforces the deepening economic ties already in evidence, and could potentially motivate a shift toward Yuan pricing of Chinese oil exports by the Saudis.

However, commodity pricing remains an important pillar of the Dollar’s global reserve status. Most prominently, it ensures that most countries will need to invoice at least a portion of their trade in Dollars, which in turn incentivizes them to hold a portion of their reserves in Dollars as well.

But the potential shift from Saudi Arabia (and also Russia’s shift into CNY in 2018) demonstrates one way for China’s Yuan to become a more important international - or at least regional - currency (that is not to say it is getting anywhere close to reserve status).

So, what is the overall “state of play” of de-Dollarization?

Goldman points out that the Saudi-China discussions occur against a backdrop where a number of countries are already taking steps towards diversifying their reserve holdings, for a variety of reasons.

While Russia accounted for a large proportion of de-Dollarization in recent years, it is far from the only country that has shifted some holdings out of G3 currencies.

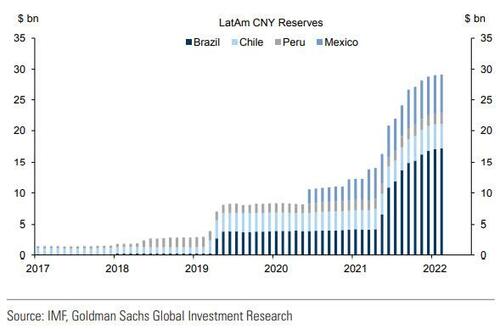

For example, together with shifting commodity demand, Latin American countries have added close to $30bn in CNY reserves over the last five years.

Even elsewhere in the Middle East, Israel has made some key diversification shifts, and added over $1bn of CNY reserves in February of this year alone.

But on the other hand, while the recent use of sanctions against Russia provides a potential motivation for some countries to think about changing their reserve accumulation practices, at the same time Russia’s experience demonstrates the limitations this can have in a still largely Dollar-denominated world.

Ultimately, there are many reasons why the Dollar maintains its role as the world’s leading international currency, and many reinforcing complementarities or “network effects” among the key variables. This structure will not change overnight.

But in the most ominous comments yet from any Wall Street bank, Goldman admits the latest move by Saudi Arabia and China is significant:

...political developments, especially military conflicts, can be important for currency markets, and we would see recent geopolitical events as negatively affecting the distribution of possible outcomes for the US Dollar over the medium term.

In essence, while there is currently no real alternative to the Dollar for capital market depth and global integration, and number of recent events fit with the type of behavior that could start to shift those dynamics, re-denominating a larger portion of commodity trade could be another important step in that process.

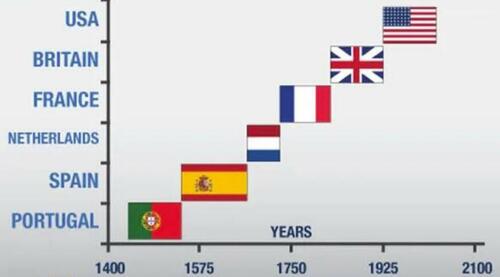

Finally, remember, as we have detailed numerous times over the years, 'nothing lasts forever' (especially global reserve currencies)...

... so what will replace the dollar? Gold (traditional), Bitcoin (novel), Yuan (all the downsides of fiat 'inside money' with no upsides), or as Zoltan Poszar detailed in his recent epochal note, a bullion/commodity-baset-backed 'currency'?

https://ift.tt/DbstHeu

from ZeroHedge News https://ift.tt/DbstHeu

via IFTTT

0 comments

Post a Comment