Oil Stimmy

By Ryan Fitzmaurice of Rabobank

Summary:

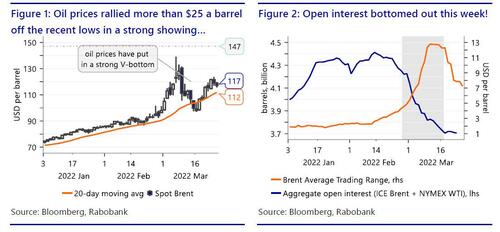

- Oil prices have rallied more than $25 a barrel off the recent lows and in short order

- A plethora of supply-side issues have come to light amid an already tight supply backdrop

- The average trading range for Brent has fallen from above $12 per day to below $8 recently

In last week’s note, we wrote that oil prices had likely found a bottom given that the widespread forced selling that occurred the prior two weeks had neared its end. This week we got confirmation of that notion with oil prices rallying sharply while putting in a strong V-bottom on the charts. Further to that end, the spot Brent price traded as high as $123.74 on Thursday, more than $25 a barrel off the recent lows and all in just six trading sessions as a plethora of supply side issues came to light amid an already extremely tight supply backdrop.

On that note, the oil market rallied early in the week on reports that the Houthis rebels had launched another drone attack on Saudi oil facilities, this time causing modest supply disruptions. The attack even prompted an official Saudi warning to the international community of the potential for consequential supply losses unless more is done to prevent these rather consistent and hard-to-defend drone attacks from the Iran-backed Houthi rebels in Yemen. Then it was a surprise outage for a major oil pipeline that moves 1.2mb/d of crude from Kazakhstan to Europe, and which just so happens to run through Russia. The pipeline maintenance, which is expected to take up to two months, is occurring in Russia, and is said to be the result of damage suffered during a recent storm in the Black Sea.

To our minds, the timing of the outage is certainly interesting and further limits Europe’s ability to completely shift away from Russian oil supplies in the near-term despite the ongoing war in Ukraine. In addition to the bullish fundamental developments this week, quantitative factors are also likely to support oil prices in the coming weeks as volatility begins to normalize. Moreover, the spike in volatility that triggered the recent de-risking event has started to subside with average trading ranges for spot Brent prices shrinking to below $8 per day from recent highs of more than $12 per day and with aggregate open interest finding a bottom too. This drop in oil market volatility should begin luring big traders back to the market, increasing open interest and helping to stabilize oil prices at much higher levels than before the war.

Stimulating demand

As is clear, the supply-side of oil markets is razor thin at the moment given the West’s ongoing and proactive shift away from Russian energy imports, in addition to the other factors we just laid out. Given this backdrop it’s no surprise that oil prices are trading at multi-year highs, and inflation is soaring as a result. In the past, we have discussed at length the feedback loop between investors and inflation i.e. Investors rush to buy commodities to hedge inflation, thereby putting upward pressure on commodities prices and driving inflation higher, holding all else equal. Now, we are seeing another feedback loop develop with oil stimulus checks being discussed by lawmakers across the globe to offset the impact from rising gasoline and diesel prices, in an effort to gain favor with constituents. In our view, these politically motivated actions would only exacerbate the current oil market deficits, while opening the door for new record oil prices. To expand on that, sending oil stimulus checks would be encouraging oil demand at a time when supply is dangerously tight, and with record demand already expected this summer given mobility is finally returning following the recent covid measure relaxations in key regions.

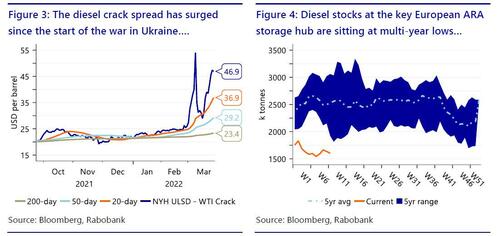

Furthermore, looking at other asset classes as a guide, it is well-known that a lot of the covid stimulus checks wound up in financial markets and were partially to blame for the “meme” stock trading trend that developed in 2020 and carried on in to 2021. In a way, this would be similar, and like adding fuel to a market that is already on fire, especially as we approach the high demand driving season. Already, diesel markets are experiencing significant shortages in Europe as Russian supplies are proving to be difficult to replace. In fact, the diesel crack spread has surged since the start of the war in Ukraine, further highlighting Russia's importance to global diesel supplies and particularly so in Europe. The tightness in diesel markets was and is clear even before the full brunt of the West's shift away from Russian supplies has been felt, and stockpiles in Europe and the US are already at multi-year lows and with less refining capacity than before the pandemic. Moreover, the backwardation in diesel markets has risen to historic levels in an attempt to push demand further out the curve. As such, oil stimulus checks would counteract this dynamic by dragging demand forward when and if these potential bills are voted into law.

Looking Forward

Looking forward, we remain bullish oil prices and are encouraged by the strong recovery this week. As we noted, the recent supply-side developments are keeping traders on edge and even a small unplanned outage could send prices soaring given how tight things are. At the same time, lawmakers appear ready to issue nonsensical oil stimulus checks, to help ease political vulnerabilities from rising inflation. Ironically, if this unnecessary demand stimulus becomes a trend, then that would all but guarantee new record high oil prices this summer. Importantly, there is also plenty of dry powder on hand to bid prices higher following the recent de-risking.

https://ift.tt/qIJnHwe

from ZeroHedge News https://ift.tt/qIJnHwe

via IFTTT

0 comments

Post a Comment