FedEx Nukes "Economy's Doing Fine" Narrative, Global Stocks/Bonds Lose $4 Trillion In Week

While some 'soft' survey data provided opportunities for the narrative-writers to suggest hope remains, 'hard data' this week was not pretty at all (and prompted The Atlanta Fed to slash its Q3 GDP outlook). Bloomberg's macro surprise index (ex-survey data) tumbled to its weakest since July 2019...

Source: Bloomberg

Additionally, CPI wrecked the 'Fed Pivot' narrative, and given Powell's reiterated position that inflation is the priority - even if a recession is enabled - that sent inflation-fighting rate-hike expectations soaring this week (and notably sent subsequent recession-fighting rate-cut expectations soaring too)...

Source: Bloomberg

And then FedEx CEO last night confirmed a global recession was underway (which bodes very poorly for global PMIs)...

Source: Bloomberg

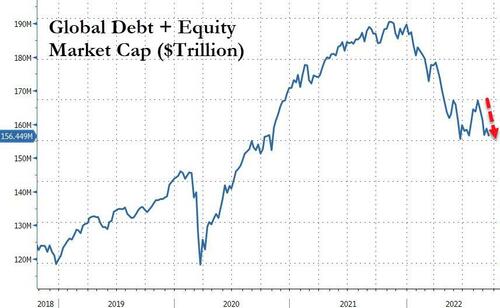

All of which stole the jam out of the global "peak inflation and Fed will pivot" narrative that bid stocks and bonds up for a few weeks... wiping out almost $4 trillion in wealth from debt and equity markets worldwide this week...

Source: Bloomberg

That's quite drop for the "strongest economic recovery in recent history"...

"biggest destruction of shareholder value since the global financial crisis." = " strongest economic recovery in recent history" pic.twitter.com/DNRzmXwY5A

— zerohedge (@zerohedge) September 16, 2022

As Goldman's Chris Hussey noted late in the day today, this week saw the 'stag' in staglation-nation show its teeth:

Stagflation has been a market concern for about a year now as investors started to realize late last summer that the Fed may need to raise rates fairly aggressively to stave off emerging persistent inflation impulses.

Monetary tightening regimes seek to slow growth in an effort to reduce upward pressure on prices -- effectively to bring demand back inline with available supply. And such a tightening regime can be most successful when growth is slowed just enough to match up supply with demand -- a so-called soft landing -- but not so much so that demand actually declines, companies layoff a lot of workers, and the economy slips into a recession. And arguably the worst outcome from a tightening regime can come if growth declines, but for whatever reason, inflation does not recede -- a so-called stagflation economy, and one not seen in the US since the 1970s.

This week, however, the camp of investors who think that the current environment of high inflation and slowing growth will persist may have grown a bit on the back of the bad mix of data that was released. Essentially, we saw signs of growth slowing (the Philly Fed index fell to -9.9, and FDX talked about a sudden global slowdown in shipping volumes) and inflation rising (Core CPI inflation rose by 0.57% mom in August versus 0.3% a month earlier).

In a scenario where the Fed has to keep pushing against growth until the unemployment rate reaches 5%, we see S&P 500 down-side to 3400.

And in a scenario where unemployment hits 6%, the S&P 500 may dip below 2900. In other words, there may be a lot more downside to markets if stagflation persists.

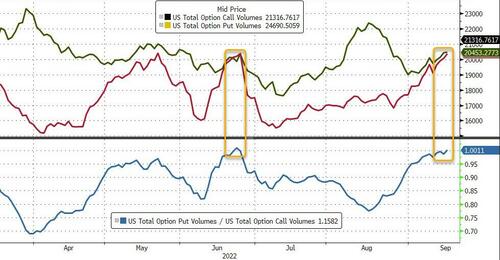

Today was also quad witch (with $3.2 trillion in OpEx not helping the chaos) as Nasdaq ended the worst on the week, down almost 6%...

The Nasdaq is down over 14% from its mid-August highs, S&P and Dow are down over 10% from those highs...

Put volumes soared this week (outpacing the rise in call volumes) into OpEx, but we note the Put/Call ratio is back at the same level it was at in mid June that marked the interim low in stocks...

Source: Bloomberg

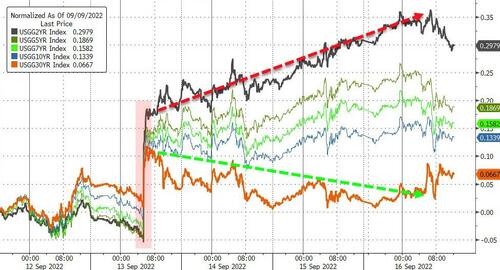

Treasury yields were up across the entire curve this week but the short-end was the big underperformer...

Source: Bloomberg

The yield curve (2s30s in this case) flattened hard this week, to its most inverted since Sept 2000...

Source: Bloomberg

As yields have soared, bonds are now at their 'cheapest' relative to bonds since Feb 2011...TINA has been Epstein'd

Source: Bloomberg

The Dollar surged higher this week,. extending gains after Tuesday morning's hot CPI print...

Source: Bloomberg

The offshore yuan puked for the 5th straight week to its lowest against the greenback since July 2020. Most notably, Beijing has been setting the onshore yuan fix dramatically stronger for 17 straight days as they attempt to show face and fight gravity...

Source: Bloomberg

Sterling fell to its lowest since 1985 today (on the anniversary of 'Black Wednesday')...

Source: Bloomberg

Cryptos were all weaker on the week with Ethereum - having successfully transitioned throug the Merge to a PoS protocol - the worst performer...

Source: Bloomberg

Dr.Copper & Mr.Crude both slid lower this week on global growth concerns (thouhg some comeback overnight after China's macro data miraculously beat). More noatble was the fact that Silver rallied on the week, dramatically outperforming silver...

Source: Bloomberg

The Gold/Silver ratio plunged on the week after silver hit its cheapest relative to the barabrous relic since the COVID crisis. The last two weeks have seen silver's biggest gains relative to gold since August 2020...

Source: Bloomberg

Spot Gold ended back below $1700 - its lowest since April 2020...

Source: Bloomberg

Finally, the S&P 500 has now closed below the 200-day for the longest time since the Financial Crisis...

Source: Bloomberg

And extending the Financial Crisis analog suggests this leg down won't stop until mid-to-late October...

Source: Bloomberg

But would Powell really come out and say something 'pivotal' that close to the election? CPI is released on October 13th?

https://ift.tt/5TedOno

from ZeroHedge News https://ift.tt/5TedOno

via IFTTT

0 comments

Post a Comment