Albert Edwards: The "Ice Age" Is Over, Replaced By The Great Melt And A Crushing "Beta Drought"

After correctly predicting the collapse in the yen and yuan all the way back in March (see "The Biggest Story No-One Is Talking About": Why Albert Edwards Expects "Something In The Market Is About To Snap"), SocGen's Albert Edwards had taken a somewhat lengthy sabbatical, reemerging only occasionally to comment on the latest market developments. Which of course meant that all those who were craving his unique style of fire and brimstone were left unsatisfied (especially with Bob Janjuah lost somewhere in the wilderness for the past two years).

Which is why we were delighted to read Albert's latest note in which he goes back to his maximalist (or is that minimalist) roots with a bang, and when mourning the death of that economic ideology that prevented politicians from breaking free from the shackles fiscal austerity, Edwards regards the "super-expansionary monetary policy" with which central bankers filled the economic void, and summarizes the current landscape as follows: "aggressive fiscal activism reigns supreme, most visible currently in the UK. This will bring higher growth, higher inflation, and higher interest rates across the curve."

What does this mean for investors? Well, according to Edwards, for them "the party is over" as is the Ice Age that defined markets according to the SocGen strategist. And as the coming "Great Melt" melts the ‘Ice’ in ‘Ice Age’, it will also "melt investor returns away too."

The core pillar of Edwards' latest note (available to pro subs in the usual place), are the recent events in the UK, where while world attention has been on passing of the late queen, financial market participants have been transfixed by the UK for a different reason: according to Edwards, "the new Conservative PM Liz Truss and Chancellor Kwasi Kwarteng have very publicly renounced the Davos-centric, ideological consensus that has dominated the G7 economics mainstream for so (too?) long. Such is the wish to shed this economic orthodoxy, the most senior civil servant at the UK Treasury was fired as soon as Kwasi Kwarteng stepped through the doors."

To Edwards, the new UK Government’s "very visible shift in policy" is the natural manifestation of the economic earthquake which took place during and after the pandemic. As the SocGen strategist explains, "prior to the 2020 recession, he thought that once the longest cycle in US economic history ended (whenever that was), a policy Rubicon would be crossed because things would be so bad that all pretense at fiscal rectitude would just be thrown out of the window." At that time, quiescent monetary authorities would shift from injecting newly printed money into the veins of Wall Street as they had done in the aftermath of the 2008 Global Financial Crisis, and instead inject the newly printed money directly into the veins of Main Street via fiscal largesse.

And, for all intents and purposes, Edwards was right as central banks were doing what the radicals of the Modern Monetary Theory (MMT) school of voodoo economics, led by Stephanie Kelton, had been advising governments to do for so long: expand the fiscal deficit and monetize it by growing the central bank balance sheet. It got so insane that Fed governors openly admitted they were effectively doing MMT.

But as Edwards notes, what should also have taken on board from that school of thought, was "the danger warning on the packet: that these policies should not be used with an economy at full capacity – which is exactly what the supply constraints brought about by the pandemic created."

The resulting global inflation tsunami occurred long before Russia’s invasion of Ukraine threw petrol onto an already burning inflation fire.

In this context, fiscal austerity of the sort we saw between 2008-2020 was never coming back anyway, whether in the UK or any place else. By contrast, Edwards writes, "the post-GFC period saw the UK as one of the most fiscally austere of the G7 countries under Chancellors Osborne and Hammond. Back then, the priority for the UK, and all other G7 counties, was to regain control of fiscal deficits, which had ballooned out of control in the GFC." Yes, the last traces of prudent fiscal policy.... and all it took was a fridge door not closing properly in Wuhan to throw it all away forever.

We joke, but it was those "tight" fiscal policies around the world that benefited financial markets hugely because, as Edwards explains, "the resulting weak economic growth ‘necessitated’ (we were told) super-accommodative monetary policy, including QE – pure financial market catnip."

Well, we are now at the other end of that spectrum, and according to the SocGen bear, the UK Government extremes of fiscal largesse will undoubtedly be countered by even more aggressive monetary tightening and QT, because of runaway inflation, rather than the monetary facilitation we saw in the pandemic.

Orthodox economists such as the leading Financial Times journalist Martin Wolf, are screaming that these policies court financial ruin. Certainly, the UK Government’s move to aggressively expand the fiscal deficit at a time of rapid inflation, tight labour markets and a central bank tightening monetary policy seems, how shall I put it… brave (a euphemism from the ‘Yes Minister’ BBC series).

But there again, as billions of ordinary people who never took part in the massive wealth accumulation by the top 0.1% will attest, "the last few decades of economic orthodoxy saw almost constant fiscal tightening, offset by G7 central banks hosing confetti money into financial markets." This is seen by many, including Edwards and this website, as a failed policy – something we have criticized since 2009 when we first said that it was central bank policies that are the root of the global inequality epidemic and all the downstream resulting evil - causing as it has a huge gulf in terms of inequality, and also said by many to have exacerbated social division and popularism, among other things.

But As Edwards notes, investors shouldn’t care about such subjective analysis of what is the ‘right’ policy. they should leave that to others. All market strategists - and real traders - should be doing is predicting what will happen without judgment, and what the subsequent market consequences might be (and how to profit from all of it, of course).

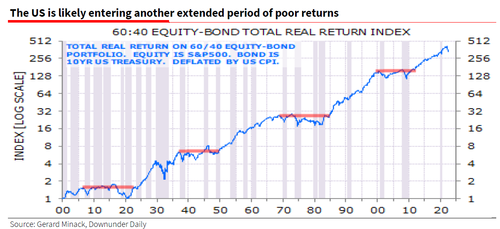

The problem, however, is that there is very little money to be made in the next several years. According to Edwards, Downunder Daily author Gerard Minack, hit the nail on the head recently: he thinks the US is entering what he termed a “beta drought” where asset-class returns are negative or negligible for an extended period. “Prior droughts have been due to rising inflation and/or high market valuation. The US is now at risk from both.”

Minack continues:

"US investors have enjoyed munificent beta for a dozen years: a 60:40 equity/bond portfolio generated a 10½% annual average return between March 2009 and January 2022. But there have been four beta droughts since 1900: extended periods of little or no beta return. Three of the four historical beta droughts – in the 1910s, 1940s and 1970s – were caused by rising inflation, typically decade-average CPI inflation of over 5%. Those three inflation episodes were associated with WW1, WW2, and the 1970s oil shocks. The 2010s beta drought was due to excess equity valuation… (like we have seen recently too). The US may now be entering another beta drought. US returns are at now risk from both the prospect of higher inflation, AND the headwind to returns from high starting-point valuations.”

Not surprisingly, the rather (always) bearish Edwards thinks that Minack is right as the world is "likely set for a decade or more of poor financial returns exacerbated by the current ongoing economic ideological shift, which effectively means that interest rates and inflation will rise on a secular basis – i.e. The Great Melt."

In conclusion, the SocGen strategist takes a quick stroll down memory lane, and writes that "one of the most amazing things working as an economist in the financial sector for 40 years is how policy dogma comes and goes":

When I started out in finance in 1982, monetarism was in the ascendency and the single most important data item for the markets was the US weekly M2 data. But fashions come and fashions go and more recently central bankers such as Fed Chair Powell have explicitly dismissed money supply as not worthy of their attention. That was clearly a mistake (see WSJ article here). Yet leading monetarists are still considered to be dinosaurs by the economics establishment and generally an object of pity – but less so in the financial markets where investors still understand the power of liquidity.

Why does this matter? Because the UK is now paving the way for politicians in other G7 countries to stop even pretending they are subject to fiscal budget constraints. But to remind readers just how economics fashions come and go, take a look at this famous video clip of UK PM Jim Callaghan lecturing the 1976 Labour Party Conference.

In echoes of the current backdrop, after the oil price shock, the 1976 Government was trying to bring down inflation, the fiscal deficit was high, and the pound was plunging. PM Jim Callaghan told sullen-faced party delegates

, “We used to think that you could spend your way out of a recession and increase employment by cutting taxes and boosting government spending. I tell you in all candour that that option no longer exists, and in so far as it ever did exist, it only worked on each occasion since the war by injecting a bigger dose of inflation into the economy, followed by a higher level of unemployment as the next step”.

As Edwards concludes, it is "funny how people forget the past", and not just forget it but repeat the same mistakes over and over...

https://ift.tt/xO6TwMW

from ZeroHedge News https://ift.tt/xO6TwMW

via IFTTT

0 comments

Post a Comment