Why One Trader Expects The Fed To Pause Hikes Amid Growing Evidence Of Slowing Demand

Ahead of tomorrow's Fed rate hike, which Jerome Powell now openly prays will push the US economy into a deep recession leaving millions without a job and Democrats furious at the Fed chair (after all they will need a scapegoat when it all goes L-shaped), stocks tumbled as Treasury yields hit multiyear highs, with traders bracing for aa potentially more hawkish Federal Reserve than is currently priced in.

As Bloomberg' Vincent Cignarella writes, some swaps traders - very few - are pricing for a 100 basis point rate hike, as some strategists also call for a full 1 point move. Still, the vast majority see 75 basis points as the likely case, especially after the WSJ's Fed whisperer Nick Timiraos called for 75bps, with only two of the 96 analysts surveyed by Bloomberg currently predicting a full-point increase.

And yet, as Cignarella writes this morning for the Bloomberg Markets live blog, the shrinking backlog at ports that contributed to supply-chain disruptions and a surge in consumer prices is rapidly slowing. As the Bloomberg trader notes, changes in container flows precede GDP changes, and the current trend is lower (not that one needs another confirmation of this, especially with the Atlanta Fed about to print negative for the 3rd quarter in a row).

Port of Long Beach Executive Director Mario Cordero expects the pandemic-era surge in US consumer demand that snarled supply chains to start to cool, with evidence of a deceleration beginning to show in weaker inbound container arrivals.

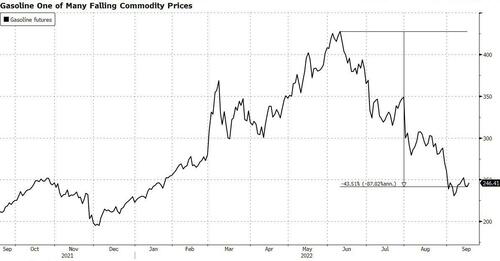

Many commodity prices are also falling without prodding from the fed as demand has been slowing. It’s not just gasoline that’s falling. Crude is lower by 25%, natural gas 22%, lumber 66%, copper down 27% and this morning the NAHB index of homebuilder confidence fell to 46 from 90 at the end of 2020. Better supply flows and slower demand sets up just the economic slowdown Powell is trying to create.

At the same time, prices that are rising -- food and rent -- are out of the Fed’s control.

Meanwhile, the only thing rate hikes will accomplish is a recession. They always do. What they will also likely bring is an eventual improvement in risk appetite and the beginning of another bull market. Of course, slower growth and declining demand will bring less inflation.

All of that, Cignarella writes, "may lead the Fed to pause after Wednesday’s rate hike, opening the way for the start of a risk rally."

https://ift.tt/kYKfydg

from ZeroHedge News https://ift.tt/kYKfydg

via IFTTT

0 comments

Post a Comment