Stocks Clubbed Like A Baby Seal After Tepper Tantrum; Bounce On Big Bill

'Good' GDP numbers were perceived as hawkish for an unflinching Fed and then dismal LEI data hurt the soft-landing hope (somewhat confusingly) but it appears the market had its ever-optimistic-pivot-blinkers really removed by Appaloosa's David Tepper who pointed out you shouldn't 'Fight The Fed'.

At its lows today, Nasdaq saw its biggest drop since Sept 13th, but the big Bill and some technical support slapped enough lipstick on this pig to hide the real chaos...

Dow broke below its 50DMA, but bounced back above in the last hour...

TSLA puked lower for the 5th straight day (8 of last 9 days and 12 of last 14 days)...

"Most Shorted" stocks were clubbed like a baby seal on the day, now trading the velocity of decline during the COVID lockdowns...

Source: Bloomberg

The Nasdaq is down over 11% from its spike high last week following the soft CPI print...

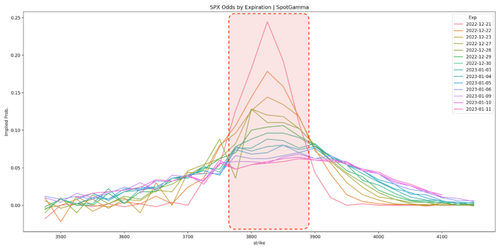

The S&P broke below its 50DMA but 3800 (the Put Wall) was the big support for the S&P 500 (which was hit as The Senate passed the 'inflation-reduction'-reduction act)...

SpotGamma said that "critical support remains at the 3800 Put Wall strike" and also referenced the JPM year-end collar at 3835 which at least in theory, should stifle volatility, to wit:

"short dated implied volatility has contracted sharply, as shown by the plot below. These are the SPX prices ranges implied by options prices, at various expiration dates...

As you can see for nearly all near term expirations, odds strongly favor the S&P holding within the ~3775-3875 range.

We see no reason to argue against these odds until 12/30 exp. Key here is that struck at the peak of this distribution is the JPM collar 3835 call, which should continue to stifle volatility. Playing mean version back into this large strike may continue to have edge."

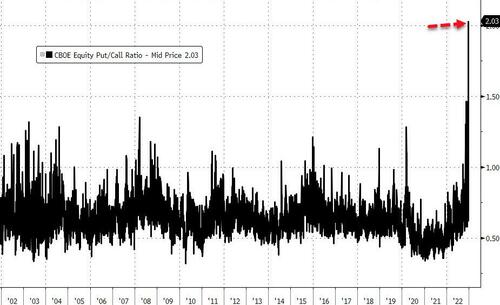

We also note that yesterday saw an unprecedented surge in the put-call ratio...

Source: Bloomberg

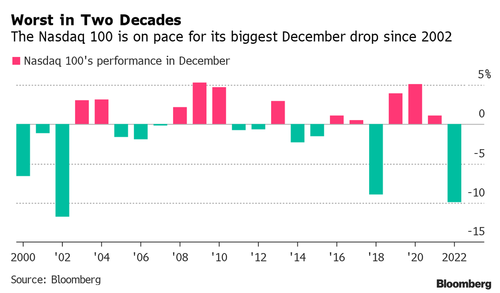

Meanwhile, The Nasdaq is on track for its worst December since 2002...

Treasuries were sold on the day with short-dated yields rising most (2Y +5bps, 30Y +1bps). Yields are up significantly on the week though with the long-end up around 20bps.

Source: Bloomberg

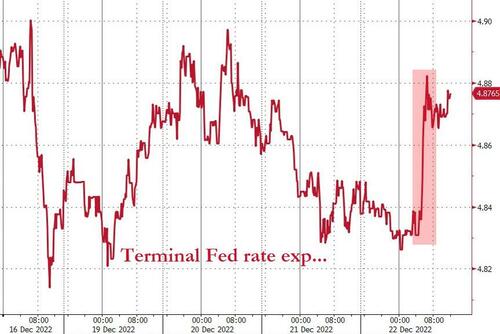

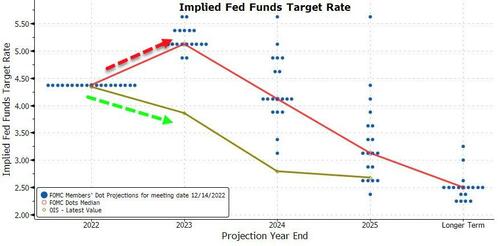

The market's expectations for The Fed's terminal rate jumped today after the hot GDP...

Source: Bloomberg

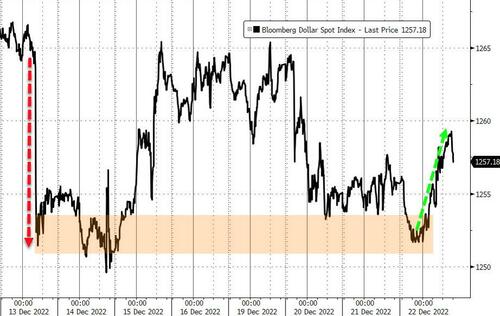

The dollar rallied on the day after finding support at CPI-day lows...

Source: Bloomberg

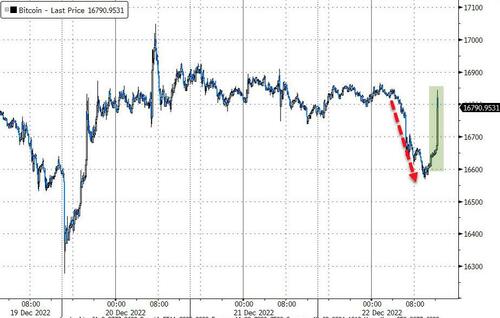

Bitcoin was dumped early on then pumped all the way back into the green after the big-bill went down......

Source: Bloomberg

Gold was monkeyhammered lower, back below $1800...

Oil prices dropped today after WTI ramped up to $80 and slid back...

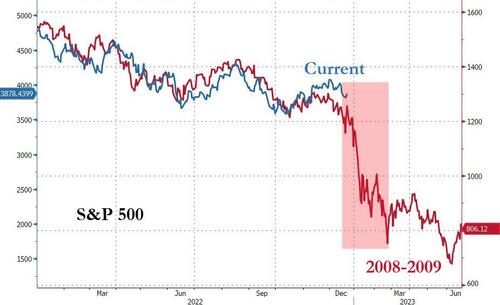

Finally, is this the start of the reversion back to reality of the tightened financial conditions that monetary policy demands...

Source: Bloomberg

While that looks painful, it appears to be what Powell and his pals are pushing for as the market remains completely decoupled from The Fed's expectations for now...

As Tepper said "don't fight The Fed."

https://ift.tt/Mq24oVY

from ZeroHedge News https://ift.tt/Mq24oVY

via IFTTT

0 comments

Post a Comment