The Top 10 Themes Of 2023: Part 2

Late last week, the team of DB's Jim Reid published its thematic outlook report laying out what they think will be the top-10 themes for 2023. With 2022 marking the end of the low-interest rate world, 2023 will be driven by multiple themes that impact markets in different ways. These include the weaponization of trade, the new growth stocks, the return of correlations, when to price in good news, global semiconductor tensions, and others.

In the preamble to the report, co-author and director of Thematic Research at DB, Luke Templeman, writes the following:

People often ask me how we choose our themes of the year ahead. It is not a hard science, but there is a framework we use and it starts by asking three questions. First, “What policies and developments in the economic, business, and political world are unsustainable, and what will it take for them to become sustainable?”. Second, “Where are people anchored to recency bias?” Third, “What is growing that people underestimate?” Asking these three questions always triggers an avalanche of ideas and tangential conversations. From here we select the ten themes we think have the most potential to affect a broad range of markets.

What about timing? We call these our ten themes for 2023, however, when they impact markets can be variable. Reviewing our ten ideas for 2022, six were reasonably accurate, two were not, and the other two are yet to play out. Of course, I do not expect the ideas in this edition to be the exact and exclusive predictions that dominate 2023. But our ideas are not specific predictions per se. Rather, they are the themes around which we think several markets may move – not just one. So even if you disagree with any of our ideas, we hope that they will at least provoke an interesting discussion about the direction of markets, economics, business, and politics next year.

For the sake of brevity, we broke down the note into two parts, with the first part (which we published a few days ago) covering such hot topics as i) the Fed and Chinese pivots; ii) political (in)stability; iii) the weaponization of trade; iv) the decoupling of semiconductors; v) what is the new "growth." The remaining five topics - including vi) "new 60/40", vii) the US vs global property market bifurcation, viii) precision agriculture, ix) cyberattacks and x) how (and when) to price in good news - are covered in this post.

* * *

I. The new 60/40: risk exposure trumps correlations - by Galina Pozdnyakova

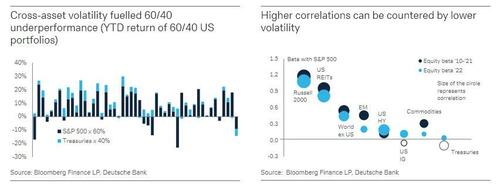

Amongst the breakdowns in tried and true portfolio heuristics this year, none has stood out quite so much as the spectacular drop in the 60/40 portfolio. Indeed, many investors now wonder if the once-normal negative correlation between equities and bonds will ever return. That adds to concerns over several other market correlations that have not worked out as many investors expected, such as gold and inflation.

What investors miss in the correlation debate will become more apparent in 2023 – the correlation between stocks and bonds may matter less to the 60/40 portfolio than asset classes’ volatility contribution amid a more uncertain macro regime. The market drops this year mainly highlight the fact that while the market weights of equities and bonds are split as 60/40, the risk exposure within the portfolio is much more highly weighted towards equities – often close to 90 per cent.

This mismatch is why the drop in 60/40 portfolios and their high volatility this year more closely resembled that of the broader equity market, although bonds also heavily sold off (see chart on the left). As the chart on the right shows, although the correlation between equities and bonds became positive this year, the magnitude of comovement (beta) is still low relative to other assets.

As investors rebuild their 60/40 portfolios in 2023, risk management will therefore be front of mind as the return of beneficial cross-asset correlations can be hard to predict. First and foremost, this will involve better diversification of equity risk. The point here is to reduce the portfolio’s equity market beta for a world of lower growth, higher inflation and more frequent left tail events that lead to the type of turbulent cross-asset repricing experienced in 2022.

Assuming US large-cap technology stocks no longer outperform as they once did, equity returns will become more meagre and potentially revert to long-term averages. That means that the nearly 90 per cent of equity risk in the classic 60/40 portfolio may extend its drag on performance, especially relative to the heavily repriced fixed income markets. The 60/40 portfolio will therefore need to include more lowly-correlated and less volatile assets – in other words, those with a low equity beta.

In 2023, less correlated stocks and bonds will be found in new places. Consider the themes that have accelerated this year, such as waning globalisation, geopolitical jitters, and diverging monetary policy cycles. These are all decoupling international assets and thus will favour geographic diversification.

For those who construct portfolios, ensuring the risk exposure of 60/40 portfolios is closer to 60/40 than 90/10 requires placing volatilities at the forefront of portfolio construction. This will keep bonds firmly as the backbone of a portfolio and emphasise the value of active duration management as central banks fight inflation. For equities, this will imply a move from growth to quality stocks and a shift to coupon clipping in credit from high-yielding stocks. And finally, it will raise further questions about whether 60/40 portfolios should be increasingly allocated to private capital.

* * *

II. A bifurcation in property market: US v Rest of the world - by Adrian Cox

The housing market in 2023 will likely bifurcate between the US and the rest of the world. Although house price drops appear inevitable everywhere, the stronger structure of the US housing market could add to its broader economic advantages – namely energy self-sufficiency and a (relatively) resilient economy. Even though some weak spots have developed in the US this year, the property market there remains strong. Yes, with the Fed funds rate aimed at restraining the post-pandemic rush in inflation, US lenders have responded by more than doubling the rate on a 30-year mortgage to a two-decade high of seven per cent. However, after the last crisis, mortgage lending standards were tightened, so called NINJA loans (No Income, No Job, No Assets) were shunned, and adjustable-rate mortgages became the exception rather than the rule.

Efforts to prevent another property collapse have culminated in the US mortgage loan-to-value ratio halving to a little more than 25 per cent. Moreover, the rise in house prices has so far outpaced the modest rise in debt. As a sign of security, government-sponsored Fannie Mae and Freddie Mac continue to act as a backstop, buying mortgages from lenders to hold or repackage, and guaranteeing timely payment of principal and interest.

The health of the US housing balance sheet gives it some resilience as the broader market cools. Indeed, mortgage applications are a little more than half of what they were a year ago. Affordability has also decreased. A homebuyer with a 20 per cent down payment, that can afford to spend $2,500 a month on their mortgage, can now afford a home worth around $450,000. A year ago, the same person would have bought a home worth $700,000. One group has reasons to stay calm - existing mortgage holders with years of tolerable fixed rates ahead of them.

While the rebuilt system in the US is helping in this downturn, other countries appear riskier. Indicators such as housing permits and housing starts are flashing amber across key economies, not just the US. What differentiates the US from the rest of the world is the fact that other countries appear less ready to withstand a property shock. Scandinavian, Dutch and Australian households have a debt-to-disposable income ratio of 200 per cent or more, twice as much as in the US. With this in mind, between 40-50 per cent of Norwegian, Dutch, Swedish and Canadian households have mortgages. Perhaps more alarming is that the vast majority of Finnish and Norwegian mortgages are fixed for no more than a year.

In most developed countries, non-prime buyers have moved in with their parents for longer, stayed in rentals, or borrowed from less-regulated shadow institutions with punitive rates. The consequences of these structural shifts go beyond the typical belt-tightening that accompanies a fall in house-prices. For most high-inflation countries, those consequences could amplify the expected recessions of 2023. That is a deep concern considering they do not have the same economic buffers that the US currently enjoys.

* * *

III. Precision agriculture: a precise solution to food security, - Olga Cotaga

Food security shot into the spotlight this year following the risk of shortages from Russia and Ukraine. Indeed, it commanded its own agenda at the recent COP meeting. As a result, 2023 is shaping up as an acceleration year for the commercialisation of ‘precision agriculture’.

Precision agriculture is the concept of tailoring farming processes to specific parcels of land by using the proliferation of wireless connectivity, new hardware, and analysis tools. These include positioning systems like GPS, geo-mapping, sensors, integrated electronic communications and variable rate technology. The aim is to help solve the food problem, particularly in emerging markets, by increasing productivity and crop yields.

Precision farming tech can roughly be separated into three categories: guiding, recording and reacting. The former includes forms of automatic steering for tractors and self-propelled agricultural machinery, such as driver assistance and controlled traffic farming. Recording tech helps with soil and soil moisture mapping, as well as canopy and yield mapping. Reacting tech means variable-rate irrigation, application technologies for nutrients and crop protecting agents, as well as precision seeding and weeding.

Take, for example, variable rate technology. One study has shown an increase of 8 per cent in wheat yields (for 10 per cent less nitrogen), a rise of nearly 7 per cent in yields over 4 years in winter wheat (through variable-rate seeding) and 7 per cent growth in net income on fields that used variable rate seeding and data-influenced management zones.

The point of precision farming is to produce more food from specific parcels of land using fewer resources. Indeed, one Spanish example showed a 25 per cent water savings. Of course, the economic benefits are different across regions. In the US, as a share of total production, precision agriculture’s potential gross economic benefit is of 18 per cent.

As precision farming techniques become more widespread, they will help decarbonize the food chain. This is critical in countries achieving their self-stated climate goals as greenhouse gas emissions from farm, livestock, and related land use comprise up to 25 per cent of all emissions from human activities. The food system as a whole is responsible for a larger share.

Carbon offsets will likely be a driving force behind the decarbonisation efforts as they help solve the issue of lack of financial incentives from agriculture climate adaptation. With carbon credits taking centre stage at COP27 following the US carbon offset plan, their path towards a projected $190bn market by 2030 (up from $2bn in 2021 ) will likely take a big step forward in 2023 with the help of precision agriculture techniques. It is rare that a true win-win scenario like this is offered to investors. 2023 could be the year they take it

* * *

IV. “Give me your data”– cyberattacks, the bigger new bully in 2023 - Cassidy Ainsworth-Grace

The events of 2022 threw into sharp relief the two questions that may shape how corporate digital infrastructure needs to change in 2023. First, who is to blame for cyberattacks: corporates or hackers? Second, what will tougher cyber regulation mean for corporate responsibility?

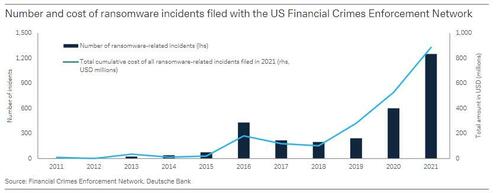

Some distressing hacks in 2022 (example below) showed that cyberattacks can no longer be written off as simply the cost of doing business. Indeed, the public is beginning to see corporates as being at fault. This change in the mood follows a pivotal year for cybercrime. In 2021, cyberattacks increased 31 per cent compared with 2020.1 And the losses are deepening. A third of central banks in developed economies have indicated cybersecurity losses have increased by over 20 per cent since the pandemic.

Ransomware has emerged as one of the most popular technological threats. This involves infiltrating a victim’s network to encrypt files and hold them for ransom. The number of these incidents in the US more than doubled in 2021.3 Globally, the number of ransomware attackers grew 151 per cent.

An example from Australia this year shows what may be in store in larger economies. The event was a hack of Australian health insurance provider Medibank. The result was the theft and ransom of the personal information from nearly a third of the population. Medibank did not pay the ransom, and the hackers not only kept the data encrypted, but also published sensitive medical details on dark web forums.

Compensation discussions are ongoing but the bigger picture is that this attack is emblematic of the growth in large scale attacks of such personal information. Given the current mood regarding corporates in the US and Europe, if growth here continues, it will quickly spark a heavy political response with serious ramifications for companies in question.

The impact of politics on cybersecurity took a notable step forward this year. In March, the Biden administration mandated companies to report hacks within 72 hours of discovery, and within 24 hours if a ransom is involved. With the US as a starting point, it is likely that similar regulation will permeate across advanced economies. Companies are still underestimating this, but if the growth rate in hacks continues in 2023 it is only a matter of time before an influential country has to respond to a Medibank-style hack.

The concerning thing for companies is that the risk has grown with work-from-home arrangements. Identity management and data protection have particularly suffered and hackers have moved their focus away from the core network to end users. Better regulation to incentivize better security is therefore critical.

* * *

V. When to price in good news – Luke Templeman

Pessimism is seductive, and especially so when we look ahead to 2023. The yield curve is hideously inverted, recession is coming, and stock markets usually bottom only after a recession has started. But when the outlook is overwhelmingly negative, and no one is positioned for good news, markets can bounce on any unexpected positives that do arise. And given there are several scenarios where good news on big events could occur in 2023, that makes for the unappetising decision for investors. Should they chase what may be another bear market rally? Or will any positive boost finally be the real deal?

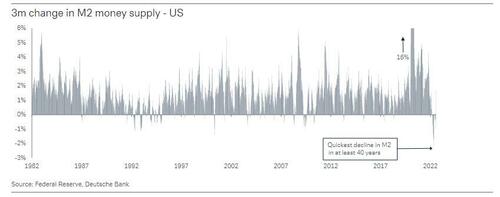

First consider inflation. In the US this will likely only fall to 4.0 per cent by next December. But just as many investors could not believe the searing growth of the US money supply in 2020 would lead to today’s level of inflation, many find it hard to conceive that the record pace at which the money supply is currently shrinking will impact the other way.

Second, China. The country’s financial markets and real economy have suffered from covid restrictions this year. However, with inflation forecast to stay below three per cent next year, China can afford to further stimulate its economy. There is upside risk if they do.

Third, the war in Ukraine. It is impossible to predict how this situation will further unfold. And, true, there may only be a small chance that good news will emerge. However, given the overwhelming consensus for a drawn-out conflict, any progress towards a resolution would certainly give global economies and markets a sudden boost.

As investors try to predict the price response to any good news, they may have to contend with a market that moves more rapidly than expected. There are a few reasons for this. One concerns the very low positioning in risk assets which means large investors chasing rallies can cause markets to ‘crash upwards’. A second reason comes from the simple maths of interest rates (and expectations) moving from very-low levels. When a company’s WACC moves from, say, 5 to 10 per cent (as may have recently occurred for some corporates), there is far more value lost than if the WACC moves the same amount but from 10 to 15 percent.

For technical buffs, 2022 offers further clues that markets move rapidly on good news. Despite the selloff in 2022, the S&P 500 has posted 22 days where it jumped over 2.0 per cent. That is not only the fourth most of any year since the Great Depression, but it is also comfortably the most in any year with a relatively “small” market drawdown. So, amidst the (justifiably) pessimistic forecasts for 2023, it appears investors are jittery to be involved in any upside. Blame algorithmic trading, passive ETFs, or even FOMO. Whatever the cause, when markets do eventually jump, the speed of the moves may catch investors by surprise.

https://ift.tt/4Jpa9rj

from ZeroHedge News https://ift.tt/4Jpa9rj

via IFTTT

0 comments

Post a Comment