Crypto Calm Before The Smile

By Marcel Kasumovich and Kartikey Sinha of One River Asset Management

1. Adapt or die. It’s clever, even if overused. The finite nature of life is what makes it so precious. Embracing adaptation over comfort, the joy of the struggle. Hundreds of brainy quotes are at your fingertips to give credibility to the mantra. Maya Angelou is my mom’s personal favorite: “If you don’t like something, change it. If you can’t change it, change your attitude.” There is no try in adaptation – you either do or you don’t. Crypto asset markets choose “do.”

2. Adaption is evident in natural cycles, naturally. Biodiverse ecosystems strengthen the resilience of cycles. Of course, the same is true of economic systems and financial markets. But our instincts are to resist. Intervening to stop forest fires that are disruptive to homes that probably shouldn’t be there. Intervening to guard against losses of banks that probably shouldn’t exist. Intervention leans against natural cycles, lessens diversity, and weakens resilience.

3. Intervention requires great humility. We don’t know what we don’t know. Yet, intervention is often executed with a force of certainty. If banks were not bailed out, we were certain to enter a Great Depression. The unintended consequence of intervention must be less than the social strains of soup kitchens in Central Park. Intervention centralizes debt to government balance sheets, leaving rich countries with unsustainable obligations. It brings generational fragility.

4. The crypto asset ecosystem stands in sharp contrast. It demands adaptive resilience. Take US dollar stablecoin. Total assets are roughly $130 billion today, on par with October 2021. Dollars chose to stay in the digital ecosystem despite a sharp rise in US interest rates, a crash in crypto asset markets, and the annihilation of poorly designed stablecoin. Resilience. Then, strains in the US banking system led to a rapid shift of stablecoin to USDT and away from USDC, raising Tether’s share to 46% of the Ethereum stablecoin supply. Adaptation.

5. Why has US dollar stablecoin been so durable? Its velocity demonstrates it is well designed and useful. A total of $1,952 billion stablecoin transactions settled on the Ethereum blockchain in the first quarter. Ethereum US dollar stablecoin assets averaged $95 billion over the same period. So, the entire stock of stablecoin turned over 20 times in the quarter, or roughly once every 4-5 days. And that doesn’t include off-chain transactions. It makes USD stablecoin the most efficient collateral in the global financial system. Bank runs are for banks.

6. Now, resilience also changes the nature of cycles. We know that cycles of the weather are simply defined – hot in the summer, cold in the winter. But the amplitudes and timing are highly nonlinear. No two cycles are the same. Crypto asset prices and activity have surged this year. Bitcoin was up more than 80% at its peak this year, transaction volumes have leapt to record levels, and bitcoin mining fees have garnered the third-highest share of revenue in its history. Historically, these would be signs of excess.

7. But derivative markets are clearly not flashing red. On the contrary, the signals are remarkably bland. Bitcoin’s three-month volatility expectation is near historic lows at 47%, the skew in option markets is neutral, and the cost of futures leverage is near-zero versus more than 10% annualized during past periods of rapid price gains. Surprised? It’s the benefit of no intervention and increased resilience. Last cycle’s crypto crash is bringing far more discipline to the current cycle.

8. It got us thinking – the “Royal us” in this case, including Kartikey, a member of our Digital Labs. How does bitcoin’s price and volatility adjust to the demand for leverage?

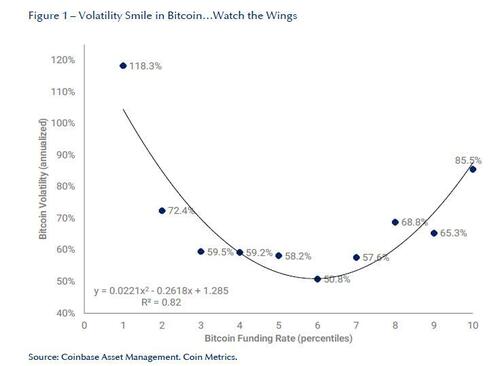

We take funding rates implied by the bitcoin perpetual futures from 2018-2022, partition them into percentile ranges, and then evaluate bitcoin’s volatility. Figure 1 shows a happy smile relationship, a dream for risk managing a portfolio.

There’s information content on both extremes – risk rises when the cost of leverage is extremely low and extremely high, in the boom and bust respectively.

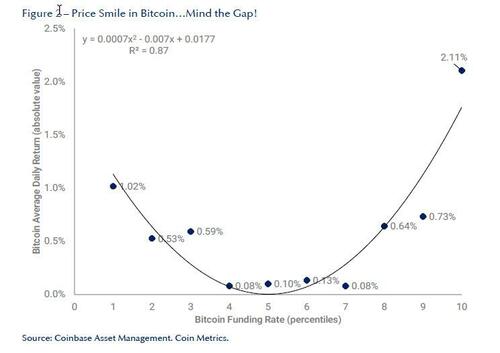

9 . The same smile emerges with the absolute move in bitcoin price returns across different stages of the leverage cycle from 2018 to 2022 (Figure 2). But the return profile is more of a jump in the extremes.

When bitcoin funding rates are in the 0-10 percentile range, the average daily bitcoin return is (1.02%), roughly seven-times the sample average. On the other extreme in the 90-100 percentile range, bitcoin’s average daily return is 2.11%. Outside of those extremes are long phases of calm, like the current one.

10. The resilience of digital asset markets ensures the previous cycle won’t be repeated. A surge in economic transactions can occur without speculative excess – we’ve already seen it this year. This is encouraging for developers as price signals are more valuable when not polluted by excess speculation. A virtuous cycle emerges. But we can’t extrapolate the calm. Extremes can be identified by funding rates and volatility markets – analytics when integrated to systematic strategies will leave any crypto asset manager smiling, just like bitcoin’s volatility curve.

https://ift.tt/KZoFSDu

from ZeroHedge News https://ift.tt/KZoFSDu

via IFTTT

0 comments

Post a Comment