Emergency Bank Bailout Facility Usage Remains At Record Highs; Fed 'QT' Accelerates

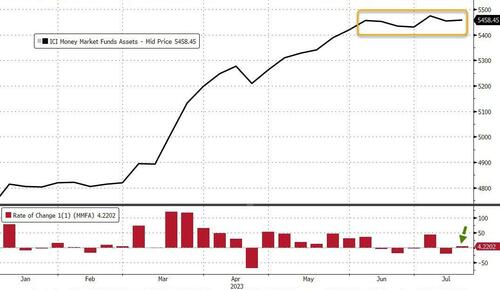

After an unexpected outflow last week, US money market funds saw inflows this week - albeit a minor $4.22 billion - with the total assets now having hovered around record highs for 7 weeks...

Source: Bloomberg

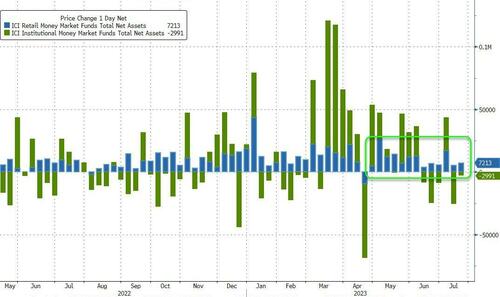

Retail funds saw their 13th straight week of inflows (+$7.2bn) while institutional funds saw a $3bn outflow...

Source: Bloomberg

Money-market fund assets (rising) and bank deposits (also rising) continue to diverge (as cash piles into NVDA calls?)...

Source: Bloomberg

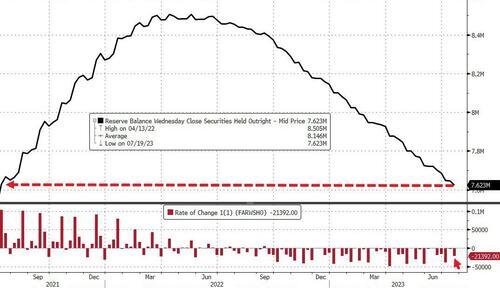

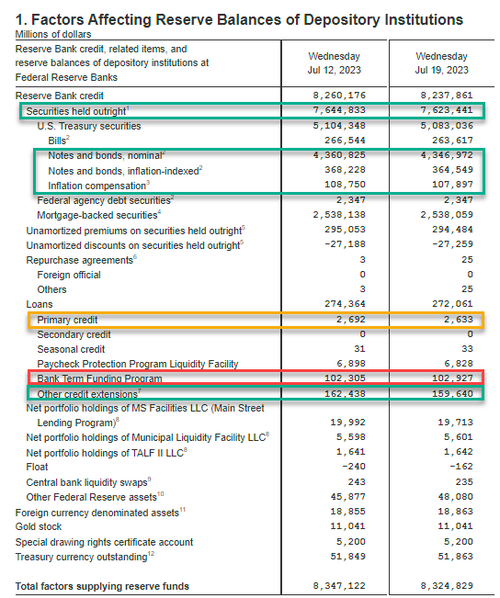

The Fed's balance sheet continued to shrink below pre-SVB levels, falling $22.4 billion last week to its smallest since Aug 2021...

Source: Bloomberg

QT reaccelerated last week with The Fed selling $21.4 billion in securities...

Source: Bloomberg

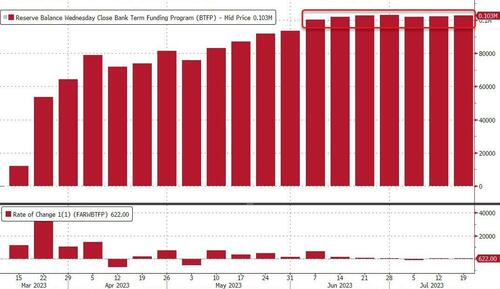

Usage of The Fed's Bank Term Funding Program facility rose once again last week (up $622mm), hovering around the record high level of $103 billion...

Source: Bloomberg

The breakdown from The Fed's H.4.1 table...

-

QT - change in notes, bonds, TIPS: down $14BN to $4.347TN

-

Discount window: unch at $2.6BN

-

BTFP: up $0.6BN to new all-time high $192.9BN

-

Other credit extensions (FDIC loans): up $7.2BN to $159.6BN

Finally, we note that the US equity market capitalization has completely decoupled from the declining trend in bank reserves at The Fed...

Source: Bloomberg

Which is more likely to catch down (or up) to which?

https://ift.tt/8RjbPkC

from ZeroHedge News https://ift.tt/8RjbPkC

via IFTTT

0 comments

Post a Comment