Dow Matches Record Winning Streak As Powell Keeps The Party Going

And to think it was less than a year ago when a demonically hawkish Jerome Powell triggered what would end up being a brutal tech bear market, when during his 2022 improvised Jackson Hole speech the Fed chair warned pain, fire and brimstone was coming.

Well, what a difference a year makes: after a neutral FOMC statement which said nothing besides informing the public of a 25bps rate hike - which sent rates to the highest level in 22 years - and keeping most of the June language in line, the S&P 500 reversed earlier modest losses to spike to a session high after the Fed chair said that "there was disinflation", and that inflation was a little better than expected. If that wasn't enough, Powell unleashed another dovish shot when he said that the Fed can start rate cuts before 2% inflation is hit (which is important since Powell also said that 2% inflation won't hit until 2025).

Unwilling to be cornered by the market, Powell also said that officials haven’t made a decision to go to every other meeting, and will instead “be going meeting-by-meeting."

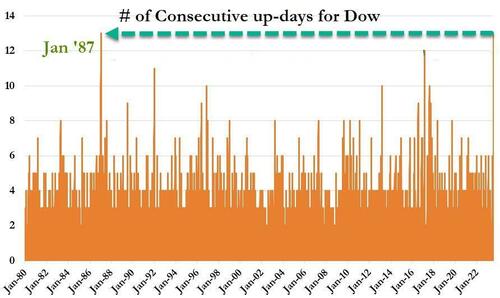

With stocks expecting a far more hawkish message from Powell, the S&P 500 promptly spiked to session highs, gains which were the first during Wednesday trading, and extended the latest rally into a fourth day. The index rose as much as 0.3% to the highest since early April - and March 2022 when the Fed first started hiking - before retreating a bit. Meanwhile, the Dow gained (and closed green) for a 13th consecutive session, matching the record stretch from January 1987!

However, things quickly reversed toward the end of Powell's presser and and spoos slumped from a session high over 4,600 after Powell said that the Fed no longer was forecasting a recession, which the market quickly interpreted as hawkish forward guidance, and suggesting that conditions would stay higher for longer.

Ironically, the market - with its 15 millisecond attention span of a gnat - forgot that this is nothing new and is a recap of what the Fed's June SEP showed, reversing the March economic forecast of a shallow recession. But since it was also headline scanning algos in control by this point, stocks promptly slumped to session lows.

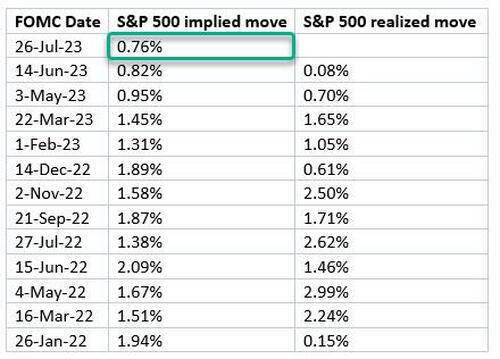

What else happened? Well, in a day when the market correctly predicted that today's FOMC would be a nothingburger with the smallest implied straddle for a Fed day since 2021...

... that's exactly what happened, with most asset classes trading basically unchanged. Well that's not exactly right: both stocks and yields fell...

... but as Bloomberg notes, under the hood the moves were not necessarily what you’d expect if the outlook was for lower yields. That raises the possibility that the rally in bonds may be driven by flows rather than the barely-changed policy outlook.

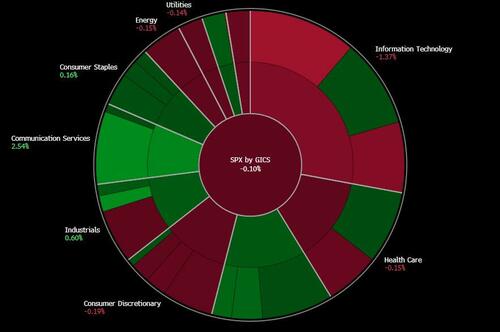

The decline in stocks was led by info tech, while communication services was up the most today (thanks to Google parent Alphabet’s better-than-expected earnings).

Banks were also solidly in the green after yesterday's PacWest take under was somehow spun as bullish.

In credit, shorter-duration bonds have tightened more on the day while the Treasury curve is steeper.

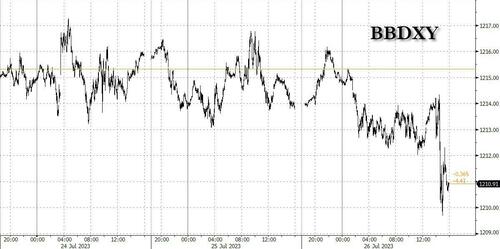

The greenback eased lower after Powell said the central bank will continue to make decisions meeting by meeting and upcoming data will inform decisions; notes that either hike or steady policy possible at September meeting.

And with the dollar sliding, both precious metals...

... and bitcoin sprinted higher, showing clearly what will happen once the Fed is no longer hiking but is forced to start easing.

https://ift.tt/yo5eXKs

from ZeroHedge News https://ift.tt/yo5eXKs

via IFTTT

0 comments

Post a Comment