Do Plunging Retail Stocks Signal The US Consumer Is Finally Done

The final week of earnings season, traditionally reserved for a slew of retail companies, was also the one we got the loudest hint yet that the US consumer is indeed starting to hit their limit, with retailer after retailer plunging by double digits on either weak earnings, poor guidance or some combination of both. Not surprisingly, the Retail ETF got crushed in all 5 days this week, sharply underperforming the market every day of the week.

And while some retail optimists have asked "did anything truly change?" the truth, as Goldman consumer specialist trader Scott Feiler notes, "anytime the group underperforms 5 days in a row vs the market and over 500 bps total on the week, it’d be a bit naïve to “say “nothing new here.” To be sure, there have been some clearly adverse developments - specifically when it comes to the rapid deterioration in consumer credit as highlighted in the dismal earnings from Macy's and Nordstrom - that bear watching especially with student debt payments set to resume in a coupe of months, this trend will only get worse, while the gradual phasing out of the trillion-dollar deficit funded "Bidenomics" stimmy.

So what drove the substantial weakness in the group this week?

1. July was the best month of the quarter, but the focus has already turned to August, when things turned much uglier. Outside of Foot Locker, nearly every company spoke to an acceleration in trends in July. This was the first notable acceleration in trends for a full month since things saw their initial slowdown in March. While some companies early in the earnings season spoke to August being strong still (WMT, ROST, TJX), this was more consumables based or defensive type companies. As Feiler notes, while "August certainly does not seem like it’s fallen off the cliff across the board, the view from this week’s round of results was it’s much choppier as a whole than July was. Nordstrom for example spoke to a slowdown at both of their banners in the month."

2. Shrink (i.e., theft) - Numerous companies spoke about this. Some were unexpected (DKS), some were expected (ULTA) and some spoke about it again as a reason for margin weakness, after just having done so last quarter (DLTR). What all companies had in common was all stocks traded down on this. The debate has made its way into how much margin recovery can be expected from this into 2024-2025, if at all(seemingly becoming more accepted that companies will have 100 bps lower gross margins vs historical for the foreseeable future). The flipside is that retailers now have a scapegoat for continued margin erosion (and inventory reduction): the Soros army of handpicked big city DAs, who have largely decriminalized retail theft.

3. Consumer Credit – will this continue?: Macy’s touched on credit concerns earlier in the week by speaking to higher than expected delinquencies in June and July. There was some skepticism originally from many if this was truly breaking news or not: was “this is just a normalization to pre-covid levels” and “this is more of a low-income issue.” And while to the Goldman trader both somewhat reasonable fair pieces of feedback, it felt notable that Nordstrom (higher income customer) spoke later in the week as well to the trend, noting that “we have seen delinquencies rising gradually and they are now above pre-pandemic levels, which could result in higher credit losses in the second half and into 2024.”

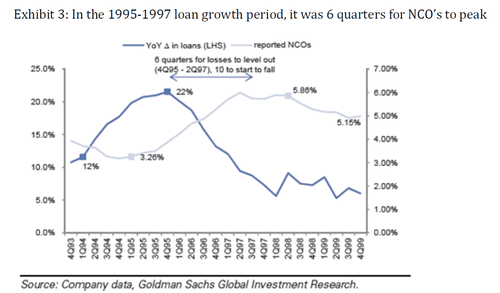

The next round of industry master trust data comes on September 12th. Data from the Goldman Financials team shows it’s usually 6 quarters before net charge-offs peak, following peak loan growth. Peak loan growth occurred this cycle at the end of Q1 23. See the 3 exhibits below on this from prior cycles that show this.

4. Positioning: One mitigating factor behind the big drops across the retail space is that according to the Goldman trading desk, many of the names down the most this week, while certainly not perfect , had logic for why they should have been down, and also had a positioning dynamic to them as well (DLTR long vs DG short, DKS a top-line beat was expected, JWN was the preferred long this quarter in dept store world, BURL was expected to have a better print post TJX/ROST). Results did disappoint, either sales, margins or the guides, but crowded - and wrong - positioning also had a multiplier effect on the reactions it seemed.

* * *

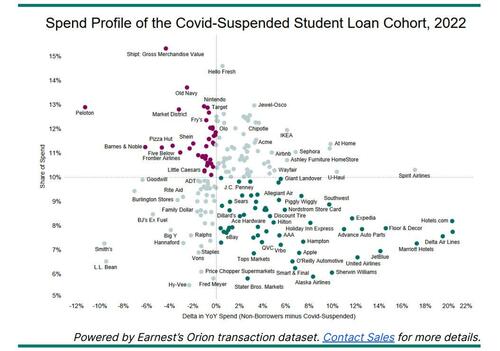

Finally, those wondering where the next big hit will come from, look no further than the student loan payers who suspended payments during Covid and who will have to resume those payments come October. According to Cohort Analytics, that cohort of shoppers made up more than 10% of spending at several national brands in 2022 (above the dotted line in the chart below). Their spending also outperformed non-borrowers at several brands (left of the solid line n the chart below), suggesting that their lack of payments may have buoyed their spending in recent years (well, duh). That leaves dozens of national brands that benefited meaningfully from the pause in student loans (primarily those in the upper-left quadrant below), that may be more exposed to that shopper base as payments resume.

Within Travel, Frontier Airlines was the most sensitive to the Covid-Suspended cohort in 2022, with 11% share and 2 points of outspending from the cohort. In contrast, Alaska Airlines and United Airlines both had 7% share and 10 points of under-spending. Airbnb had a high 11% share from the cohort but with 4 points of underspending.

Within the Home sector, Peloton was most sensitive, with 13% share and 11 points of outspending from the Covid-Suspended cohort; Sherwin Williams had 6% share and 10 points of under-spending. IKEA, Ashley, HomeGoods, Wayfair, and Lowe’s all had 10%+ share from the cohort but the cohort also underspent Non-Borrowers by ~5 points.

Most Apparel and Department Stores had over 10% share from the Covid-Suspended cohort: Old Navy had the highest share at 14%; Nordstrom Full Price had the lowest share at 8%. Old Navy and Burlington each had 3 points of outspending from the cohort, while most others saw minimal to underspending.

More in the full reports (here and here) available to pro subs.

https://ift.tt/DSzwBQo

from ZeroHedge News https://ift.tt/DSzwBQo

via IFTTT

0 comments

Post a Comment