Nvidia Erupts To New Record High On Blowout Q2 Earnings, Whisper-Shattering Q3 Guidance, And New $25BN Buyback

As we wrote in our preview of NVDA's Q2 earnings, it is safe to say that more were paying attention to today's earnings report from Nvidia than some/all of the other giga caps or frankly any other company this quarter, thanks to the thundrous, "paradigmatic" impact Nvidia has had on the broader market. In fact, the excitement was so palpable that JPM trader Stuart Humphrey said "The anticipation is LITERALLY killing us!"

Well, the anticipation is over, and moments ago NVDA reported not only Q2 earnings that crushed estimates, but gave Q3 guidance that has absolutely blown out even the most optimistic whisper number.

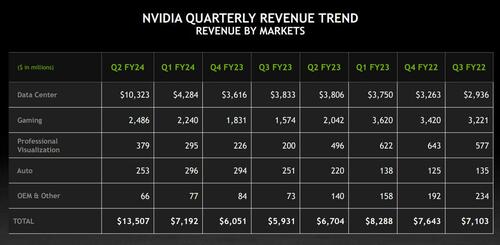

Here is what NVDA reported about Q2 earnings:

- Adjusted EPS $2.70 vs. 51c y/y, smashing estimates of $2.07

- Revenue $13.51 billion, up 101% vs $6.70 billion a year ago, and blowing away estimates of $11.04 billion

- Data center revenue $10.32 billion vs. $3.81 billion y/y, beating estimates of $7.98 billion

- Gaming revenue $2.49 billion, +22% y/y, beating estimates $2.38 billion

- Professional Visualization revenue $379 million, -24% y/y, beating estimates of $318.7 million

- Automotive revenue $253 million, +15% y/y, beating estimates of $309.4 million

Some more details on the revenue breakdown:

- Data Center revenue was a record, up 171% from a year ago and up 141% sequentially, led by cloud service providers and large consumer internet companies. Strong demand for the NVIDIA HGX platform based on our Hopper and Ampere GPU architectures was primarily driven by the development of large language models and generative AI. Data Center Compute grew 195% from a year ago and 157% sequentially, largely reflecting the strong ramp of our Hopper-based HGX platform. Networking was up 94% from a year ago and up 85% sequentially, primarily on strong growth in InfiniBand infrastructure to support our HGX platform.

The hart below from Bloomberg shows all you need to know about the company's main revenue driver:

- Gaming revenue was up 22% from a year ago and up 11% sequentially, primarily reflecting demand for our GeForce RTX 40 Series GPUs based on the NVIDIA Ada Lovelace architecture following normalization of channel inventory levels.

- Professional Visualization revenue was down 24% from a year ago and up 28% sequentially. The year-on-year decrease primarily reflects lower sell-in to partners following normalization of channel inventory levels. The sequential increase was primarily due to stronger enterprise work station demand and the ramp of NVIDIA RTX products based on the Ada Lovelace Architecture.

- Automotive revenue was up 15% from a year ago and down 15% sequentially. The year-on-year increase was primarily driven by sales of self-driving platforms. The sequential decrease primarily reflects lower overall auto demand, particularly in China.

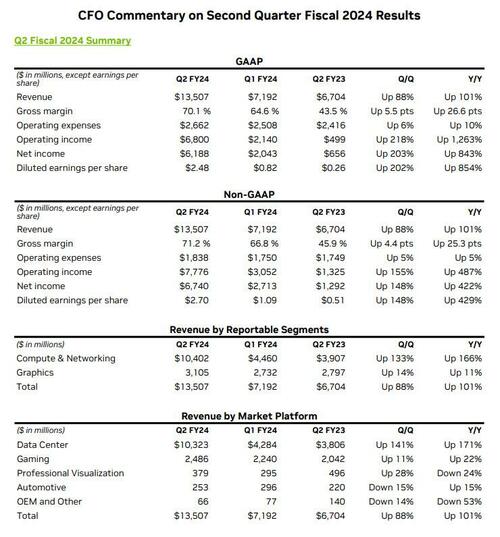

Going down the line:

- Adjusted gross margin 71.2% vs. 45.9% y/y, beating estimates of 70.1%

- R&D expenses $2.04 billion, +12% y/y, in line with estimates of $2.05 billion

- Adjusted operating expenses $1.84 billion, +5.1% y/y, beating estimates of $1.91 billion

- Adjusted operating income $7.78 billion vs. $1.33 billion y/y, beating estimates of $5.89 billion

Gross Margin

- GAAP and non-GAAP gross margins increased from a year ago and sequentially, primarily reflecting growth in Data Center sales. The year-on-year increase also reflects the impact on the year-ago gross margin from $1.34 billion in inventory provisions and related charges.

Expenses

- GAAP operating expenses were up 10% from a year ago and up 6% sequentially, primarily driven by compensation and benefits, including stock-based compensation, reflecting growth in employees and compensation increases.

- Non-GAAP operating expenses were up 5% from a year ago and up 5% sequentially, primarily reflecting increased compensation and benefits.

The financial results in a nutshell:

Commenting on the results, CEO Jensen Huang said that “A new computing era has begun. Companies worldwide are transitioning from general-purpose to accelerated computing and generative AI... NVIDIA GPUs connected by our Mellanox networking and switch technologies and running our CUDA AI software stack make up the computing infrastructure of generative AI."

“During the quarter, major cloud service providers announced massive NVIDIA H100 AI infrastructures. Leading enterprise IT system and software providers announced partnerships to bring NVIDIA AI to every industry. The race is on to adopt generative AI,” he said.

But while the Q2 results were in themselves stellar, it was the company's Q3 guidance that absolutelyblew away investors far more so than even last quarter, as the company now expects Q3 revenues of $16 billion not only some $3.5BN above Wall Street's estimate of $12.5 billion, but also above the highest whisper number of about $15.0BN!

The full Q3 guidance:

- Revenue is expected to be $16.00 billion, plus or minus 2%, Est. $12.5BN

- GAAP and non-GAAP gross margins are expected to be 71.5% and 72.5%, respectively, plus or minus 50 basis points.

- GAAP and non-GAAP operating expenses are expected to be approximately $2.95 billion and $2.00 billion, respectively.

- GAAP and non-GAAP other income and expense are expected to be an income of approximately $100 million, excluding gains and losses from non-affiliated investments.

- GAAP and non-GAAP tax rates are expected to be 14.5%, plus or minus 1%, excluding any discrete items.

- Gross margins are expected to be 71.5% and 72.5%

- GAAP and non-GAAP operating expenses are expected to be approximately $2.95 billion and $2.00 billion, respectively.

And if all that was not enough, NVDA said that the Board of Directors approved an additional $25.00 billion in share repurchases, without expiration. NVIDIA plans to continue share repurchases this fiscal year. In Q2, NVIDIA returned $3.38 billion to shareholders in the form of 7.5 million shares repurchased for $3.28 billion. As of the end of the second quarter, the company had $3.95 billion remaining under its share repurchase authorization.

In response to the stunning earnings, NVDA stock is up about 7% after hours to a new all time high of $506, and a market cap that is set to rise above $1.2 trillion tomorrow.

A back of the enveloped calculation shows that NVDA is now trading at 20x sales based on Q3 annualized run rate of $16BN

https://ift.tt/ru8Ii3O

from ZeroHedge News https://ift.tt/ru8Ii3O

via IFTTT

0 comments

Post a Comment