'Derailing Goldilocks' - Goldman Questions The 'Soft Landing' Narrative

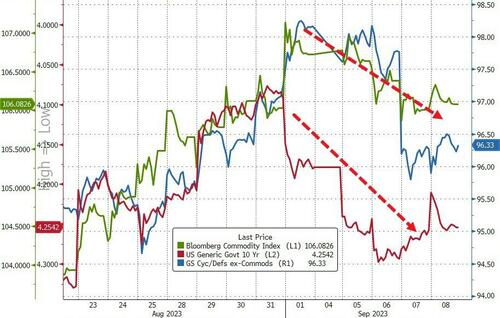

Equities sold off last week and rotated out of cyclicals and low quality assets as an uncomfortable combination of rallying rates & commodities prices derails the goldilocks soft landing scenario, triggering a readjustment of the market optimism.

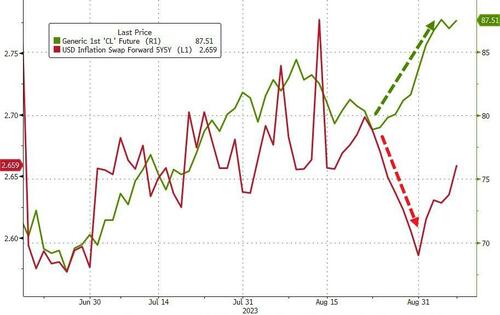

The smell of stagflation - not goldilocks - was everywhere with 'inflation expectations' too hot...

Source: Bloomberg

...and growth expectations ('hard' data) too cold...

Source: Bloomberg

As Goldman notes, rallying rates and commodities are derailing the goldilocks soft landing scenario.

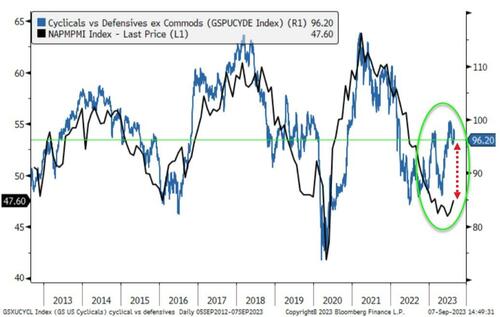

Cyclicals and long duration assets have been rallying jointly over the summer on the narrative of strong growth but limited headwinds from rising rates.

This is no longer the case and cracks are appearing, sending rate-change expectations hawkishly higher...

Source: Bloomberg

The uncomfortable combination of rallying oil and US long end breaking up is disrupting this equilibrium and triggering a rotation into the "persisting inflation & sticky rates" narrative, adding pressure on equities and valuations.

Cyclicals continue to trade rich relative to PMIs & fading China momentum across regions, but are beginning to close this dislocation as highlighted mid-August.

Additionally, growth seems less durable in Europe, with underwhelming manufacturing production, making it all the most remarkable to see EU Cyclicals holding up as banks got unwound.

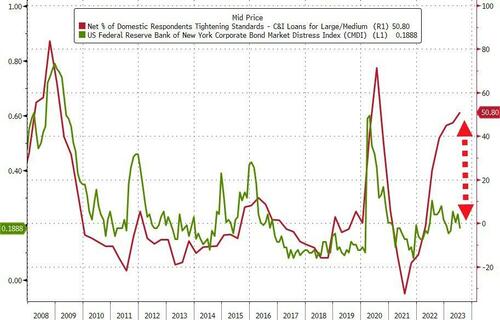

And finally, the credit risk component is seeing limited focus, although as highlighted by Rich Privorotsky in his daily note: according to the Fed, 37% of non-financial corporates are in distress in what should be a positive growth backdrop.

Given the dramatic tightening in lending standards, one has to wonder at credit spreads optimism...

Goldman warns, there's room for disappointment as goldilocks hope fades:

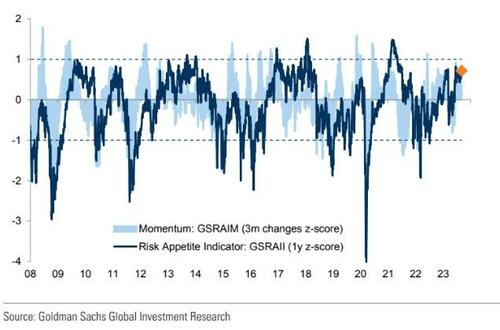

Sentiment has cooled down a bit from July extreme greed but still remains optimistic on overall, leaving room for disappointment.

The VIX fell below 14, IG credit spreads are at the tightest of the year, the AAII bull bear index has bounced back to greed territory, the GS risk appetite index remains range bound c. 0.6 Z-Score - all consistent with investors just back to school and yet to adjust to the evolving macro backdrop.

Notably, our cross asset team noted that market correlation to macro growth surprise turned negative, suggesting rates are now high enough and that additional increases are seen as punitive from here .

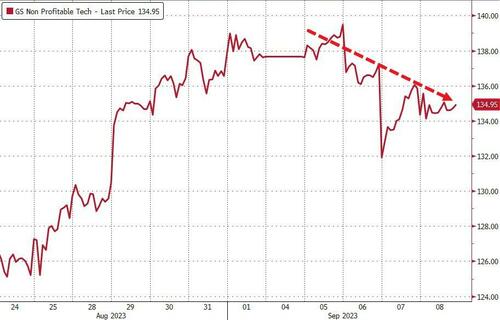

US non-profitable tech underperformance is consistent with this dynamic...

The problem for Goldilocks believers is Energy.

Oil and Gas supply restrictions triggered sharp moves in the commodity space.

Oil is on the move and too hot to handle, breaking key resistances and now at the highest levels since Nov 22. This seems incompatible with 5y5y breakeven down...

...and suggesting room for upside inflation surprise, and therefore higher rates and PE compression.

Supply/demand dynamics catalyzed this move, with SPR starting to re-build, Saudi cutting production, and Australia strike pushing gas prices higher.

Besides, it is interesting to note growing concerns on the implications of rising energy prices ahead of the winter season among investors.

On the technical side, systematic flow is turning positive on the short term - however, CTA positioning in US equities remains very long c. 82nd 12m%ile, pointing at limited room for incremental demand from this investor base.

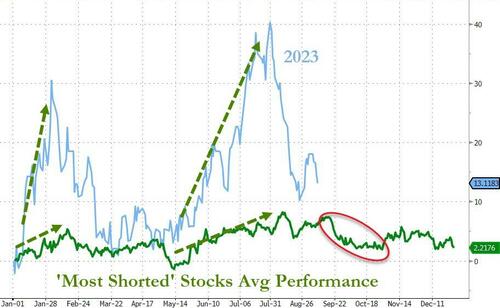

September seasonality dynamics tend to benefit consensual longs & Momentum...

...while Most Shorteds tend to underperform looking at data back since 2008.

China uncertainty remains a key factor for investors and Pro Subs can read the full note here...

https://ift.tt/fuP3XVx

from ZeroHedge News https://ift.tt/fuP3XVx

via IFTTT

0 comments

Post a Comment