American Dream Megamall Sees Losses Quadruple To $245 Million

Well if you consider the "American dream" nowadays to be spending money you don't have while racking up debt, the American Dream megamall outside of New York City (in NJ) might be aptly named after all.

The massive shopping destination inside of the Meadowlands saw its losses quadruple last year, according to the New York Post, sending the facility a stunning $245 million into the red.

The facility is having trouble attracting tenants and is watching customer foot traffic slow, according to the report. Its expenses and debt, as we have documented here on Zero Hedge over the last 2 years, have been burdensome.

The megamall had probably the worst "grand opening" timeline in history, welcoming customers for the first time just five months before the Covid pandemic locked down consumers and ensured the failure of many businesses who couldn't adapt.

Beyond pandemic-induced closures and building setbacks, the shopping complex has been hit by a series of unexpected incidents, like the collapse of a decorative helicopter model into a pool full of kids last February. Then, in December, an Air National Guard member tragically died in a snowboarding mishap at Big Snow American Dream.

A preliminary financial report indicates that the mall's operating costs soared to a staggering $428 million in 2022, nearly double the previous year's $232 million, the Post noted in its writeup.

Separate from operating costs, the mall also incurred $350.3 million in non-operational expenditures, such as debt interest and restructuring fees, according to documents submitted to the Municipal Securities Rulemaking Board's EMMA database. Financial liabilities, including debt repayments, reached $189 million in 2022.

We have previously written about the American Dream mall, writing back in February 2022 that the megamall had just $820 in its reserve account after making a massive $9.3 million interest payment.

That should have been the first sign things weren't going as planned...

We noted in summer of 2021 that the mall was drowning in debt. We wrote that the mall saw its opening delayed more than once and suffered from the extremely unfortunate timing of the pandemic.

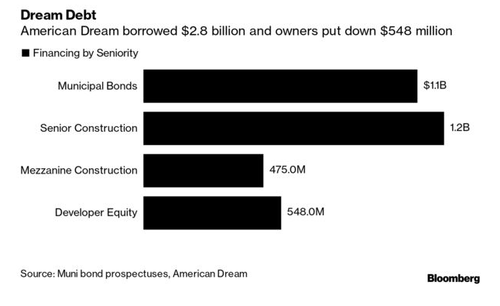

Owners the Ghermezian family were having trouble preventing the mall from "hemorrhaging cash", according to Bloomberg at the time, who also noted that the family had already hired advisors to help restructure the project's $3 billion in debt.

Lenders for the project, including J.P. Morgan, Goldman Sachs and Soros Fund Management, stood to face losses on about $1.7 billion in construction loans, we noted last summer. The project was carrying about $1.1 billion in municipal debt at the time.

Neil Shapiro, a New York real estate attorney, said of the project last year: “It’s been like watching a train wreck that goes on forever. There aren’t a lot of projects that lose at least $3 billion that we’re still talking about as projects.”

The financial difficulties plaguing the mall serve as a cautionary tale about the dangers of over-leveraging that we believe we are going to see over and over again as the Fed maintains its tight grip on the gears of the economy, via its "higher for longer" stance.

https://ift.tt/w95dErB

from ZeroHedge News https://ift.tt/w95dErB

via IFTTT

0 comments

Post a Comment