Tverberg: Today's Energy Bottleneck May Bring Down Major Governments

Authored by Gail Tverberg via OurFiniteWorld.com,

Recently, I explained the key role played by diesel and jet fuel. In this post, I try to explain the energy bottleneck the world is facing because of an inadequate supply of these types of fuels, and the effects such a bottleneck may have. The world’s self-organizing economy tends to squeeze out what may be considered non-essential parts when bottlenecks are hit. Strangely, it appears to me that some central governments may be squeezed out. Countries that are rich enough to have big pension programs for their citizens seem to be especially vulnerable to having their governments collapse.

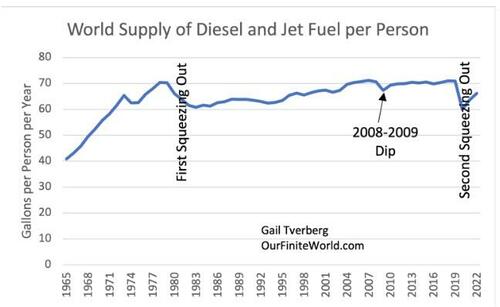

Figure 1. World supply of diesel and jet fuel per person, based on Middle Distillate data of the 2023 Statistical Review of World Energy, produced by the Energy Institute. Notes added by Gail Tverberg.

This squeezing out of non-essential parts of the economy can happen by war, but it can also happen because of financial problems brought about by “not sufficient actual goods and services to go around.” An underlying problem is that governments can print money, but they cannot print the actual resources needed to produce finished goods and services. I think that in the current situation, a squeezing out for financial reasons, or because legislators can’t agree, is at least as likely as another world war.

For example, the US had trouble electing a Speaker of the House of Representatives because legislators disagreed about funding plans. I can imagine a long shutdown occurring because of this impasse. Perhaps not this time around, but sometime in the next few years, such a disagreement may lead to a permanent shutdown of the US central government, leaving the individual states on their own. Programs of the US central government, such as Social Security and Medicare, would likely disappear. It would be up to the individual states to sponsor whatever replacement programs they are able to afford.

[1] An overview of the problem

In my view, we are in the midst of a great “squeezing out.” The economy, and in fact the entire universe, is a physics-based system that constantly evolves. Every part of the economy requires energy of the right types. Humans and animals eat food. Today’s economy requires many forms of fossil fuels, plus human labor. This evolution is in the direction of ever-greater complexity and ever-greater efficiency.

Right now, there is a bottleneck in energy supply caused by too much population relative to the amount of oil of the type used to make diesel and jet fuel (Figure 1). My concern is that many governments and businesses will collapse in response to what I call the Second Squeezing Out. In 1991, the central government of the Soviet Union collapsed, following a long downward slide starting about 1982.

All parts of economies, including government organizations and businesses, constantly evolve. They grow for a while, but when limits are hit, they are likely to shrink and may collapse. The current energy bottleneck is sufficiently dire that some observers worry about another world war taking place. Such a war could change national boundaries and reduce import capabilities of parts of the world. This would be a type of squeezing out of major parts of the world economy. In fact, shortages of coal seem to have set the stage for both World War I and World War II.

Each squeezing out is different. When there are physically not enough goods and services to go around, some inefficient parts of the economy must be squeezed out. Payments to pensioners seem to me to be particularly inefficient because pensioners are not themselves creating finished goods and services.

World leaders would like us to believe that they are in charge of what happens in the world economy. But what these leaders can accomplish is limited by the actual resources that can be extracted and the finished goods and services that can be produced with these resources. When there are not enough goods and services to go around, unplanned changes to the economy tend to take place. These changes work in the direction of allowing parts of the system to go forward, without being burdened by the less efficient portions.

[2] The importance of diesel and jet fuel

Diesel and jet fuel are important to today’s industrial economy because they fuel nearly all long-distance transportation of goods, whether by ship, train, large truck, or airplane. Diesel also powers most of today’s modern agricultural equipment. Without the use of modern agricultural equipment, overall food production would decline drastically.

Without diesel, there would also be many other problems besides reduced food production. Diesel is used to power many of the specialized vehicles used in road maintenance. Without the ability to use these vehicles, it would become difficult to keep roads repaired.

Without diesel and jet fuel, there would also be an electricity problem because transmission lines are maintained using a combination of land-based vehicles powered by diesel and helicopters powered by jet fuel. Without electricity transmission, homes and offices without their own solar panels and batteries wouldn’t be able to keep the lights on. Gasoline pumps require electricity to operate, so they wouldn’t operate either. Without diesel and electricity, the list of problems is endless.

[3] Green energy is itself a dead end, but subsidizing green energy can temporarily hide other problems.

Green energy sounds appealing, but it is terribly limited in what it can do. Green energy cannot operate agricultural machinery. It cannot make new wind turbines or solar panels. Green energy cannot exist without fossil fuels. It is simply an add-on to the current system.

The reason why we hear so much about green energy is because making people believe that a green revolution is possible provides many temporary benefits. For example:

-

The extra debt needed to subsidize green energy indirectly increases GDP. (GDP calculations ignore whether added debt was used to produce the added goods and services counted as GDP.)

-

Manufacturers can pretend that their products (such as vehicles) will operate as they do today for years and years.

-

The educational system is given many more areas to provide courses in.

-

Citizens are given the hope that the economy will grow endlessly.

-

Young people are given hope for the future.

-

Politicians look like they are doing something for voters.

Unfortunately, by the time that the debt comes due to pay for subsidized green energy, it will be apparent that the return on this technology is far too low. The overall system will tend to collapse. Green energy is only a temporary Band-Aid to hide a very disturbing problem. Its impact is tiny and short-lived. And it cannot prevent climate change.

[4] Energy bottlenecks are a frequent problem.

Energy bottlenecks are a frequent problem partly because the human population has tended to increase ever since early humans learned to control fire. At the same time, resources, such as arable land, fresh water supply, and minerals of all kinds, are in limited supply. Extraction becomes increasingly difficult over time (requiring more inputs to produce the same output) because the easiest-to-produce resources tend to be exploited first. Extracting more fossil fuels to meet the energy needs of a growing economy may look like it would be easy, but, in practice, it is not.

As a result of energy bottlenecks, civilizations often collapse. Sometimes war with another group is involved. In such a case, the population of the losing civilization falls.

[5] The standard supply and demand model of economics makes it look like prices will rise in response to fossil fuel shortages. The discussion in Section [4] shows that energy supply bottlenecks often occur. When they do occur, the response is very different.

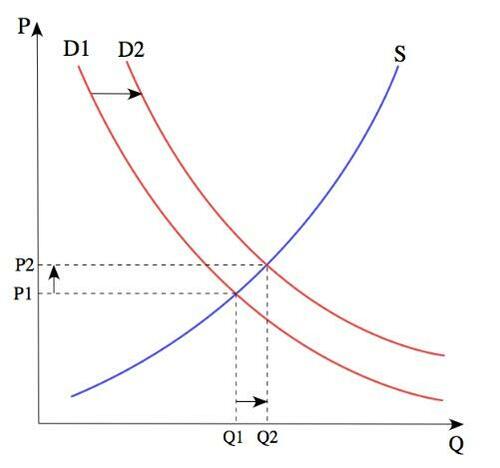

Figure 2. From Wikipedia: The price P of a product is determined by a balance between production at each price (supply S) and the desires of those with purchasing power at each price (demand D). The diagram shows a positive shift in demand from D1 to D2, resulting in an increase in price (P) and quantity sold (Q) of the product.

The model of many economists is far too simple. Based on the model shown on Figure 2, it is easy to get the idea that a shortage of oil will lead to a rise in prices. As a result, more oil will be produced, and the problem will be solved. Or perhaps efficiency changes, or substitution for a different type of fuel, will fix the problem.

When bottlenecks appear, the real situation is quite different. For example, increases in oil prices tend to cause food prices to rise, and thus increase inflation. Politicians know that citizens don’t like inflation and therefore will not vote for them. As a result, politicians tend to hold down prices. The resulting prices tend to fall too low for producers, and they start producing less, rather than more.

Energy products of the right kinds are essential for making every part of GDP. If there is not enough of the right kinds of energy products to go around, what I call some kind of “squeezing out” is likely to take place. Early on, there may be changes that reduce energy consumption, such as cutbacks in international trade. More businesses may fail. Eventually, some parts of the world economy may disappear, such as the central government of the Soviet Union in 1991. Or war may take place.

[6] When there is not enough energy of the right kinds to go around, spreading what little is available “thinner” doesn’t work.

As an example, if people need to eat 2,000 kilocalories per day, and if the food supply that is available would only supply 500 kilocalories per day (on average), giving everyone the same quantity would lead to everyone starving. Similarly, if a communist government gives every worker the same wage, lateness and “slacking off” become huge problems. Experience in many places has shown that equal pay for all, regardless of native abilities, responsibilities, or effort, simply doesn’t work. Somehow, diligent work and greater responsibility needs to be rewarded.

When an energy bottleneck occurs (leading to too little finished goods and services in total being produced), what I call a “squeezing out” takes place. Such a squeezing out may be initiated in many ways, including a war, angry citizens overturning a government, financial problems, or a shift in climate. The winners in a squeezing out end up ahead; the losers see collapsing institutions of many kinds, including failing businesses and disappearing government organizations.

[7] Most people do not understand the interconnected nature of the world economy, and the way the whole system tends to evolve.

The Universe is made up of many temporary structures, each of which needs to “dissipate” energy to stay away from a cold, dead state. We are all aware that plants and animals behave in this manner, but businesses of all kinds and government organizations also require energy of the right kinds to grow. They get much of their energy from financial payments that act as temporary placeholders for goods and services that will be made in the future using various types of energy, including human labor.

Strangely enough, because of the physics of the situation, business and government organizations are also temporary in nature, and in some sense, they also evolve. In physics terms, all these structures are dissipative structures. Physicist Francois Roddier writes about this broader kind of evolution in his book, The Thermodynamics of Evolution. In fact, economies themselves are dissipative structures. I have written about the economy as a self-organizing system powered by energy many times, including here, here, and here. All these self-organizing structures eventually come to an end.

History is full of records of economies that have collapsed. The book Secular Cycles by Peter Turchin and Serjey Nefedov analyzes eight of these failed economies. Populations tend to grow after a new resource is found or is acquired through war. Once population growth hits what Turchin calls carrying capacity, these economies hit a period of stagflation. This period lasted 50 to 60 years in the sample of eight economies analyzed. Stagflation was followed by a major contraction, typically with failing or overturned governments and declining overall population.

[8] Logic and some calculations suggest that the world economy is likely to be reaching a major downturn, about now.

One way of estimating when a major contraction (or squeezing out) would occur would be to look at oil supply. We know that US oil production hit a peak and started to decline in 1970, changing the dynamics of the world economy. This started a period of stagflation for many of the wealthier economies of the world. Adding 50 to 60 years to 1970 suggests that a major downturn would take place in the 2020 to 2030 timeframe. Since it was the wealthier economies that first entered stagflation, it would not be surprising if these economies tend to collapse first.

There have been several studies computing estimates of when the extraction of fossil fuels would become unaffordable. Back in 1957, Rear Admiral Hyman Rickover of the US Navy gave a speech in which he talked about the connection of the level of fossil fuel supply to the standard of living of an economy, and to the ability of its military to defend the country. With respect to the timing of limits to affordable supply, he said, “. . .total fossil fuel reserves recoverable at not over twice today’s unit cost are likely to run out at some time between the years 2000 and 2050, if present standards of living and population growth rates are taken into account.”

Confusion arises because some people would like to believe that fossil fuel prices can rise to extraordinarily high levels, and this will somehow permit more fossil fuels to be extracted. However, as I discussed in Section [5], the problem is really a two-sided one. Politicians want to hold fossil fuel prices down to prevent inflation, while oil producers (such as those in OPEC+) choose to reduce production if prices are not sufficiently high to meet their needs.

An easily missed point is that tax revenue from the sale of oil is often a large share of the total tax revenue of oil exporting countries. Because of this issue, in order for prices of oil to be adequate for oil exporters, they must include a wide margin for payment of taxes. These taxes are used to support the rest of the economy. For example, in Saudi Arabia, taxes provide support for huge building programs that provide jobs for citizens, but are of questionable long term value. These projects keep citizens happy, at least temporarily. Without adequate subsidy from tax revenue, citizens would want to overturn governments–a form of collapse.

[9] Energy problems are easily hidden because “scientific models” are considered to be important in forecasting the future. These models tend to be misleading because they leave out important elements regarding how the economy really works.

The easiest models to make are the ones that seem to say, “the future will be very similar to the recent past.” These models miss turning points. They assume that growth will continue even though resource extraction can be expected to become more difficult. Some examples of overly simple models include the following:

-

Money is a store of value. (Not if the economy has stopped functioning properly because insufficient energy resources are available.)

-

Forecasts of Social Security payments recipients will be able to receive in the future are overstated. (It takes energy of the right kinds to produce the goods and services that the elderly require. If the economy is not producing enough goods and services because of energy extraction limits, the share that pensioners can receive will need to fall so that workers can be paid adequately. Inflation-adjusted benefits to the elderly must be much lower or disappear completely.)

-

Climate models give high estimates. (These models miss the real-world difficulty of extracting fossil fuels. They also assume the economy can grow indefinitely, greatly overstating future CO2.)

-

Future energy supply based on “Reserve to Production” ratios give high estimates. (Reserve amounts are often puffed-up numbers to make an oil exporting country look wealthy.)

-

Energy Return on Energy Invested models greatly overestimate the value of intermittent wind and solar energy. (It is easy to assume that all types of energy are equivalent, but intermittent wind and solar cannot replace diesel and jet fuel.)

[10] Added complexity is not a solution to our energy problems.

Many people believe that if we can just be smarter, we can solve our energy problem. We can add more fuel-efficient engines, more advanced education, and more international trade, for example. Unfortunately, many things go wrong, leading to an upward energy complexity spiral. Difficulties include:

-

The complexity changes with the best payback tend to be discovered and implemented very early.

-

Added complexity may lead to higher energy consumption if cost savings result. For example, more vehicles may be sold if reduced fuel consumption makes their operation more affordable to a wider number of users.

-

Wage disparity results because the wages paid to highly educated employees and those in managerial positions leave little funding available to pay less-skilled workers.

-

Less-skilled workers indirectly compete with similarly skilled workers in low-wage countries, further holding their wages down.

It is clear that we are now moving past the limits of complexity. For example, international trade as a percentage of GDP has been falling for the world, the US, and China.

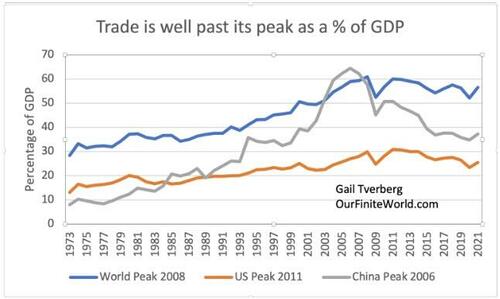

Figure 3. Trade as a percentage of GDP based on World Bank data for the World, the United States, and China.

Countries are now actively trying to bring supply lines back closer to home. Trips for goods across the Atlantic and the Pacific Oceans are being reduced, saving diesel and jet fuel.

[11] Repayment of debt with interest acts like a Ponzi Scheme if there is inadequate growth in the energy supply.

Most people today do not realize the extent to which the entire financial system is dependent on growing inexpensive-to-produce energy supply of the right kinds. It takes physical resources of the right kinds to produce goods and services. Resources such as fresh water, copper, lithium, and fossil fuels require more and more energy consumption to produce the same amount of supply because the easiest-to-extract resources are extracted first.

When the economy is far from limits, adding more debt (or other types of promises, such as shares of stock) does seem to increase “demand” for finished goods and services, and this, in turn, tends to increase the production of fossil fuels and other commodities. Thus, for a while, increased debt does indeed increase energy supply.

But when we start reaching extraction limits, instead of producing more fossil fuels and other commodities, higher debt tends to produce inflation. (In other words, more money plus practically the same amount of finished goods and services tends to lead to inflation.) This is the issue central banks are up against today. Central banks raise interest rates in response to the higher level of inflation, partly to compensate lenders for the inflation that is taking place, and partly to make their own economies more competitive in the world economy. The combination of higher interest rates and higher inflation is problematic in many ways:

(a) Ordinary citizens find that they must cut back on discretionary goods and services to balance their budgets. This tends to push economies in the direction of recession and debt defaults. Some citizens find they need to apply for government assistance programs for the first time.

(b) Businesses find it more difficult to operate profitably with higher interest rates and inflation. Businesses increasingly expand in programs supported by government subsidies, such as those for electric cars and batteries, as it becomes increasingly difficult to make a profit without a subsidy. In the US, defaults seem especially likely on commercial real estate loans.

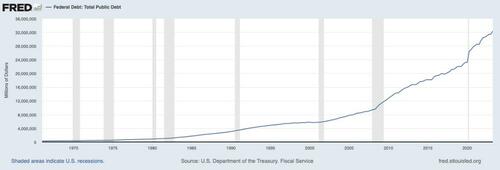

(c) Governments become especially squeezed. Many of them find that their own tax revenue is falling at precisely the time when citizens need their programs most. Governments also find that with higher interest rates, interest costs on their own debt rises. Subsidized programs increasingly seem to be needed to keep the economy operating. The number of retirees also grows year after year. Government debt levels spiral upward, as shown for the US on Figure 6.

With all these issues, the world becomes increasingly prone to war. Political parties, and even groups within political parties, find it increasingly difficult to agree on solutions to problems. The stage seems to be set for an array of worrisome outcomes, including major debt defaults, failing governments, and even widespread war.

[12] The world economy was able to grow rapidly in the 1950 to 1980 period because of a rapid rise in energy consumption. Now, there is an energy bottleneck. The recent increases in interest rates seem likely to burst debt bubbles. They may even squeeze out some major economies with pension programs for their citizens.

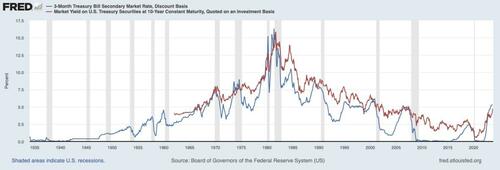

Figure 4. Measures of average interest rates of 3-month US Treasury Bills and 10-year Treasury Securities, in a chart produced by the Federal Reserve of St. Louis.

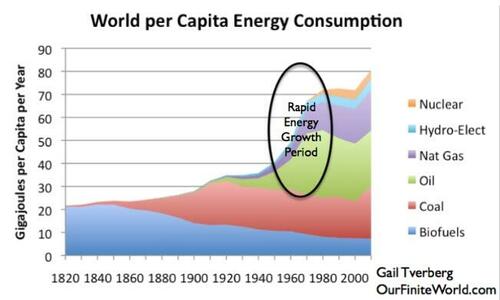

On Figure 4, the significant increases in interest rates up until 1981 corresponded to a huge increase in world energy consumption in the 1950 to 1980 period (Figure 5).

Figure 5. World per capita energy consumption, with the 1950-1980 period of rapid growth highlighted. World Energy Consumption by source, based on Vaclav Smil’s estimates from Energy Transitions: History, Requirements and Prospects (Appendix) together with data from BP’s Statistical Review of World Energy for 1965 and subsequent years. Population estimates used to produce per capita amounts are based on estimates by Angus Maddison for dates prior to 1950. They are based on UN estimates for more recent years. Chart prepared by Gail Tverberg in 2018.

The rapid rise in fossil fuel consumption in Figure 5 was the reason why the economy was able to grow as rapidly as it did in the 1950 to 1980 period. Raising interest rates acted like brakes on the economy and lowered oil prices. The Soviet Union was the economy most harmed by these low oil prices. It also had a communist form of government that did not work well, compared to capitalism. Ultimately, the central government of the Soviet Union collapsed in 1991.

Now, the rise in interest rates during 2022 and 2023 on Figure 4 correspond to a very different situation. Extraction of fossil fuels, and in particular the heavy oil used to produce diesel and jet fuel, is no longer growing rapidly. Instead, what has been growing is debt, especially government debt. Figure 6 shows US government debt through April 2023. US government debt spurted upward in 2020 and is still rising rapidly.

Figure 6. US Public Debt, based on a chart prepared by the Federal Reserve Bank of St. Louis.

The business closures in 2020 and interruptions in travel reduced oil prices and provided a good excuse for more government debt. All this debt added buying power, but it didn’t actually produce very many goods and services. Instead, it added a debt bubble. Similarly, investing in close-to-useless green energy temporarily added GDP, but it mostly added a huge debt bubble. Raising interest rates is likely to burst these debt bubbles.

The US and other rich countries have also put in place pension plans for the elderly. These are not treated as debt, but they depend upon resources of all kinds being available to feed, clothe, and provide shelter to a growing army of retirees. If there is not enough diesel to allow as many goods and services to be produced as are produced today, there is likely to be a huge problem if payouts to pensioners aren’t significantly reduced. Other citizens will be unhappy if retirees get a disproportionately large share of the reduced supply of goods and services. Some will say, “Why work if retirees on pensions get more than those of us who are still working?”

Thus, the world seems to be increasingly in a situation where more squeezing out will take place. Major governments, especially those with pension plans for their citizens, seem especially vulnerable. No one understood that there had been a temporary rapid rise in energy consumption per capita in the 1950 to 1980 period (Figure 5) that led to a temporary spurt in interest rates on bonds. This temporary rise in interest rates made pension programs look far more feasible than they really are for the longterm.

[13] How does the problem resolve itself?

It seems to me that the problem of debt bubbles and of unaffordably generous pension plans is very widespread. Analysts of all kinds have missed the hidden brakes on economies caused by inadequate energy resources of the right kinds, relative to rising populations. Collapse of at least some central governments seems possible. Perhaps some of these collapses can be postponed by rollbacks in government-sponsored programs, particularly those for the elderly and for those who are not working.

But even aside from the pension problem, there is a problem with many debts not being repayable in an economy that is forced to slow, as described in Section [11]. Many other promises become iffy as well. For instance, derivatives may not be able to pay as planned.

If there are problems with inadequate supply of essential materials, they are likely to spill over to asset values. For example, a farm that cannot purchase fuel for its agricultural equipment is, in some sense, not worth very much, since workers with simple tools like shovels cannot produce very much food. Likewise, a factory with permanently broken supply lines is not worth much.

I wish I could provide a happy-ever-after ending. The closest I can come to such an ending is to say that it appears to me that there is a literal Higher Power that is somehow providing an enormous amount of energy in a way that allows the Universe to continually expand. This literal Higher Power is, in some way, influencing the world today, through the self-organizing nature of the economy. The book Rare Earth: Why Complex Life Is Uncommon in the Universe, by Ward and Brownlee, explains that life could not have happened on the Earth, as quickly as it did, by chance alone. Perhaps things will turn out differently than we expect.

https://ift.tt/f5GUB3N

from ZeroHedge News https://ift.tt/f5GUB3N

via IFTTT

0 comments

Post a Comment