WTI Shrugs Off Large Crude Inventory Build Reported By API

Oil prices were flat today as traders anxiously await OPEC+'s decision later this week.

Crude slipped after President Joe Biden said that a deal to free some Israeli hostages held by militant group Hamas is imminent.

Later on, oil regained some ground on news that Federal Reserve policymakers are united around a strategy to “proceed carefully” on future interest-rate moves.

An expected buildup in US stockpiles, as well as the contango structure of WTI’s front-month spread, “are keeping a lid on prices,” said Dennis Kissler, senior vice president for trading at BOK Financial Securities.

“But its mostly a choppy trade until we see what OPEC+ is going to do.”

After four weeks of builds crude is once again expected to see stockpiles increase, as Cushing builds off tank bottoms

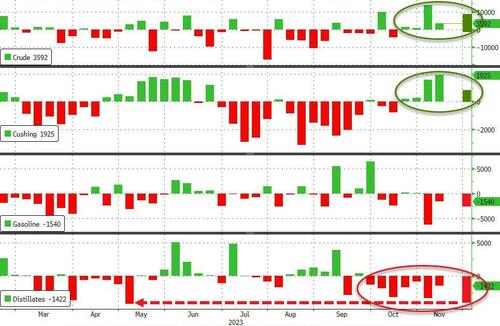

API

-

Crude +9.05mm (+100k exp)

-

Cushing +640k

-

Gasoline -1.79mm (-600k exp)

-

Distillates -3.51mm (-600k exp)

A dramatically larger crude inventory build than expected (+9mm vs +100k exp!)a long with another rise in Cushing stocks. But, on the product side, API reports significant draws...

Source: Bloomberg

Additionally, crude inventories at key Cushing, Oklahoma, storage hub rose by 8k barrels in week ending Nov. 17, according to AlphaBBL data.

WTI was hovering around $77.80 ahead of the API data and barely shrugged at the large crude build...

In a Tuesday note, Carsten Fritsch, commodity analyst at Commerzbank, said the main question ahead of the OPEC+ meeting is whether Saudi Arabia "would leave its oil production at the currently reduced level beyond the end of the year or would raise it back to the agreed level of 10 million barrels per day from January."

"This speculation is likely to continue until the OPEC+ meeting at the weekend, with the result that oil prices could well rise further in the coming days," Fritsch wrote.

"That said, this also raises expectations of the meeting: if Saudi Arabia's voluntary production cut, and possibly Russia's reduced oil exports, were merely to be left in place beyond year's end, which had been regarded as the most probable scenario until a few days ago, this could meet with disappointment on the market and trigger a renewed oil price slide after the meeting."

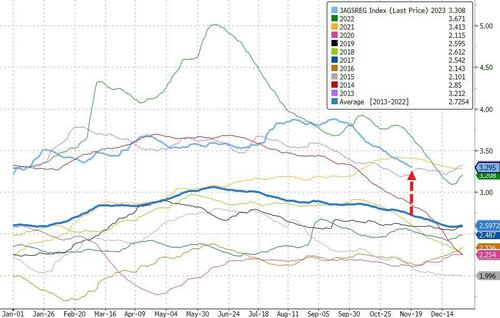

Meanwhile, although gas prices are down significantly from their summer highs, we note they are still 21% above average for Thanksgiving week...

Get back to work Mr.Biden!

https://ift.tt/X6hKF9q

from ZeroHedge News https://ift.tt/X6hKF9q

via IFTTT

0 comments

Post a Comment