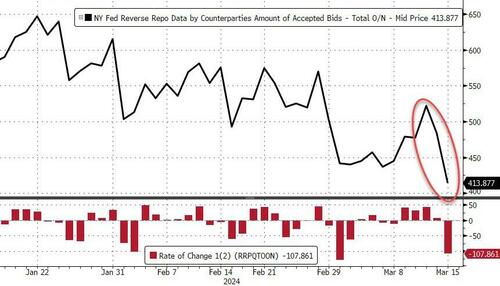

US Banks See Large Deposit Inflows As Bailout Fund Expires, RRP Liquidity Plunges

With The Fed's bank bailout facility now expired (and the one-year term loans starting to mature), it is perhaps not surprising that we saw a very large liquidity drain from The Fed's Reverse Repo facility in the last two days - over $107BN pulled out to fresh cycle lows...

Source: Bloomberg

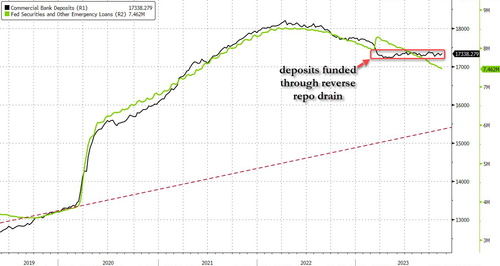

Total deposits - on a seasonally-adjusted basis - rose by $54BN last week...

Source: Bloomberg

On a non-seasonally-adjusted basis - remind us again how actual deposits are seasonally-adjusted - banks saw and even larger $82BN deposit inflow...

Source: Bloomberg

Excluding foreign bank deposits, domestic banks saw seasonally-adjusted deposits rise $60BN (Large Banks +$59BN, Small Banks +$0.9BN), and non-seasonally-adjusted deposits rose $94BN (Large Banks +$73BN, Small Banks +$21BN)...

Source: Bloomberg

However, rather oddly, on the other side of the ledger, loan volumes plunged despite the surge in deposits (Large bank loan volumes tumbled $15BN while Small bank loan volumes rose by $0.3BN)....

Source: Bloomberg

And finally, as if you needed a reminder after the recent NYCB debacle-and-bailout - the regional bank crisis is still very much alive as evidenced by the red line below (without The Fed's expired BTFP facility)...

Source: Bloomberg

...what else are big banks (green line) going to do with all that cash burning a hole in their pockets (although we do note a big cash drop at large banks - which includes NYCB). Regional bank shares took a tumble this week, erasing all the post-NYCB bailout gains...

As one veteran Fed watcher remarked "this is such a clusterfuck... deposits should be $500BN lower"

Source: Bloomberg

The bottom line is - this looks a lot like a 'Small Bank' crisis. The last time this happened, the crisis sparked a sudden $300BN 'run' in small bank deposits (this time it's bigger!).

Is The Fed 'hoping' for a controlled bank-run this time - so as many small bank deposits are drained voluntarily, before they are drained all at once in a panic (and the Reverse Repo facility is empty, unable to provide any cushion)?

https://ift.tt/NnKFtmE

from ZeroHedge News https://ift.tt/NnKFtmE

via IFTTT

0 comments

Post a Comment