Gold & Bitcoin Close At Record Highs As Bonds & Stocks Dip

A quiet macro day let the grown-ups play... and today saw gold and bitcoin roar up to record closing highs (amid rising breakevens and falling rate-cut expectations) as all eyes and ears and algos remain glued to any further hints of QE (Reverse Twist) as Waller revealed last week, and Fed's Bostic didn't help today.

In a commentary published on the Atlanta Fed website Monday, Bostic said he was worried that businesses have too much exuberance and could unleash a burst of new demand after a rate cut that adds to price pressures.

“This threat of what I’ll call pent-up exuberance is a new upside risk that I think bears scrutiny in coming months,” he said.

“ As my staff and I have talked to business decision-makers in recent weeks, the theme we’ve heard rings of expectant optimism.”

That could be another reason not to cut rates at a rushed pace, he told reporters in a press briefing.

“I would probably not anticipate they would be back to back” cuts, Bostic said.

“Given the uncertainty, I think there is some appeal to acting and then seeing how participants in the markets, businesses leaders and families respond to that.”

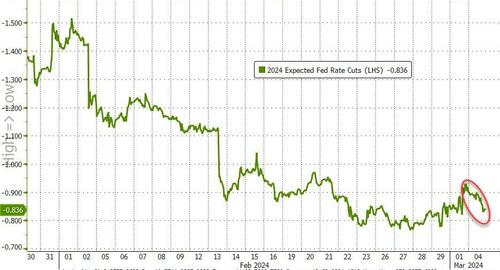

2024 rate-cut expectations drifted (hawkishly lower) to barely three cuts priced in for 2024 now...

Source: Bloomberg

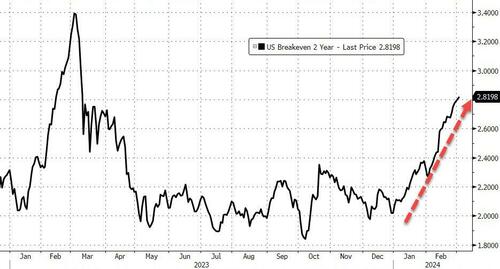

But breakevens are soaring in the face of disinflationary delusion...

Source: Bloomberg

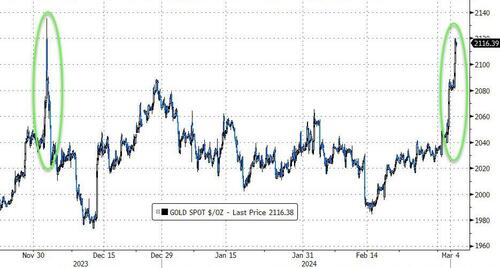

And it appears gold got the hint...

Source: Bloomberg

...soaring to a new record closing high (just shy of its intraday record high)...

Source: Bloomberg

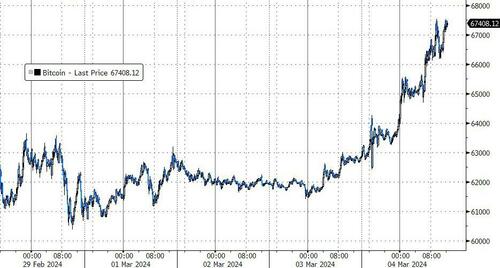

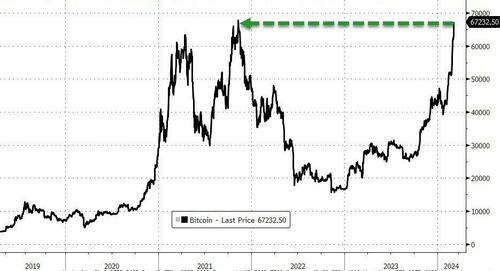

And the other alternative currency also soared, Bitcoin topping $67,000...

Source: Bloomberg

...up to its record closing high (yes, we know bitcoin doesn't 'close')...

Source: Bloomberg

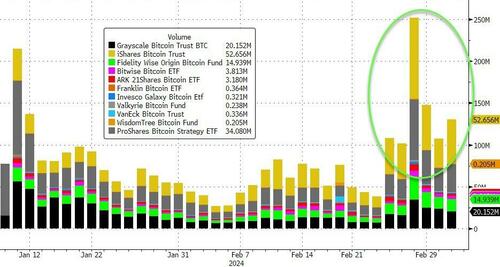

...amid another high volume day in BTC ETFs...

Source: Bloomberg

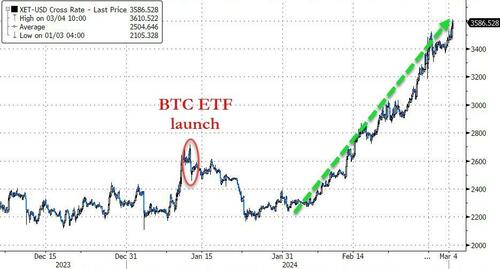

Ethereum also caught a bid, topping $3600 for the first time since

Source: Bloomberg

Still has some room to go its record highs...

Source: Bloomberg

Elsewhere, stocks ambled along with Small Caps pumped (at the European open) and dumped back to unchanged-ish. A late-day sell program dragged the Nasdaq to the lows of the day and the ugliest horse in today's glue factory...

VIX continued to decouple from stocks here (and this time it was not call-buying FOMO malarkey as skews ticked higher)...

Source: Bloomberg

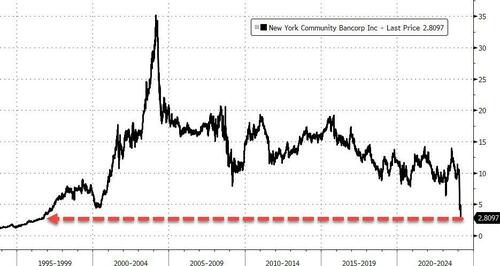

As NYCB collapsed to 28 year lows...

Source: Bloomberg

Bonds were sold with the short-end underperforming....

Source: Bloomberg

Which prompted bear-flattening in the yield curve...

Source: Bloomberg

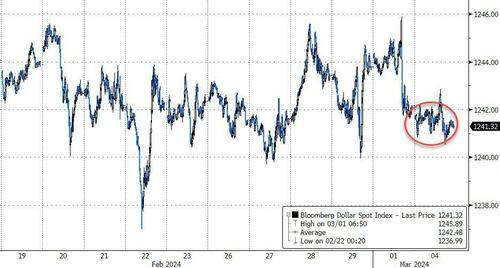

The dollar limped lower but remains broadly speaking in its recent range...

Source: Bloomberg

Oil prices declined, apparently not enthralled by the idea of The Fed printing money to buy short-dated bills anymore, round-tripping Friday's gains...

Source: Bloomberg

Finally, NVDA just refuses to drop, up another 6% today...

...overtaking Aramco as the 3rd most valuable company in the world...

Source: Bloomberg

It's different though this time...

Source: Bloomberg

...probably nothing.

https://ift.tt/IFU2wHN

from ZeroHedge News https://ift.tt/IFU2wHN

via IFTTT

0 comments

Post a Comment