Bitcoin, Bullion, Black Gold, & Bonds Bid As 'Trump Trade' Builds

A slow start (volume-wise) with light macro this week dominated by heavy micro with NVDA's earnings on Wednesday after the close.

Vol markets are already pricing some notable moves - but also then the normalization into the holidays as seasonals help...

Source: Bloomberg

On the bright side from the equity bulls, Nasdaq broke its 5-day losing streak today (while The Dow ended red)...

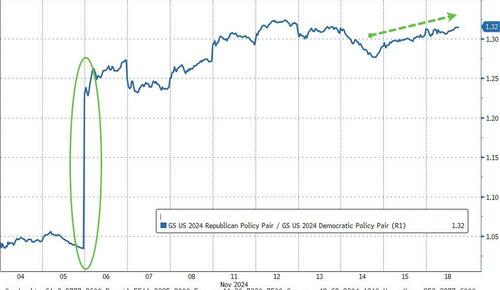

The 'Trump Trade' continues to build momentum, holding its post-election spike gains (Republican policy basket / Democrat policy basket)...

Source: Bloomberg

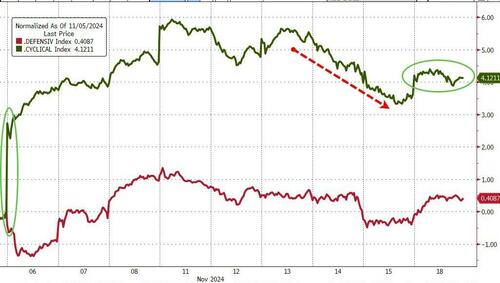

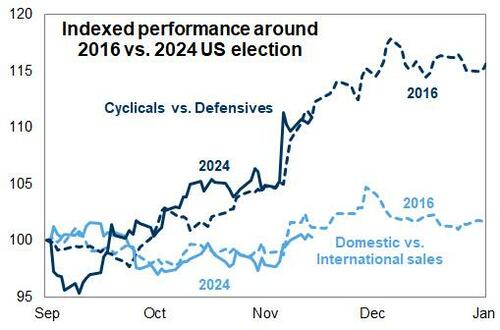

Cyclicals continue to outperform Defensives post-election...

Source: Bloomberg

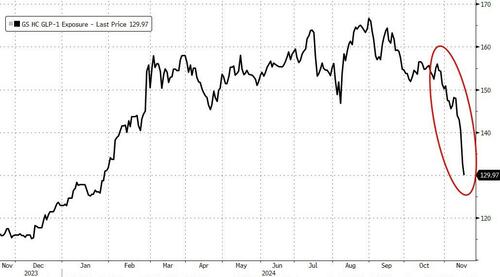

GLP-1 weakness continues with the group down for the 5th straight session as near-term catalysts + RFK overhang remain headwinds...

Source: Bloomberg

...pushing Goldman's MAHA-exposed basket down to multi-year lows...

Source: Bloomberg

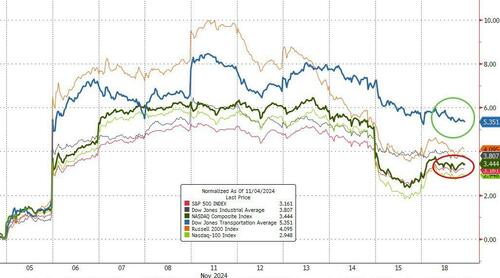

In the short term - since the election - trannies are trouncing tech...

Source: Bloomberg

But longer-term, drilling down, semis are slamming planes, trains, and automobiles...

Source: Bloomberg

Treasury yields pumped and dumped AGAIN with the belly of the curve outperforming (yields were lower across the whole curve on the day). The overnight Asia session was flat but Europe saw selling which was then dominated by buying during the US session...

Source: Bloomberg

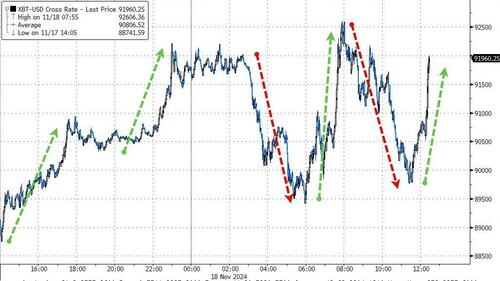

Crypto markets were volatile (as always) today with bitcoin chopping between $89500 and $92500...

Source: Bloomberg

...but all in all holding up well on the post-election gains...

Source: Bloomberg

Side-note - DJT rumored to buy BKKT...

However, crypto continues to dominate gold post-election...

Source: Bloomberg

But the barbarous relic did surge today...

Source: Bloomberg

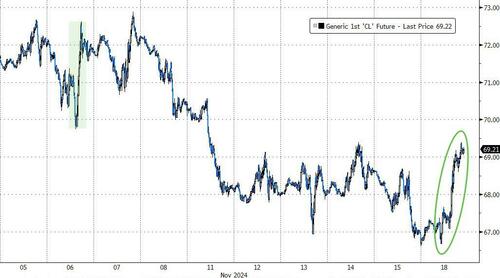

While WTI futures front-month soared higher today...

Source: Bloomberg

...A key oil market gauge is flashing signs of oversupply in the US, in the latest indication of a looming global glut. The so-called prompt spread — which measures the difference in price between futures for immediate delivery and those a month later — traded in negative territory for the first time since February.

Source: Bloomberg

Finally, it's not over yet if history is any precedent...

Source: Goldman Sachs

Goldman's Pete Callahan notes that during the market rotations around 2016 and 2024 elections, cyclicals sharply outperformed Defensives around the election while domestic facing stocks outperformed international facing stocks by a smaller magnitude.

Trade accordingly.

https://ift.tt/sSLMBJU

from ZeroHedge News https://ift.tt/sSLMBJU

via IFTTT

0 comments

Post a Comment