All Three Pillars Holding Up The Economy Have Cracked

Authored by Charles Hugh Smith via OfTwoMinds blog,

All three pillars propping up workforce spending are cracking. Plan accordingly.

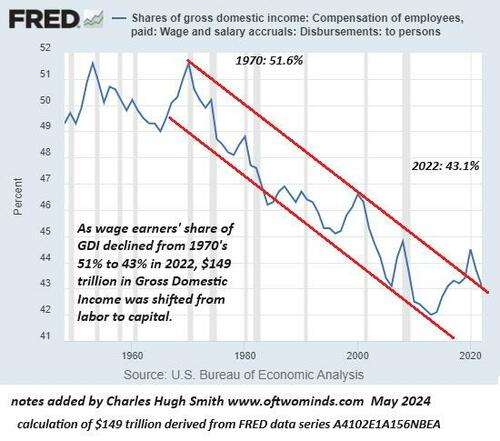

Karl Marx and Henry Ford both understood the key pillar of an industrial economy: the workforce has to earn enough to buy the output of the economy. If the workforce doesn't earn enough to have surplus earnings to spend on the enormous output of an industrial economy, then the producers cannot sell their goods / services at a profit, except to the few at the top as luxury goods--and that's not an industrial economy, it's a feudal economy of very limited scope.

Marx recognized that capitalism is a self-liquidating system as capital has the power to squeeze wages even as the output of an industrial economy steadily increases due to automation, technology, etc.

Henry Ford understood that if his own workforce couldn't afford to buy the cars rolling off the assembly line, then his ambition to sell a car to every household was an unreachable chimera. (There were other factors, of course; the work was so brutal and mind-numbing that Ford had to pay more just to keep workers from quitting.)

If we say the three pillars holding up the economy, the conventional list is: 1) consumer spending (i.e. aggregate demand); 2) productivity and 3) corporate profits. These are not actually pillars, they are outcomes of the core pillar, wage earners making enough to buy the economy's output.

As the statistics often cited here show, the purchasing power of wages has been declining for almost 50 years, since the mid-1970s. This means the workforce's surplus earnings have bought less and less of the economy's output.

There are three ways to fill the widening gap that's opened between what the workforce has to spend as surplus earnings and the vast output of the economy:

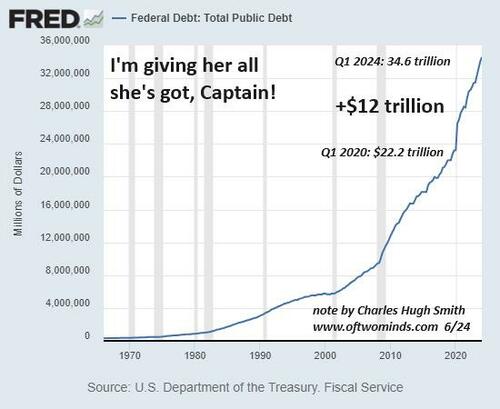

1. Government distributed money. The government distributes "free money" to the workforce via subsidies, tax cuts and credits, or direct cash disbursements.

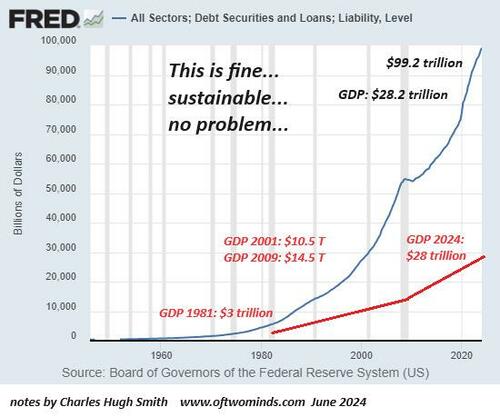

2. Cheap abundant credit. The cost of credit is lowered to near-zero and credit is made available to virtually the entire workforce so workers can borrow money to buy goods and services they cannot afford to buy from surplus earnings. If auto loans are 1.9%, the interest is a trivial sum annually.

3. Asset bubbles. Boost the value of assets via monetary policies to generate unearned "wealth" that can be spent (by either borrowing against the newfound wealth or by selling assets). This expansion of "free money" also generates the "wealth effect," the feel-good high of feeling richer, which increases the confidence and desire to spend more money.

There are intrinsic, unbreachable limits to each of these solutions.

1. The government either "prints" or borrows the money it distributes to the workforce. Over time, low interest rates are unsustainable, despite claims to the contrary, and the interest paid on the state's vast borrowing consumes so much of the state's revenues that it starts limiting how much the government can spend. Once state spending stagnates or declines, this pillar breaks and the economy crumbles into recession / depression.

In other words, depending on the government to fill the gap between wages and the economy's output is a self-liquidating system.

2. The expansion of credit leads to defaults and bankruptcies. Relying on the ceaseless expansion of credit based on the declining purchasing power of wages is also a self-liquidating system, as the number of marginal borrowers steadily increases, as does the volume of marginal loans issued by lenders. Marginal borrowers default, triggering losses that push lenders into bankruptcy. This is a self-reinforcing cycle, as the economy rolls over into recession as credit contracts. More workers lose their jobs and default, more loans become uncollectible, and so on.

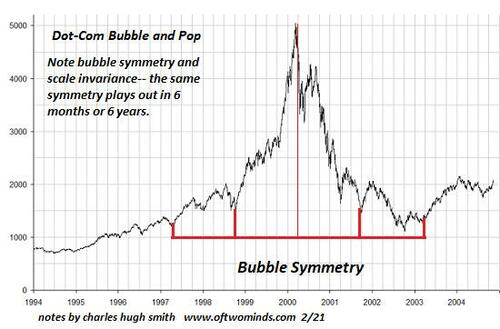

3. Asset bubbles concentrate the newfound wealth in the top 10%, exacerbating wealth-income inequality and pushing those left behind to gamble in an increasingly speculative financial sector as the only available means of getting ahead. Speculation is also a self-liquidating system as risky bets eventually go bad and the losses trigger a self-reinforcing feedback of selling assets to raise cash which then pushes valuations lower, triggering more selling, and so on.

All three of these pillars propping up the economy are self-liquidating systems, and they're all buckling. Federal borrowing is pushing up against the limits posed by the interest payments on soaring debt. Credit costs are rising and cannot return to near-zero due to inflationary forces. All asset bubbles eventually pop, and the higher they ascend, the more devastating the collapse.

Wages' share of the economy have been in structural decline since 1975:

Federal debt: and no, we can't "grow our way out of debt" by inflating asset bubbles and subsidizing consumer spending with federal debt:

Total debt, public and private: the acme of a self-liquidating system:

The pillars of consumer credit and federal borrowing are reaching intrinsic breaking points, and so everything is now depending on the asset bubbles in housing and stocks to keep inflating phantom wealth at rates high enough to support more borrowing and spending.

The problem is all asset bubbles pop, despite claims that "this is a new era." That was widely held in March 2000, too, just before the dot-com bubble burst and the Nasdaq fell 80%.

All three pillars propping up workforce spending are cracking. Plan accordingly.

* * *

https://ift.tt/O4GtW8s

from ZeroHedge News https://ift.tt/O4GtW8s

via IFTTT

0 comments

Post a Comment