Credit Crisis Unfolds In China As Steelmaker Default Sparks Contagion Fears

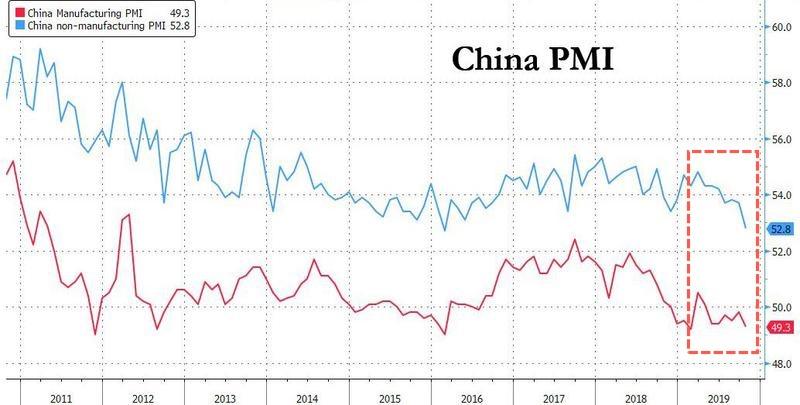

China's manufacturing PMI slumped deeper into contraction on Thursday -- as economic growth in the country fell to its weakest pace in three decades. The economic slowdown, coupled with massive corporate leverage, has created a ticking debt time bomb, which could explode in the next global recession.

The unraveling and coming debt crisis in China will take a series of corporate debt defaults to spook investors, and perhaps, the first series of defaults has already started.

The latest causality is Shandong-based steelmaker Xiwang Group Co., who defaulted on a $142 million bond last week, has sparked contagion fear with other companies in the same region, reported Bloomberg.

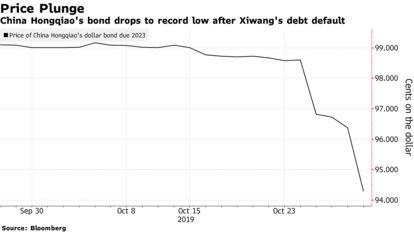

Then on Wednesday, Shandong Sanxing Group Co.'s 2021 dollar bond and China Hongqiao Group Ltd.'s dollar bond due 2023 plummeted to their lowest levels ever as contagion from Xiwang's default continued to frighten investors.

"Xiwang's default onshore has raised concerns that other privately owned enterprises in Shandong, particularly those from the same locality, may have been associated with the firm," said Wu Qiong, executive director at BOC International Holdings Ltd. in Hong Kong, who spoke with Bloomberg.

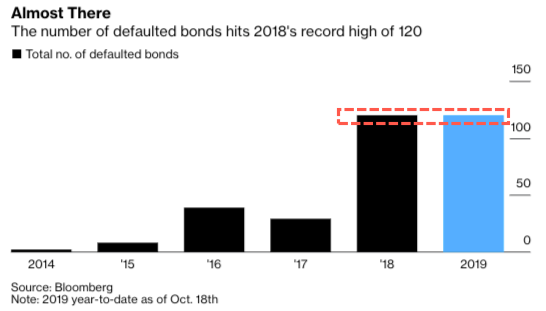

China's onshore credit markets continue to erupt with stress after 2019 defaulted bonds have already hit 2018 highs.

Fitch Ratings said the default rate of all Chinese issuers in the first three quarters of this year was 1.03%. By historical standards, the default rate is much higher than last year. Most of the firms skipping out on bond payments were private entities.

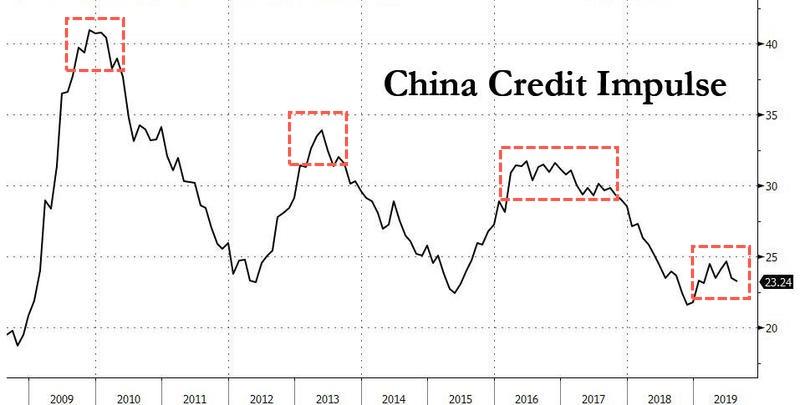

The cash crunch comes at a time when overleveraged companies in China are reeling from a global synchronized slowdown and a controlled deleveraging period by the government to create a soft bottom in the economy.

"Defaults are likely to continue rising, as many medium- and small-sized private firms are facing significant refinancing pressures," Zhang Shuncheng, associate director of corporate research at Fitch, said in an interview. "Private companies suffer from many problems in their own operations, not to mention the impact from the slowing economy and tight credit environment."

China's corporate sector downfall is overleverage, taken on during the global synchronized recovery. Now, a synchronized decline, these firms are starting to deleverage, adding to the downward pressure in the economy.

Hedge fund manager Kyle Bass, the CIO of Hayman Capital Management, has famously said China's coming economic crash could be three to four times bigger than the 2008 subprime crisis.

Bass said in August, China's "recklessly built" banking system could come tumbling down in the next global recession.

As long as Beijing refuses to spark a massive credit injection spree, the global economy will continue to falter -- this could usher in the next global crisis, one where China's corporate sector implodes, well that's at least what Bass thinks...

https://ift.tt/2oyycJm

from ZeroHedge News https://ift.tt/2oyycJm

via IFTTT

0 comments

Post a Comment