HSBC CEO Vows To "Remodel" Bank After Profits Plunge 24%

With its largest and most important market, Hong Kong, in chaos, it's hardly a surprise that HSBC, the nominally British lender which has its largest business footprint in Asia (particularly HK) reported a double-digit slump in pre-tax profits during Q3.

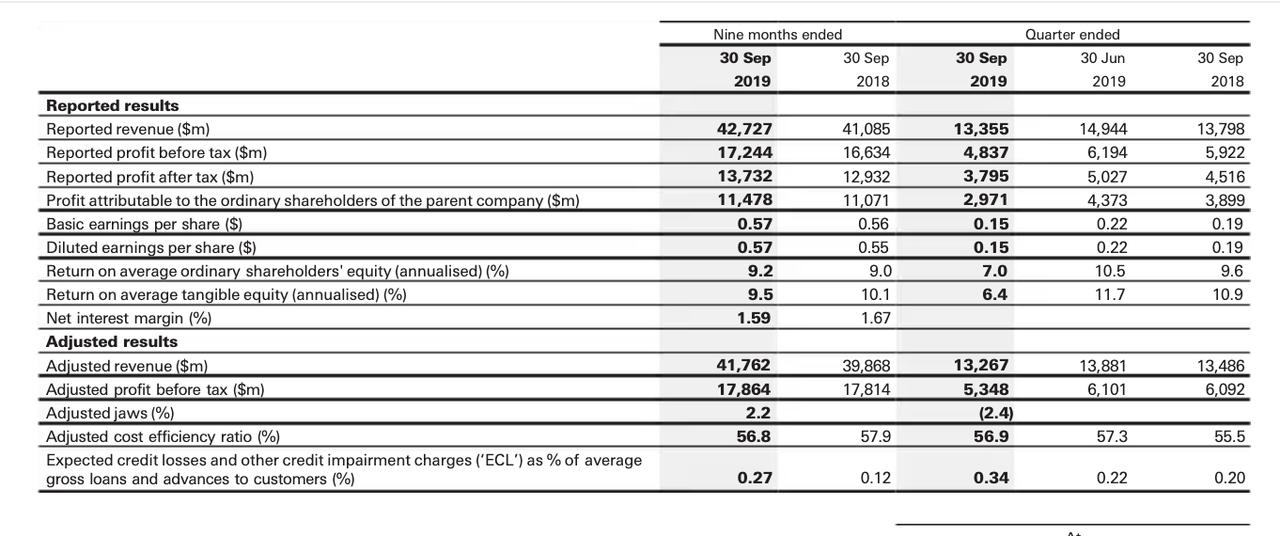

The bank said net profit slumped 24% YoY to $3 billion, falling far short of what analysts had anticipated, according to the FT.

With few easy alternatives, and the situation in Hong Kong (particularly its housing market) looking increasingly uncertain, HSBC's interim CEO Noel Quinn unveiled plans to "remodel" large parts of the bank, according to the FT. Even amid fears that the HK unrest would hurt the bank, Quinn said its results in the region had been "resilient" in the face of these fears.

Surprisingly (or maybe not), the weakness is coming from somewhere else: Europe.

And so begins another restructuring initiative at another troubled European lender. Like Deutsche Bank, which is planning to shutter unprofitable businesses and re-focus resources, cutting what's expected to be nearly 20,000 jobs in the process, HSBC will likely need to take drastic steps to truly reorient its business.

Though Quinn is only interim CEO, it looks like the bank means business with this initiative: The FT reported earlier this month that the bank's plan to cut costs and divest businesses could lead to 10,000 job cuts.

But on Monday, the bank took this a step further, and formally abandoned its main profitability target: to generate a return on tangible equity of more than 11% next year (it was 6.4% for Q32019).

The bank blamed a "challenging" environment that meant "the outlook for revenue growth is softer."

In a video presentation posted to HSBC's website, Quinn said "there are parts of our portfolio that are underperforming in terms of return. We need to urgently address that, move capital from those low-return portfolios and move it into the higher-return, higher-growth opportunities."

He added that the bank is still working on "detailed plans to make that happen."

We don't know what those might be yet, but we'd venture a guess that thousands more European banking jobs will disappear before this is all over. And HSBC just might rethink its decision to remain domiciled in the UK.

The bank's HK-traded shares slumped more than 3% after its earnings report, adding to a double-digit decline over the past six months.

191028 3q 2019 Earnings Release by Zerohedge on Scribd

https://ift.tt/2Wnkuph

from ZeroHedge News https://ift.tt/2Wnkuph

via IFTTT

0 comments

Post a Comment