We Now Have Mass Public Unrest In France, Spain, Algeria, Iraq, Lebanon, Egypt, Hong Kong, Venezuela, Chile, Ecuador And Bolivia

Submitted by Michael Every of Rabobank

Ages and Ages of Rage

Monday morning and we here we go again for another “dramatic week”. There are going to be monthly PMIs to look at in particular: will we see any further deterioration, or will growth start to pick up as an early Christmas present? And there are of course rate meetings for the Fed, and the BOJ, and the BOC: the former will cut, with the real issue being if they will signal more soon or not given they are already deep in Repo Madness; and will the giant BOJ wake up from slumber like a giant Kaiju and start throwing markets into turmoil again?

Plus there is the Brexit circus. Will the EU grant the UK an extension until end-January 2020, or a more flexible date, or will France veto that and insist on a very short extension? Almost certainly they will insist that the newly reopened Withdrawal Agreement is this time firmly shut – so if the British Parliament then decides to merrily reopen it from its end and unilaterally start ramming amendments into it, it will not be doing so with EU approval. As such, and just as pertinently, will PM BoJo get his December election or not? The greater likelihood is not, as Labour appears to be desperate for an election – just not now – although the Lib Dems may be prepared to allow one given they see this as a way to prevent any further movement towards Brexit in the short term. (Though what do they think the election campaign will be about? The price of cheese?) Note that the latest opinion poll for the Observer has the Tories on 40% (+3 on the week), Labour unchanged on 24%, and the Lib Dems on 15% (-1), with the Brexit Party on 10% (-2).

In Europe, we have just seen the AfD surge to second place in state elections in Germany’s Thuringia with 24% of the vote, double what it got last time, putting it 1ppt ahead of Chancellor Merkel’s CDU, with the Far Left Die Linke in first place. The AfD are nowhere near power as nobody will co-operate with them, but that 24% outcome is all the more remarkable given an attack on a synagogue and neo-Nazi death threats through the campaign.

In China, Chairman Xi Jinping will be presiding over the long-expected Communist Party Plenum, which is usually looked to for policy guidance. Market expectations this time are that all the focus will be on politics and control, and none will be on market-based reforms. Tellingly, this weekend saw China disband a three-year old Global Forum on Steel Excess Capacity after nobody has been prepared to cut back on capacity: China is claiming it alone has, but this somehow overlooks that its net steel output is up on three years ago, at a record high, and still growing.

On Ukraine-Gate the US impeachment wagon continues to trundle along, with supporters claiming it is laden with damning evidence, and opponents arguing it has exactly as much weight as Russia-Gate did. Perhaps the apparent elimination of IS leader Abu Bakr al-Baghdadi by US special forces will tip the Washington political balance slightly back towards consensus…but perhaps not, as the Washington Post (“Truth Dies in Darkness”) changes its headline description of al-Baghdadi--who presided over torture, mass murder and rape, slavery, and genocide--from “Terrorist-in-chief” to “Austere Religious Scholar” and then finally to “Extremist Leader”. Could they not perhaps have settled on “populist?”, he wondered sarcastically?

Enough minutiae about Fed policy: our house view remains they are going all the way back to zero. Enough minutiae about PMIs: it is obvious that broad swathes of the economy are slowing down.

The global backdrop remains of slowing growth, increased financial vulnerability in places, and yet an institutional architecture that is either in denial or has no firm idea of what policy mix to use to stop this happening. And, crucially, global populations that are not content to just sit and wait for something better to turn up eventually.

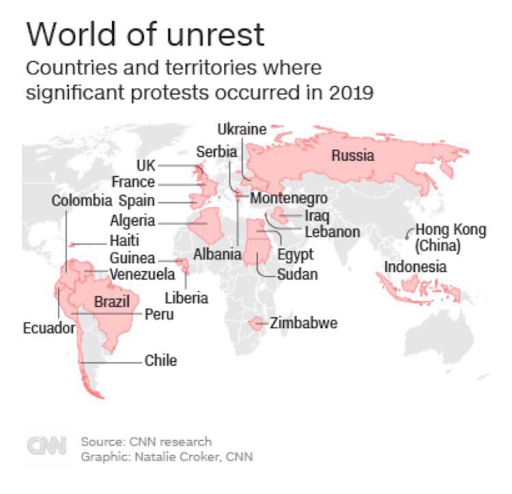

Indeed, consider that we now have mass public unrest (on and off) in: France, Spain, and that 24% AfD vote in Germany, and Brexit in the UK; Algeria; Iraq: Lebanon; Egypt; Russia; Hong Kong; Venezuela; Chile; Ecuador; and Bolivia. Plus deepening polarisation in the US – and one could add the middle-class disruption of Extinction Rebellion in Australia, Canada, and others.

In short, there isn’t a continent that isn’t seeing unrest in some form, and as Branko Milanovic notes today, one wonders if this isn’t all a little 1968-ish.

When you look at Chile, Ecuador, Venezuela, Bolivia, Hong Kong, Spain, France, Algeria, Iraq, Lebanon, Egypt, Russia...you sort of wonder if 2019-20 will be a new (global) 1968.

— Branko Milanovic (@BrankoMilan) October 27, 2019

Of course, one can’t usually join dots that simply, but if this is 1968-redux then consider the historical echoes. The Prague Spring was violently crushed by Soviet Tanks and the West was powerless to prevent it. Meanwhile, student uprisings in the West produced social reforms and a policy swing to the Left. Along with the Vietnam War, that contributed to the end of the USD peg to gold and the first phase of the global Bretton Woods order – and then to very high inflation in the 1970s, which was ultimately ended by the Volcker Fed and the current phase of deflationary neoliberal globalisation that is once again pushing people out onto the streets.

In short, regardless of what the Fed does this week, or the BOJ; and whatever the PMIs print at; and whatever the EU or Boris give and get, we still face Ages and Ages of Rage in a market that is still largely pricing for the calm of the status quo ante.

https://ift.tt/2No6cjY

from ZeroHedge News https://ift.tt/2No6cjY

via IFTTT

0 comments

Post a Comment