Futures Rebound On Apple Hail Mary Leak Despite Mounting Coronavirus Fears

After yesterday's global stock selloff, the worst since early October, US index futures and European stocks staged a comeback and edged higher as investors digested the latest international efforts to contain the Coronavirus like virus from spreading, including curbs on travel between China and Hong Kong.

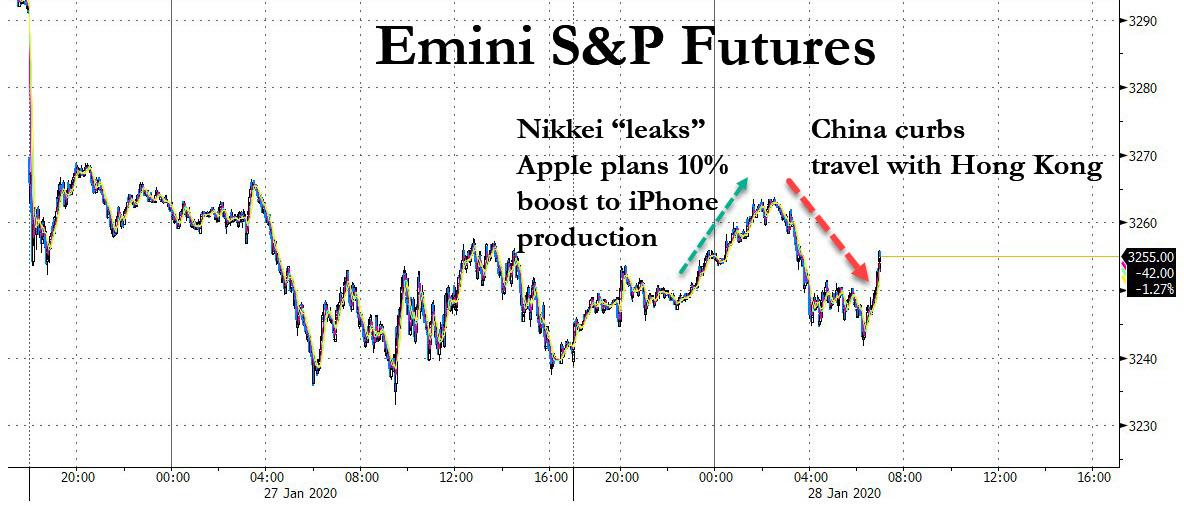

With all eyes on Apple today ahead of its earnings report, the world's biggest company which single-handedly carried the weight of the S&P ascent for the past 5 months, leaked a report via the Nikkei that it had asked its suppliers to make up to 80 million iPhones over the first half of this year, a 10% increase over on last year's production schedule that, as the Nikkei tactically added "could boost the company's near-record share price."

Sure enough, the news helped send AAPL stock rebound over 1% from yesterday's rout and pushed both S&P and Nikkei future after the report hit, just before midnight.

However, much of the gains were promptly lost after Hong Kong Chief Executive Carrie Lam said the city will close some border checkpoints and restrict flights and train services from the mainland. The outbreak has shattered a calm in markets that hadn’t seen a 1% up-or-down move in the S&P 500 since early October. The latest surge in demand for havens also sent bond yields tumbling, with the global supply of notes with negative rates surpassing $13 trillion, to the highest since November according to Bloomberg.

After rising as much as 0.5% in early trading on the Apple news following a Monday pullback that wiped out around 180 billion euros of market capitalization from the European companies index, the European Stoxx 600 index gave up the as miners extend a decline and travel-and-leisure shares turn negative after news that China will stop individual travelers to Hong Kong to curb the spread of coronavirus.

Airbus was the biggest boost to the benchmark index, after the planemaker agreed to reach a settlement with French, British and U.S. authorities regarding a probe into allegations of bribery and corruption. “It’s just a rebound as markets await further information on what’s happening with the virus situation in China,” said Russ Mould, investment director at broker AJ Bell. “We’re moving into the results season with some European heavyweights slated for today, central bank meetings this week and Brexit on Friday. There is lots to keep people occupied.”

Shares of Europe’s most valuable technology company SAP dropped 2.5% as the software provider’s in-line results failed to impress investors. Some analysts also pointed to the company’s slowing cloud revenue growth. Dutch firm Philips slipped 1.3% after the health technology company’s quarterly sales fell short of estimates. The company is also said it was looking to sell its domestic appliances division. Among lenders, Swedish bank Swedbank gained 3.3% after a better-than-expected fourth quarter profit while Spain’s state-owned lender Bankia slipped 3.3% after a wider-than-expected quarterly loss.

Earlier in the session, Asian stocks declined, led by materials and energy, as investors weighed the fallout from the spread of the deadly coronavirus. The MSCI Asia Pacific Index fell for the fourth-straight day, its longest run of losses since September. Japanese shares fell for a second day and South Korean stocks sank as that market reopened after holidays. Most markets in the region were down, with South Korea’s Kospi Index plunging the most since October 2018, led by tourism-related stocks. Singapore’s Straits Times Index had its biggest drop since August. Investors who took holidays yesterday returned to a further increase in the coronavirus death toll, infections and geographic spread. Trading is set to resume in Hong Kong Wednesday; the latest guidance from China, where the outbreak is still concentrated, is for markets to reopen Monday.

“Risk appetite is unlikely to improve until we start getting news that the virus is under control,” DBS Group Holdings Ltd. strategists Philip Wee and Eugene Leow wrote in a note. “For now, the lack of positive news flow is likely to keep investors on the defensive.”

In FX, the Bloomberg Dollar Spot Index steadied and haven currencies reversed losses after China restricted travel to Hong Kong. The pound slipped with commodity-related currencies while currency volatility extended gains for near-term options. The offshore yuan fluctuated after a sharp slide the previous day while the yen nudged higher for a sixth session.

In rates, Treasuries first gained, with the yield on the 10Y sliding as low as 1.57% before reversing, and the 10Y was trading at 1.62% last.

In commodities, crude oil declined.

In addition to keeping a close watch on Coronavirus headlines - because even as containment efforts intensify, the likelihood of the virus disrupting global businesses and the world’s second-largest economy appears to be growing - investors are keeping an eye out for a slew of earnings due this week including from Apple, Pfizer, United Technologies and Lockheed on Tuesday. Durable goods orders and consumer confidence are among economic data due.

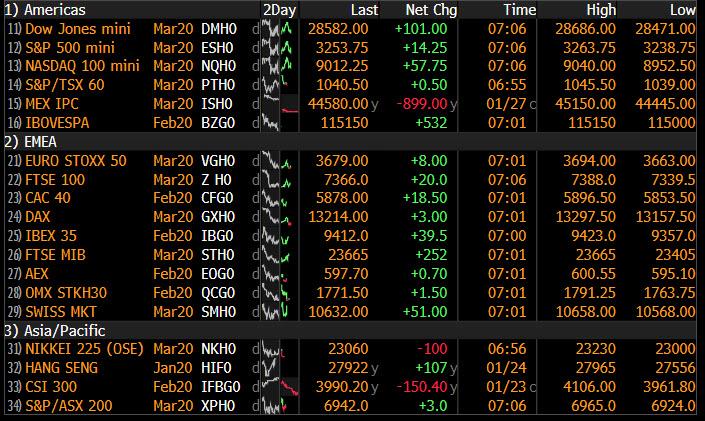

Market Snapshot

- S&P 500 futures up 0.3% to 3,249.00

- STOXX Europe 600 up 0.01% to 414.11

- MXAP down 0.9% to 169.09

- MXAPJ down 1% to 549.15

- Nikkei down 0.6% to 23,215.71

- Topix down 0.6% to 1,692.28

- Hang Seng Index up 0.2% to 27,949.64

- Shanghai Composite down 2.8% to 2,976.53

- Sensex down 0.5% to 40,939.43

- Australia S&P/ASX 200 down 1.4% to 6,994.46

- Kospi down 3.1% to 2,176.72

- German 10Y yield fell 1.6 bps to -0.401%

- Euro down 0.04% to $1.1015

- Brent Futures down 1% to $58.74/bbl

- Italian 10Y yield fell 19.3 bps to 0.871%

- Spanish 10Y yield fell 1.5 bps to 0.266%

- Brent futures down 0.6% to $58.69/bbl

- Gold spot down 0.2% to $1,579.52

- U.S. Dollar Index up 0.04% to 98.00

Top Overnight News from Bloomberg

- The outbreak of the deadly coronavirus threatens to derail a fragile stabilization in the world economy, which had appeared poised to benefit from the phase one U.S.-China trade deal, and signs of a tech turnaround.

- The director-general of the World Health Organization is visiting Beijing to assess China’s response to the coronavirus as the death toll climbs to at least 100. Global efforts to curb the spread of the disease have intensified. Companies including Honda Motor Co. are evacuating workers from areas of China hardest hit by the outbreak. The U.S. said citizens should reconsider travel to China, while Hong Kong announced the temporary closing of all sports and cultural facilities starting Wednesday

- President Donald Trump’s lawyers avoided the explosive allegation in former National Security AdvisorJohn Bolton’s book that the president tied aid to Ukraine to an investigation of a political rival as they sought to undermine the House impeachment case. Sen. Mitt Romney says four GOP senators may back Bolton testimony, according to Reuters

- Oil extended declines after closing at the lowest level since mid-October as the coronavirus hits China’s economy and threatens to crimp worldwide energy demand. Libya says oil output may almost fully halt within days

- The Taliban claimed responsibility for the downing of a “special American aircraft” flying over Afghanistan on what it described as an intelligence mission, while the U.S. military said there was no indication the plane was hit by hostile fire

- Prime Minister Shinzo Abe nominated economist Seiji Adachi to the Bank of Japan policy board amid growing attention over his stance on monetary easing

- America’s longest-serving secretary of state, Cordell Hull, is best known for winning the Nobel Peace Prize for his role in establishing the United Nations at the end of World War II. Today, 75 years later, another important piece of his legacy, the World Trade Organization, looks increasingly at risk as President Donald Trump realigns the U.S.’s relationships.

- One way the rich get richer is through inheritance, and they’re barely paying taxes on it. Americans are projected to inherit $764 billion this year and will pay an average tax of just 2.1% on that income, New York University law professor Lily Batchelder estimates in a paper published Tuesday by the Brookings Institution.

Hefty losses were suffered across Asia-Pac bourses as virus-induced fears caught up to several indices on their return from the extended weekend and which followed Wall St’s worst performance in nearly 4 months. ASX 200 (-1.4%) traded subdued as the energy and mining related sectors led the declines due to concerns of the impact to demand and growth from the virus epidemic, although gold stocks bucked the trend after the recent safe-haven bid for the precious metal and defensives were also resilient in the downturn. Nikkei 225 (-0.5%) was pressured by the outbreak jitters as the number of confirmed cases in China rose to 4515 and total deaths at 106, considering that the Chinese account for around 30% of foreign tourists to Japan. KOSPI (-3.1%) and Singapore Straits (-2.5%) slumped in their first trading session after the Lunar New Year in reaction to the increased number of virus cases confirmed in China and their individual countries, while India’s NIFTY Index (Unch.) was indecisive with earnings the main driver for domestic stocks. Finally, 10yr JGBs were flat amid slight fatigue from the recent extended rally and after mixed results at today’s 40yr JGB auction, although downside was also restricted due to the sell-off across regional stocks.

Top Asian News

- Abe Taps Seiji Adachi to Replace BOJ Board Member Harada

- Afghan Troops Clash With Taliban to Access U.S. Plane Crash Site

- Carrie Lam Says China to Stop Individual Travelers to Hong Kong

- Japan Finds Coronavirus in Person With No Wuhan Contact: Jiji

Overall a mixed session thus far in the European equity space [Eurostoxx 50 +0.1] following on from a predominantly downbeat APAC handover as coronavirus jitters hit multiple bourses on their return from holidays. For reference, Hong Kong confirmed that its stock markets will trade as normal on January 29th, whilst Shanghai and Shenzen return on February 3rd. Back to Europe, FTSE MIB (+0.5%) outperforms its peers amid further tailwinds from the weekend’s regional election which diminished the chance of a snap election in the country. Meanwhile, Netherland’s AEX (-0.2%) modestly lags following earnings from Philips (-2.7%) after reporting sub-par earnings, albeit the company noted that it is reviewing options for its domestic appliances’ business. Philips holds a 6.2% weighting in the Dutch bourse. Sectors are mixed with no clear reflection of the overall risk-tone, although the IT sector (-0.9%) underperforms on account of earnings from SAP (-2.7%), despite what seemed to be positive on the surface. The DAX-giant (accounts for 10.5% of the index) raised profit revenue guidance but narrowed its all-important 2020 cloud sales to the range of EUR 8.7-9.0bln from the prior EUR 8.6-9.1bln. In terms of stock specifics – Airbus (+1.2%) rose in excess of 2% at the open the Co. reached a deal to settle corruption probes. Meanwhile, Bayer (+0.6%) shares remain supported amid a positive broker move at MainFirst Bank. As a reminder, 14 DJIA companies will be reporting this week, with today’s slate including 3M (4.17% weighting), Pfizer (0.95% weighting) and United Technologies (3.59% weighting) before market open followed by Apple (7.3% weighting) after the bell.

Top European News

- Swedbank Promises Dividends Won’t Fall as Compliance Costs Swell

- Greece to Issue 15-Year Debt for First Time in More Than Decade

- Johnson Walks Huawei Tightrope as U.K. Sets Up Clash With Trump

- Turkey Stocks Reverse Gains as Risk-Off Sentiment Halts Recovery

In FX, The traditional safe havens are back in vogue following a transitory and tame recovery in risk sentiment, as the Chinese coronavirus continues to unnerve markets amidst reports of the outbreak reaching further beyond the region. The Dollar is in demand almost across the board as a result, with the DXY pivoting 98.000 and briefly crossing Fib resistance just above the big figure at 98.011 before topping out at 98.035 in part due to fractional outperformance in the Franc and Yen that are holding above 0.9700 and 109.00 respectively. Conversely, Gold has handed back some of yesterday’s gains, but remains relatively well bid within a tight Usd1577-1583/oz range and technically bullish around 20 Bucks over last Friday’s circa Usd1566.62 low.

- AUD/NZD/GBP - The major losers on a combination of contagion from China and cross flows for month end as the Aussie teeters around 0.6750 and not far from deeper troughs posted last October ahead of 0.6700, Kiwi hovers close to the base of 0.6550-22 parameters and Sterling skirts 1.3000. Aud/Usd and Nzd/Usd are still inversely correlated to moves in Usd/Cnh-Cny on breaking virus updates in the absence of official daily PBoC settings during the Lunar New Year break, with the Yuan inching nearer the 7.0000 mark again having reached peaks beyond 6.8500 only 8 days ago on the crest of the Phase 1 trade deal signing. Meanwhile, Cable is trading cautiously into Thursday’s BoE/MPC rate announcement and Brexit the day after, as market contacts note RHS interest in Eur/Gbp for month end that has lifted cross through 0.8450.

- EUR/CAD/SEK/NOK - The Euro has survived another test of bids/support into the 1.1000 level, partly on the purported orders for January 31 noted above, but perhaps also benefiting from the common currency’s semi-safe haven status, while the Loonie has extended losses alongside the Norwegian Krona amidst yet another decline in crude prices. Usd/Cad has absorbed more offers at 1.3200, though not all and supply is said to be stacked up to 1.3210, while Eur/Nok has been up to 10.1155 and higher than Eur/Sek in percentage terms after mixed Swedish data in the form of retail sales, trade and ppi saw the latter briefly breach a Fib (10.6121), but not really threaten the 200 DMA (circa 10.6400).

In commodities, another subdued European session for WTI and Brent font-month futures, as the benchmarks pare overnight gains amid the overhang of the coronavirus outbreak. WTI Mar’20 futures have given up their 53/bbl+ status (vs. overnight high of 53.25/bbl) and drifts towards mild support at 52.70/bbl. Meanwhile, its Brent counterpart hovers around 58.75/bbl (vs. overnight high of 59.35/bbl) ahead of yesterday’s low of ~58.50/bbl. OPEC sources noted that Russia has been keen to exit from the agreed upon OPEC+ cuts, but they would be prepared to stay on-board in the event that prices drop below USD 60/bbl. Heading into tonight’s weekly API private crude inventory release, desks note that the complex will likely focus more on the virus developments. Nonetheless, the release is expected to show a build of 300k barrels in crude stocks, gasoline a build of 1.5mln and distillates a draw of 1mln – according to some data vendors. For reference, Barclays note that the further virus woes could see a USD 2/bbl impact on oil process on the potential economic fallout, meanwhile, UBS retains its positive outlook on oil prices in H2 2020, with Brent recovering to USD 64/bbl - recommends investors with high-risk tolerance to sell downside in Brent from USD 50/bbl. Elsewhere, spot gold trades relatively lacklustre around the 1580/oz mark ahead of mild support ~1577/oz - ABN AMRO warn investors of a possible price correction in the coming weeks, while remaining bullish on the lustrous metal in the longer-term. Copper prices have continued bleeding amid the global-growth implications of the virus outbreak – as prices remain sub 2.60/lb (vs. Jan high of 2.87/lb) and around levels seen last October.

US Event Calendar

- 8:30am: Durable Goods Orders, est. 0.35%, prior -2.1%; Durables Ex Transportation, est. 0.3%, prior -0.1%

- 8:30am: Cap Goods Orders Nondef Ex Air, est. 0.15%, prior 0.2%; Cap Goods Ship Nondef Ex Air, est. 0.2%, prior -0.3%

- 9am: S&P CoreLogic CS US HPI YoY NSA, prior 3.34%; CS 20-City YoY NSA, est. 2.4%, prior 2.23%

- 9am: S&P CoreLogic CS 20-City MoM SA, est. 0.4%, prior 0.43%; 20-City NSA Index, prior 218.4

- 10am: Conf. Board Consumer Confidence, est. 128, prior 126.5; Expectations, prior 97.4; Present Situation, prior 170

- 10am: Richmond Fed Manufact. Index, est. -3, prior -5

DB's Jim Reid concludes the overnight wrap

Morning from Brussels, after a day in Luxembourg yesterday. If you’re meeting me today, I apologise for my appearance as I stupidly left my luggage on the train yesterday. I decided to get the train and tube to City Airport from home rather than a taxi. This meant I was getting my normal commuting train. The big difference is that I had a suitcase and rucksack whereas I’d normally only have my rucksack. Rather cleverly I worked out as I got on the train that I’m a man of routine and as such if I just put my suitcase in the rack above the seats I wouldn’t remember it. I therefore put my rucksack there as well. Normally my rucksack stays at my feet and I would never forget it. I patted myself on the back and got on with emails. It wasn’t until I got to security at the airport an hour later that I realised that I’d left my suitcase on the train and just took my rucksack down and ignored my suitcase. Muscle memory and routine took over. So if you see me shopping for smalls in Brussels this morning you’ll know why. As soon as it happened I texted my wife to tell her and she texted back and said “well that’s a bit annoying but can’t talk as the twins have just taken my car keys from the armrest console and locked themselves in the car and are giggling at me trying to get in”. As usual my problems were trumped by our two little identical terrors.

Yesterday was the day that most major equity markets from around the world dipped into negative territory YTD - a far cry from the melt-up thesis of two weeks ago. The notable exception is the US where the S&P 500 remains +0.40% YTD even after yesterday’s -1.57% fall - the worst day since October 2nd last year and the first 1% or more daily move in either direction over the same period. The NASDAQ remains +1.86% YTD (-1.89% yesterday) and faces the start of a big week for tech earnings today with Apple leading the charge. S&P futures are up +0.48% this morning, partly on news ahead of earnings that 10% more phones are being produced than last year.

So can the micro help offset the bigger picture challenges? The Coronavirus is of course the main short-term driver of markets but as we’ve discussed of late, we think markets have been priced for perfection whereas the reality is that positioning and valuations are stretched and the data still has a lot to prove. Also the market risk of a Bernie Sanders Presidential victory has been completely underplayed (more later).

Before we discuss markets in more detail, in terms of the latest on the virus, total number of confirmed cases now stand at 4,515 (up from 2,774 yesterday) with around 47,833 (up from 30,000) people under observation. Globally, Thailand and Hong Kong have reported 8 cases each, 7 in Macau, 5 in the US, Australia, Taiwan and Singapore, 4 in South Korea, Japan and Malaysia, 3 in France, and 2 in Vietnam and Canada while, Germany, Sri Lanka and Nepal all have 1 confirmed case. However, there have been no fatalities outside of China. Meanwhile, Starbucks and WeWork have decided to shut locations in China while most other companies are enacting measures to shield employees in the areas hardest hit. Elsewhere, the US has issued a level 3 warning for China saying the citizens should avoid all nonessential travel to China. Futures on China’s stock market are down -0.72% this morning after declining by -5.64% yesterday. Also, the Dow Jones reported that as per current guidance Chinese stock markets are slated to re-open on February 3rd.

Something we’ve been thinking about on my team is how much should we be worrying about this from a macro standpoint. Without downplaying the very tragic human effects, a confirmed death toll of 106 so far (vs. 80 yesterday) is but a fraction of the hundreds of thousands of people who die each year globally from seasonal flu. On the other hand of course, this is a new virus that’s seen the number of confirmed cases double every 2 days (nearly doubled overnight) and at this rate is on the brink of passing the number of recorded cases of SARS back in 2003 in China and HK which eventually killed 774 people globally. Many experts suggest that by far the biggest issue in this episode is the long contagious period where there are no symptoms which makes the virus much harder to isolate and different from SARS. SARS had a higher mortality rate of 9.6% though against c.2.8% for Coronavirus so far. For reference the famous 1918 flu outbreak had a fatality rate of 2.5% with normal flu often no more than 0.1%. China’s reaction has been a lot more rapid than for SARS so a different template and this makes analysing it hard. In doing the research the thing that stood out for me was how many people die of flu globally in normal years even if the fatality rate is low. Anyway as a minimum Chinese data is going to take a notable hit for many weeks and getting a true read of underlying momentum is going to be hard.

Asia markets are continuing to trade lower this morning with the Kospi, which opened after the NY holiday, leading the declines at -3.22%. The Nikkei (-0.84%) and Australia’s ASX (-1.35%) are also down. The Nikkei is on track to make worst consecutive losses since the peak of trade war in August. Chinese and Hong Kong markets continue to remain close on account of holidays. As we discussed earlier US futures are up suggesting some break to the selling for now. As for overnight data releases, Japan’s December services PPI came in line with expectations at +2.1% yoy.

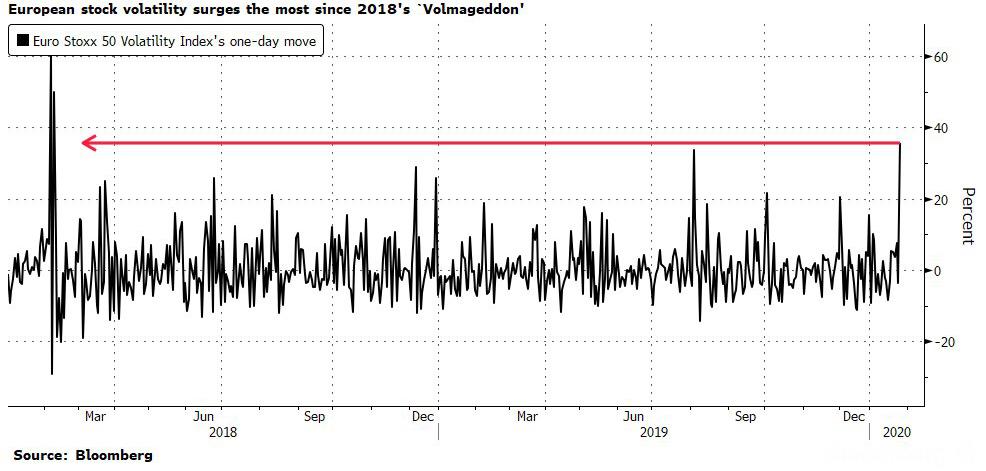

Amidst the virus’ spread, and as already mentioned, yesterday saw equity markets suffer on both sides of the Atlantic. The trade-sensitive Philadelphia semiconductor index had its worst day since August 23rd last year, down -3.91% (-0.04% YTD), while the losses were pretty severe in Europe too, with the STOXX 600 down -2.26% (-0.43% YTD) and the DAX down -2.74% (-0.33% YTD). Oil continued its decline on fears of plummeting economic demand, and Brent crude fell for a 5th consecutive session, down -2.95% to close below $59 a barrel for the first time since October and close to 13-month lows. Gold was the beneficiary as investors fled from risk, ending the session up +0.75% at its highest level since April 2013.

Investors also moved into sovereign debt, with 10yr Treasury yields down -8.6bps to 1.598%, their lowest level since October and only 25bps from all time lows, while the 2s10s curve flattened by c.-3bps to 15.5bps - its flattest level since November. Notably the Fed’s preferred yield curve measure (18m3m-3m) when assessing recession risks has returned back to being inverted.

Over in Europe, bunds (-5.0bps and -20bps YTD now), OATs (-4.8bps) and gilts (-5.5bps) also made gains. The real outperformances came in the periphery though, which had an incredibly strong day. Firstly in Italy, the spread of 10yr BTPs over bunds fell by -14.5bps, which is its biggest daily decline since September, and brings the spread to its lowest level in over two months. The outsized move follows the weaker-than-expected performance for Matteo Salvini’s right-wing Lega party in regional elections at the weekend, which is expected to strengthen the national government in the near term. DB’s Clemente De Lucia put out a note on the issue yesterday (link here) where he writes that the results from the regional elections push back the risks of an early election. The other big move came from Greek debt, which also rallied strongly with 10yr yields down -13.1bps, though pulling back from their intraday lows in which they looked on track to close at a record low. The moves there come after Fitch upgraded the country’s credit rating to BB with a positive outlook.

Speaking of politics, as we highlighted yesterday, something the market should definitely keep an eye on over the coming days is the Democratic primary in the US, where the first voting takes place this coming Monday in Iowa. This will be a key risk event for markets as the polling is tightly bunched there, and whoever comes out ahead is likely to take that momentum into the states ahead. Going into the caucuses, the national race seems to be settling around the two polling frontrunners of Joe Biden and Bernie Sanders, and right now Bernie Sanders has actually edged ahead of Biden on both Betfair and PredictIt. However, when we asked who was most likely to be the Democratic nominee in our EMR survey a couple of weeks ago, Biden was the most popular choice, with 49% of respondents, while Sanders was selected by just 10%, which suggests that many market participants (or at least the ones who answered our survey) could be completely underestimating the chances that Sanders might be selected as the nominee especially as 90% said his Presidential victory would be a negative for markets.

Adding to the downbeat mood yesterday, the Ifo survey from Germany surprised on the downside, with the business climate indicator falling to 95.9 in January (vs. 97.0 expected), the first decline for the reading since August. The expectations reading also fell to 92.9 (vs. 94.8 expected), though the current assessment did see a modest increase to 99.1, in line with expectations.

Over in the US, December’s new home sales also came in below expectations at a seasonally-adjusted annual rate of 694k in December (vs. 730k expected), with the previous month’s figure revised down by -22k. However, the Dallas Fed manufacturing activity did rise to -0.2 in January (vs. -2.0 expected), with the new orders indicator rising to 17.6, the highest since October 2018.

Turning to the day ahead now, and there are a number of US data releases, including December’s preliminary reading for durable goods orders, January’s consumer confidence reading from the Conference Board, and the Richmond Fed manufacturing index. Earlier in the UK, we’ll also get the CBI’s distributive trades survey for January. From central banks, we’ll hear from the ECB’s Villeroy, Lane and Hernandez de Cos, while earnings releases out today include Apple, LVMH, Pfizer and SAP. Finally the U.K. will today decide whether to allow Huawei a role in building its 5G network. This decision and those for other countries in a similar situation will have major geo-political consequences for years to come.

https://ift.tt/37L2k5u

from ZeroHedge News https://ift.tt/37L2k5u

via IFTTT

0 comments

Post a Comment