5 Reasons Why Big Oil Is Here To Stay

Authored by David Messler via OilPrice.com,

The investment case for oil companies has been under attack recently. Climate change activists know that the dividends paid by the largest of these companies are among the most lucrative and stable over time, of any payers in the marketplace today. Further, they know these attacks will receive wide coverage precisely because of the criticality of the dividend stability to these companies stock price. It’s a two-fer for these folks. The only thing is…it isn’t true.

Dividends are the principle reason to own the shares of the major oil companies. The dividend payouts these days are yielding 4-7 percent, thanks to the depressed equity valuations of the oil majors. As you will note, this is well above most other options, like U.S. 10-year treasury notes as an example. Any threat to the dividend will absolutely bring a “dog diving under the bed in a thunderstorm” response from the typical investor. They will push the sell button lickety-split. And, of course, that’s just the response hoped for. Smart investors in these companies will pause just a moment for a second opinion. Perhaps one with some facts behind it, like you will read in this article.

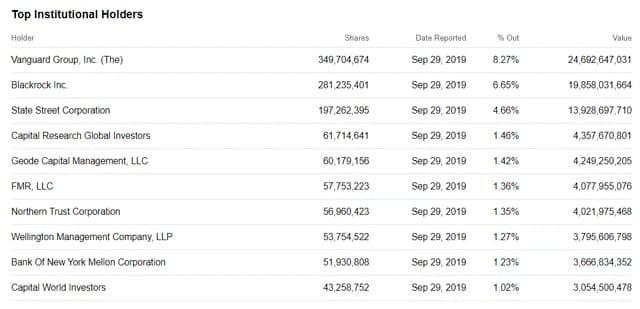

"Sustainable" forms of energy are all the rage these days. You can’t watch a money show without hearing from the bloviator de jour about how “Green Energy” will replace traditional hydrocarbon sources in about ten-years or so. Among these worthies are the CEOs of major institutional holders, like Blackrock or Norway’s Sovereign Wealth Fund and other large banking and fund management companies. These leaders will freely admit they are moving toward divestiture due to the political narratives regarding climate change, stating it as a fact. The truth is they have no rational basis, but are rather yielding to the out-spoken minority “stake-holders,” who are demanding action on their part to divest “dirty energy sources.”

As noted above in this article, we will take a closer look at the investbility of some of the biggest dividend payers on the planet. In doing this we will look past the splashy headlines that the CEO’s of these companies garner in watering-holes like Davos. Get ready for some real analysis, and prepare to sleep well at night knowing your retirement portfolio will be there when you need it.

Climate change propaganda and misinformation

The stimulus for this article was an article I chanced on by a climate change crisis group called the Institute for Energy Economics and Financial Analysis, or IEEFA.

A little research finds this is an organization that takes its mission as:

“The Institute’s mission is to accelerate the transition to a diverse, sustainable and profitable energy economy.”

Hmmm, what the heck are they talking about, you may wonder? One thing is for sure they have an agenda against the petroleum industry, making their conclusions suspicious to this reader. Now, let's understand information can be completely accurate and still be misleading.

I haven't gone back and fact-checked any of the information linked from this IEEFA article. Instead, I did my own investigation using company documents to see if I could justify my faith in the companies whose viability was being questioned. My results will be revealed in the next section of this article.

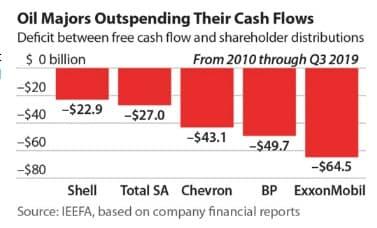

Like most investigations that start with an agenda, the IEEFA article contains a grain of truth. This "grain" helps to anchor the disinformation that follows. To wit: many oil companies have outspent cash flows maintaining dividends over the time period measured.

IEEFA course provides no context here, just raw data. This can be misleading. In the discussion that follows, we will provide some context to help evaluate the concerns that we really have.

What is the trend for the future? Are our investments safe, as safe as any stock investment can be, and are the dividends many of us rely upon to maintain our retired standard of living, likely to continue?

That's what I want to know, and I expect if you are reading this article, you do as well.

Reasons why super major stocks will remain investible

Let me offer the following points that should give you more confidence in the ability of these companies to continue earning your trust and your capital on into the future.

1. Dividend Payout Patios (Net income/dividend)

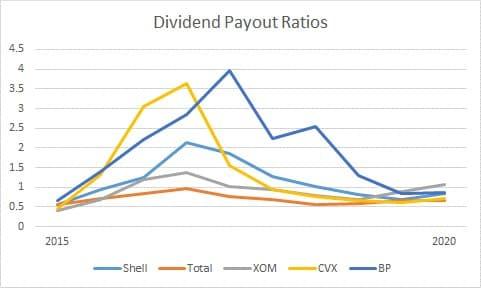

Ratios below 1:1 are considered "safe,” classically, but safe is a relative term. Over the past five years all of these companies with the exception of Total (NYSE:TOT) bonds sales have been the way they covered the dividend. Currently, they are in the range of or slightly above historical sub 1:1 levels.

The context lacking in the IEEFA article, denoted by the hump in the middle of the chart above, represents the full impact of the "lower for longer" oil price. The impact of these lower price realizations, and the fact that these companies were also slow to whittle down their capex budgets, meant that the dividend was being supported by borrowing.

So what is the truth, if that IEEFA article is so offbase? What are these companies telling us about coverage projections going forward? Let's look at a few cash flow projections from this cohort.

-

Based on a Brent price of $60, Shell, (NYSE:RDS.A) (NYSE:RDS.B) projects free cash flows to rise from around $28 bn in 2020 to about $35 bn by 2025. With current obligations of about $16 bn for dividends, that leaves an increasingly fat amount for stock repurchases. Dividend coverage should improve consistently over this time and shareholders should lose no sleep. The check will be in the mail.

-

ExxonMobil (NYSE:XOM) recently has struggled to maintain a sub-1:1 cash flow to dividend ratio as my chart above shows. Currently, it is well above that and the current 5.15 percent yield notes the markets dissatisfaction with that situation. That will change and soon. With the Liza field coming on line and with break-even costs in the $30/bbl range, as much $5 bn of free cash could be generated from that project alone. XOM is on track to produce a million barrels a day from the Permian by 2025 with BE costs as low as $20/bbl. Bank America Merrill Lynch recently put out a bullish call on XOM with a price target based on increasing cash flow from these projects of $100/share.

-

Chevron (NYSE:CVX) is a dividend champion that has been increasing its dividend in recent years and lowering capex resulting in its current 0.53 coverage ratio. Market sages will tell you that the safest dividend is one that's just been raised. CVX consistently ranks as one of the best-managed companies and has a project portfolio that will keep profits gushing in years to come. It grew cash flow by 50 percent YoY in 2018, and current management's fiscal discipline should maintain that trend over the next few years. It currently covers capex and dividends with a $52 oil price, and has been buying back stock currently at a clip of $4 bn per annum.

This has turned into a long article so I will skip the same type of analysis for (NYSE:BP) and (NYSE:TOT) in terms of project portfolios and capex restraint. All of these companies have redesigned their upstream projects to be cash flow positive with oil prices much lower than they are now. In this core group of Super Major energy companies, investors should sleep well at night.

2. Stock buybacks.

These companies are all buying back billions of dollars of their common stock every year. This decreases the total dividend payout, and makes the dividend safer for each remaining share of stock. In the past year, Shell has bought back about $12 bn worth of its stock, on a 2018 commitment of $25 bn by 2020. Shell recently announced that weaker than expected oil prices might drag this out a bit. That knocked the stock price down a bit, which I saw as a buying opportunity.

Shell will buy another ~$3 bn in Q-1 of 2020. Do investors care if this happens by the end of 2020 or takes a quarter or two more? They shouldn’t. On the plus side, oil prices might rise more than anticipated and share repurchases could be accelerated. As you may have noted things can change rapidly in the oil market.

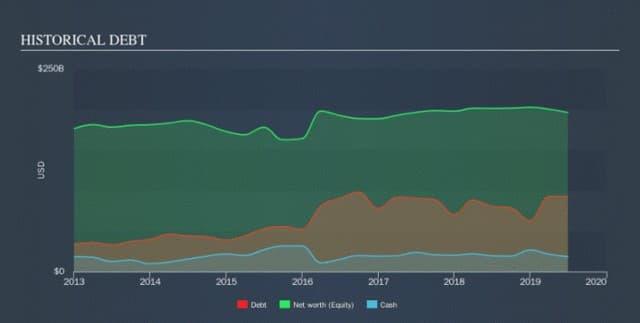

3. Debt reduction.

This is a priority for all of these companies and is being funded through free cash and assets sales with the proceeds going to debt reduction. Portfolio "high grading" is underway. It's not perfect and sometimes it one step back for every two steps forward. Picking on Shell once again, the official target for debt to capital is 25 percent. Moving toward that goal for most of 2018, the company has taken a stutter-step higher to the 28 percent range. Part of this was due to lease costs hitting the balance sheet in late 2018. There can be no doubt that lower than anticipated oil prices has slowed this process.

Shell management reminds us of this regularly during the analyst calls. What matters to us is that they consider it a matter of the utmost priority. Ben Van Beurden comments in response to an analyst's question regarding the timing of stock buybacks and debt reduction:

“So, very clearly, we are still completely intent on buying back $25 billion of shares and we are also completely committed to strengthening the balance sheet by bringing debt down.”

4. Diversifying the product mix to include "Green Energy."

Green energy or sustainable energy sources is the path to the future, or so we are repeatedly told. It is only prudent for the big oil companies to seed research and startup companies in this area. So far, none of these efforts have reached the level where they are accounted for separately on the balance sheet however, with the notable exception of LNG. Whether it's biodiesel in Brazil, or electrical charging stations in the UK, or wind farms in the Permian, or LNG, efforts are being put forth by them all. Whether any of these can turn a profit down the road remains to be seen. For now, it is enough that the exercise is underway, as it raises their ESG profile.

5. Investing in new technologies.

These companies all have and are developing more AI expertise with big data. The Shells and BPs of the world all generate huge amounts of data every day. Terabytes upon terabytes of it daily. Historically, the resources to manage this information efficiently just did not exist. Now it does these companies are moving rapidly to integrate and perhaps monetize this technology.

“AI can help find those cost reductions by tackling a range of problems. Its deployment in upstream operations could yield collective savings in capital and operating expenditures of $100 billion to $1 trillion by 2025, according to a 2018 report by PricewaterhouseCoopers. Most companies declined to discuss their exact spending on AI.”

As these resources are deployed in remote locations or refineries, costs will come down as the article quoted above notes.

Risks

Oil prices carry the key risk to dividend sustainability over the near and medium term. As we've seen in a plus-$50 environment they can all make money and cover their dividends.

West Texas Intermediate- WTI, has fluctuated wildly in price over the last 10 years. For the last four however, it has been above $50 except for a couple of very brief periods. I’m ok with economics built on $50 oil.

Environmental and Social Governance-ESG, risk must now be built in to the risk profile in owning these stocks. It can be thought of as replacing the old exploration risk that modern technology has reduced dramatically. When I entered the oilfield 40+ years ago, dry holes- ones with no hydrocarbon shows, ran as high as 85 percent of the exploration wells drilled. Today that ratio has more than flipped with dry holes being a rarity. Just what is the extent of this risk?

No one really knows for sure. That said, a measure of comfort can be taken in the broad ownership of legacy oil stocks. For example, have a look at the top ten institutional holders of ExxonMobil below.

Your takeaway

These are the companies that hold the trillions of retirement dollars from 401Ks and Roth IRAs. They are invested in the big oil companies for yield, stability, and to an extent growth. I don't mind keeping company with the tens of thousands institutional holders of XOM and the other companies we've been discussing.

The key takeaways for you as an investor in the big oil company dividend payers is that they are all on track to deliver the cash flow that underpins the dividends they are committed to pay.

As investors, there is no doubt we need to keep an eye on this ESG divestiture movement. For the short term it represents little threat to the value of our investments. It is worth noting however, the Norwegian Sovereign Wealth fund has endorsed companies like Shell and BP expressly. In a recent Financial Times article Norway's Finance Minister, Siv Jensen commented that:

“Ms Jensen said the largest oil and gas majors were given a reprieve because Norway believed such groups were “in all likelihood” the ones that would make the main investments in renewable energy in the future.”

You have a responsibility here as well. That is the task of vetting what you read and take stock in. Ask yourself as read if there is an under-lying agenda that is masked behind the seemingly objective and forthright information being presented?

We’ve shown here that information presented this way can be completely factual and still be misleading. Potentially with portfolio damaging consequences if acted upon. Caveat emptor! Protect your wealth!

https://ift.tt/2S1q2Uz

from ZeroHedge News https://ift.tt/2S1q2Uz

via IFTTT

0 comments

Post a Comment