"It Was The Final Bucket Of Straw" - Trump Tax Plan Sparks Middle-Class Exodus From California, New York

Years of mismanagement by unaccountable Democrats in Sacramento has made it practically impossible to build new homes in the state of California. And even with the minimum-wage hikes, affordable homes are still few and far between.

Over the years, we've closely followed the trend of frustrated Californians seeking greener (or at least cheaper) pastures in Nevada, Idaho, Texas and other states in the West, Midwest and the South, because it's a great example of how high-tax states sacrifice economic growth for the ability to finance generous benefits to state workers, as well as other generous giveaways.

But not only is this trend ultimately a threat to the local economy, which, to be fair, is still roaring, even if fewer and fewer residents are reaping the spoils, but just as we highlighted a few weeks back, the net population decline might cost the Golden State a few seats in Congress once the 2020 census is completed.

While most tax-paying Americans saw their overall tax bill decline under President Trump's tax-reform package - and American corporations pay substantially less as well - there's no question that homeowners in blue states, a group that includes some of the most affluent people in the county, lost out. By capping how much of an individual's property and income taxes can be written off their federal tax bill, as well as lowering the threshold for mortgages that qualify for interest deductions to $750,000 from $1 million (one reason why the luxury market in places like Greenwich has gotten whacked), Trump managed to exact his revenge on the blue-staters who supported his presidential rival back in 2016.

Now, Trump has said offhandedly that there's been talk of reinstating the deductions and raising the mortgage cap. But for the most part, this seems like idle talk. The federal budget deficit has exploded, but Trump and his team are still talking up their tax-reform part 2 (though it's likely this chatter mostly a ruse to pump the market). But suspect any tax cuts between now and November will be focused squarely on aiding the midwestern states who handed Trump the presidency.

Since the tax-reform package was passed, what was once a trickle of blue-staters fleeing places like California, New York, New Jersey, Connecticut and even Texas over the past two years has become a flood.

And after a smattering of stories detailing the gradual migration from high-cost blue states and cities like San Francisco and New York (we've paid close attention to the trend over the years), two WSJ banking reporters have published a deep dive on the trend, signaling its arrival as a major national issue.

Just like Carl Icahn and David Tepper left New York and New Jersey for Florida, millions of Americans are following suit, swapping Connecticut for Florida, Nevada or Arizona.

Two years after President Trump signed the tax law, its effects are rippling through local economies and housing markets, pushing some people to move from high-tax states where they have long lived. Parts of Florida, for example, are getting an influx of buyers from states such as New York, New Jersey and Illinois.

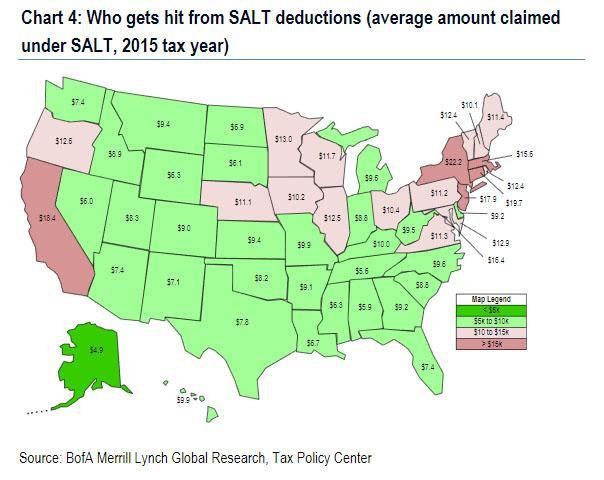

Though the exact figures have probably changed since the tax reform was passed, this map helps illustrate how capping SALT and lowering threshold for mortgages impacted each state.

While President Trump, Secretary Mnuchin and the rest of the administration have insisted that they capped the deductions to end what they described as an unfair subsidy for blue states. The average US property tax bill in 2018 was about $3,500, according to Attom Data Solutions, a real-estate data firm cited by WSJ. But in New York, New Jersey and Connecticut, hundreds of thousands of residents make annual property tax payments well above that level. In New York's tony Westchester County, the average property tax bill is more than $17,000.

Most of the people interviewed by WSJ said they had long considered moving to a more tax-friendly state. But for many, Trump's tax plan was the catalyst to actually act on these impulses.

"It was another bucket of straw on the back of the camel," said John Lee, a wealth-management executive and longtime resident of the Sacramento, Calif., area. Mr. Lee and his wife, Tracy, moved their primary residence last winter to Incline Village, a resort community on the Nevada side of Lake Tahoe.

The Lees kept their California home, where one of their six adult children is living. That means they are still paying California property taxes. But Mr. Lee estimates the move to Nevada, which has no state income tax, whacked his state tax bill by 90%.

The impact on housing markets in the ten most heavily taxed states has been impossible to ignore. The Manhattan luxury housing market is showing signs of serious distress that's provoking anxieties among the wealthy developers who were expecting a boom in demand. According to Fitch Ratings, home-price appreciation in these states declined almost immediately after the tax reform package was passed. By comparison, home-price appreciation was steady for the 10 states with the lowest property taxes and levels of mortgage interest.

Among Gen Xers and Boomers who have only recently achieved empty-nest status, plotting an escape from taxation hell has become a simple tenant of good retirement planning.

Rick Bechtel, head of U.S. residential lending at TD Bank, lives in the Chicago area and said he recently went to a party where it felt like everyone was planning their moves to Florida. "It’s unbelievable to me the number of conversations that I’m listening to that begin with 'When are you leaving?' and 'Where are you going?'" he said.

Even some states known for having relatively low taxes are being affected by this trend, as some residents opt for states with no income tax, like Florida or Nevada.

The dynamic is affecting even states typically thought to have low taxes. Mauricio Navarro and his family left Texas last year for Weston, Fla. Neither state collects its own income tax, but Mr. Navarro was paying more than $25,000 annually in property taxes in the Houston area, he said. Texas ranks among the states with the highest share of taxpayers who pay more than $10,000 in property taxes, according to the National Association of Home Builders.

Filling out his 2018 tax returns helped motivate him to move with his wife and two children, said Mr. Navarro, who owns a software-development business.

"It was not that we were struggling," he said. "It's that we did some analysis."

Mr. Navarro is renting but plans to eventually buy a home in Florida. He expects his property tax bill will be lower than it was in Texas.

Another angle to this story that wasn't really discussed in the WSJ piece is how this migration will impact state budgets. Particularly in California's case, many of those leaving are homeowners and taxpayers, people who bear a disproportionate burden in financing the state budget. With pension funds in Illinois already dangerously underfunded thanks to the unsustainable benefits lavished on state employees.

A few days ago, the Chicago Tribune published an interesting editorial on the subject of pension reform that gets right to the heart of the problem:

You and your neighbor have a decade of familiarity and own similarly comfortable homes. You drive similarly fuel-efficient family SUVs.

You even cut your lawns in similar stripe patterns each Saturday, nodding to one another as you sweep the clippings and wrestle giant paper bags.

But when it comes to retirement, the similarities end. Your neighbor, who pulled in a similar salary, worked for the state. You didn’t.

The thought of retirement terrifies you as you prepare to live on a fixed 401(k) — one close to the American average of $195,000 for people close to retirement. Most of it comes from earnings that you’ve socked away over the years. Combined with a meager Social Security check, which maxes out at a little over $45,400 per year, it’ll have to last you for the rest of your life.

Your neighbor, meanwhile, is expected to receive more than $1.5 million in pension benefits during the course of his retirement. He personally contributed less than $60,000 to the pot. He gets to retire at 56. You? 70, if you’re lucky.

If a huge chunk of Illinois middle class decamps for Florida, what then?

But we digress. Another issue with this new great American migration is that sometimes the transplants clash with the locals - not only because of their ultra-liberal California values, but also because they're inconveniently driving up home prices and rents for everybody else. As more Californians flood into Nevada, the locals have greeted them with a whiff of suspicion. "I just hope all the Californians going to Nevada don’t turn Nevada into a California," said one recent transplant.

After watching how they bungled things in their former home state, that would indeed be a tragedy.

https://ift.tt/3aZoa7l

from ZeroHedge News https://ift.tt/3aZoa7l

via IFTTT

0 comments

Post a Comment