Decentralized Finance As Value Creator... And Destroyer Tyler Durden Mon, 09/28/2020 - 21:40

Authored by Omid Malekan via Medium.com,

As you’ve probably seen, DeFi on Ethereum is now the hottest thing in all of crypto, further establishing the platform’s first mover advantage, and firing what should be perceived as a shot across the bow of traditional financial services. The success of the movement is attributable to three fundamental properties of decentralized blockchain networks:

-

Composability: Any output of an existing solution — such as collateralized lending or automated market making — could easily be used as an input of a new solution. This means that developers can build on the work of others, mixing and matching existing services to create their own financial supermarkets (what the crypto kids call money legos).

-

Transparency: Every project is transparent, open-source and imminently replicable. Not only can developers look under the hood of successful projects, they can copy the code and introduce their own variation.

-

Permissionless: Anyone can do anything. There are no licenses to acquire, vendors to onboard, KYC procedures to follow or AML/CFT laws to be crippled by. Those who have innovative ideas build them and those who like the resulting service use them. Full stop.

Also aiding the boom is a growing cast of supporting infrastructure in the form of stablecoins, oracles and ramps to other platforms such as Bitcoin. All of this has been around for years, as have the earliest DeFi protocols. But the action didn’t take off until the arrival of liquidity mining earlier this year, an innovative incentive scheme best understood with an analogy: Back in the day, banks used to give away toasters for opening a new account. DeFi projects go one step further and give away equity, in the form of a governance token. The more users borrow, lend, provide liquidity or trade in a particular protocol, the greater the claim on future revenues and say in ongoing governance that they get.

Liquidity mining is the decentralized and community-owned ethos of the crypto universe expanded to financial services. There is no off-chain equivalent, but analogous to Robinhood giving away free stock to its clients based on usage. (RH would never do this, because the infrastructure can’t handle it and the regulators won’t allow it— yet another reason why the only real innovation in financial services is happening on the blockchain).

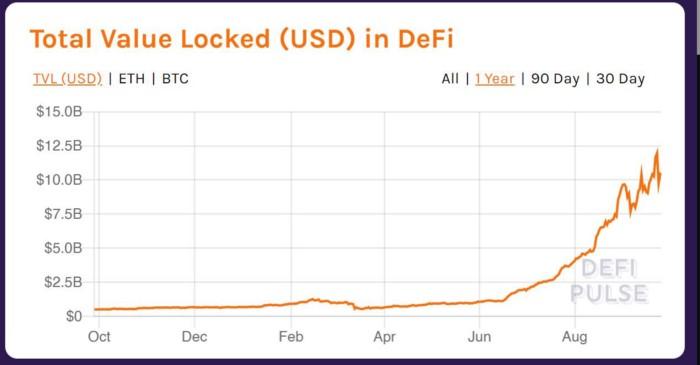

The introduction of liquidity mining set the DeFi world on fire. Even those who didn’t have an immediate need to lend, borrow or trade started doing so to earn a reward. This spike in activity created a virtuous cycle: the more people used a protocol, the more valuable the token it was giving away was perceived to be, so the greater the incentive for new users to join the party. In just three months, the value of assets involved with DeFi went up 10x, and fees on Ethereum surged as well.

All of this is great for adoption, energy and excitement. DeFi has reinvigorated the crypto ecosystem, attracted attention from outsiders and caused even greater agita for regulators still grappling with the difference between security tokens and tokenized securities. What it’s not great for is the value of the DeFi governance tokens themselves. This might be considered heresy in the most devout DeFi circles, but I would argue the vast majority of DeFi tokens are borderline worthless. Why? Because of what makes DeFi great in the first place. Put in crypto speak:

Composability + Transparency + Permissionless = No Moat

Put in plain English: If you build it, they will come, but then someone will build a replica, and they will leave. In a world where anyone can do anything, including copy your code, tweak your solution and parody your name, then every successful project will have imitators, and since there are no account signups, national borders or regulatory barriers, your customers can become their customer with a single click. This isn’t just speculation, it has already happened, with comical naming conventions to boot. The popular decentralized exchange Uniswap yielded Sushiswap which was then copied into Kimchiswap. Another popular service called Curve was forked into Swerve, and the robo-yield-farmer Yearn has spawned more copycats than one can keep track of.

At issue is the fundamental equation of trust. The main goal of a decentralized platform like Ethereum is the minimization of counterparty risk — a fundamental driver of financial innovation for millennia. The platform’s success in doing so makes it both easy to build new solutions and hard to monetize them, because everyone shares the most important edge. This is not the case in traditional finance. You can spend billions of dollars replicating the physical infrastructure of the NYSE or BoA, but end up with none of their customers, because you won’t have the licenses, reputations and relationships that make those entities trustworthy.

Ironically, that means the only lasting value any DeFi solution could have comes from the messy and more centralized stuff that you can’t just copy and paste, such as business development, VC backing and human talent. It also means that the oldest DeFi protocols who have the most sophisticated teams and weathered more than just a single season are the only ones worth owning at current prices. My favorites are MakerDao, Compound, Aave and Uniswap. Everything else is either too new, too unproven, too unused or too easy to copy (Maker increasingly seems like the only solution that’s truly fork proof, given Dai’s growing penetration into obscure corners of the ecosystem, and Latin America)

Even more ironically, the market currently values most of these protocols in the opposite order that I do. The DeFi aggregator Yearn, which would have no reason to exist if not for the base protocols it feeds, has a higher market cap than all of them. The synthetic asset maker Synthetix, whose sUSD stablecoin has less than $60m in distribution, is valued more than Maker, whose Dai stablecoin is approaching $1B. These disparities are the result of the crypto world’s never ending (and always embarrassing) desire for free money. Maker isn’t giving away any equity, while SNX is giving away plenty.

These disparities will eventually be resolved. The valuations of the core protocols will rise to the top while some of the current high-flyers will end up worthless. But even then, the upside will always be capped by the fact that competition is easy to build. The most sustainable winners will be the off-chain infrastructure providers, for the simple reason that you can’t fork USDC’s cash reserves or Bitgo’s cold storage.

And once again, the biggest winner of all will be Ethereum itself, as DeFi has only increased its value and cemented its first mover advantage. It is a mistake to assume that today’s astronomical transaction fees are anything other than a blessing. Demand outstripping supply is the best thing that can happen to any startup.

https://ift.tt/2EMsJHa

from ZeroHedge News https://ift.tt/2EMsJHa

via IFTTT

0 comments

Post a Comment