On Gold, The Dollar, & Real Yields Tyler Durden Wed, 09/30/2020 - 06:00

Authored by Ven Ram, FX and rates strategist at Bloomberg,

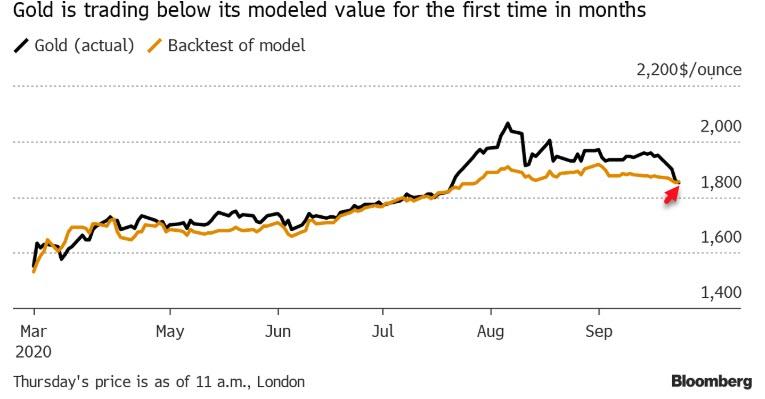

Gold is fast losing its status as this year’s go-to asset thanks to higher real rates and the dollar’s comeback. After trading at a considerable premium over estimated fair value, it is now at a discount, suggesting it’s unlikely to revisit its cyclical peak in the next few weeks.

Bullion has tumbled this month after being the best-performing major asset in the first half of the year.

[ZH: in fact this month - to date - has seen the dollar outperform gold by the most since Trump's election]

The difference between gold’s trading price and its modeled value, estimated from multiple factors such as nominal yields, breakeven rates and the dollar turned negative on Thursday for the first time since July.

[ZH: Note that gold has bounced since then...]

That suggests gold is unlikely to re-visit its nominal record of about $2,075 in the short term if investors continue to take a view that the U.S. economy will be locked in a scenario characterized by steady yields on long-dated nominal bonds and anemic inflation breakeven-rates.

Specifically, that means the 10-year nominal yield hugging the 0.65% level that has become its familiar perch since the Federal Reserve’s emergency measures in March. The 10-year rate has been pretty resilient this week despite the sell-off in stocks, suggesting that traders are factoring an economy on the mend.

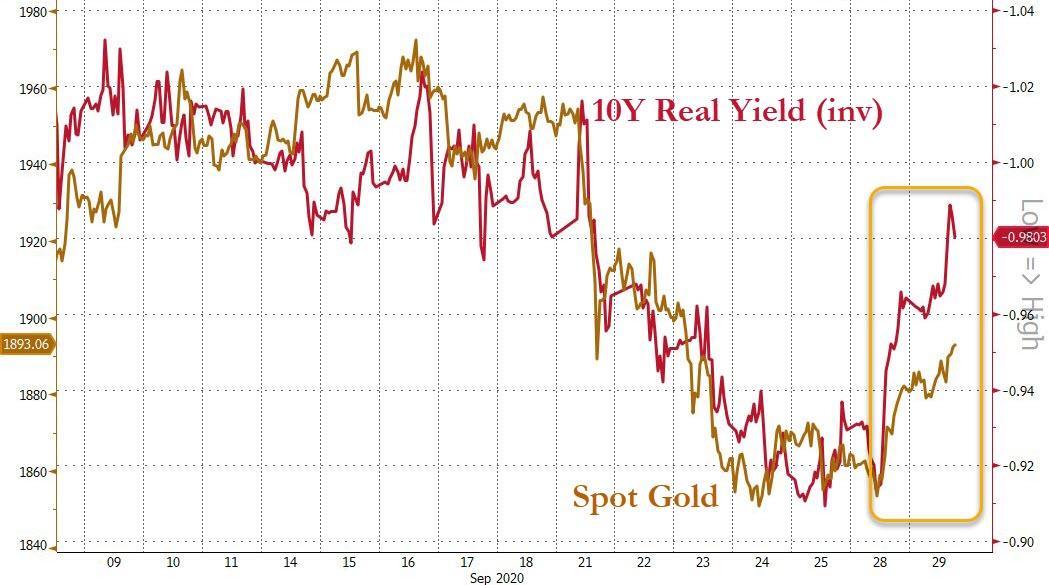

Meanwhile, inflation breakeven rates, which marched higher for five consecutive months through August, have crumbled in September. Taken together, the nominal and breakeven rates mean that real rates have nudged higher, weighing down on gold

Gold has a strong inverse relationship to the currency it is priced in, and as an asset with perceived inflation-busting properties that carries no yield, tends to do well when real rates are low.

Amid all this, the U.S. Dollar Index has risen about 1.6% this week, leaving gold exposed to further losses should the currency strengthen. At Wednesday’s close of 94.389, the DXY Index is still undervalued by almost 3% on my currency model.

The chart below shows how a backtest of the model would have aligned with gold’s actual value.

In extrapolating the forecast value of gold, I treated it essentially as a pure fixed-income derivative. That represents a limitation since gold prices are often affected by several other factors such as fund flows. My study also overlooks its utility as a haven in times of distress.

While gold may be losing its attractiveness, it would be foolhardy to completely write its fortunes off, especially given its convexity. While its ride isn’t immune to the twists and turns in the global markets, its prices tend to be sticky on the downside.

Given that there is no real clarity on the availability of a coronavirus vaccine and the attendant trajectory of the global economy, any recovery may take longer than the markets are currently projecting. That may, in turn, send real yields tumbling again, providing a second wind for gold.

But real rates and the dollar on the upswing look like a stiff challenge for bullion to overcome in the short term.

https://ift.tt/3nepsSm

from ZeroHedge News https://ift.tt/3nepsSm

via IFTTT

0 comments

Post a Comment