How A Bunch Of French Math Nerds Built SocGen's Now-Crumbling 'Structured Products' Empire Tyler Durden Tue, 09/29/2020 - 04:15

It has been years since European banks' dominated traditional investment-banking business lines like trading and M&A. But things weren't always this way. Before the financial crisis, and before regulators around the world started scrutinizing banks' derivatives businesses to try and curb risk.

But while Deutsche Bank has become the poster-child for post-GFC decline - as its ambitions to become a global rival to JP Morgan crumbled to dust - Societe Generale, the French banking giant that reaped massive profits during the late 1990s and 2000s via its pioneering 'structured products' business, is also presiding over the twilight of a business line that was once the bank's profit center, but has been blamed for massive losses during the coronavirus downturn this spring.

Oudea

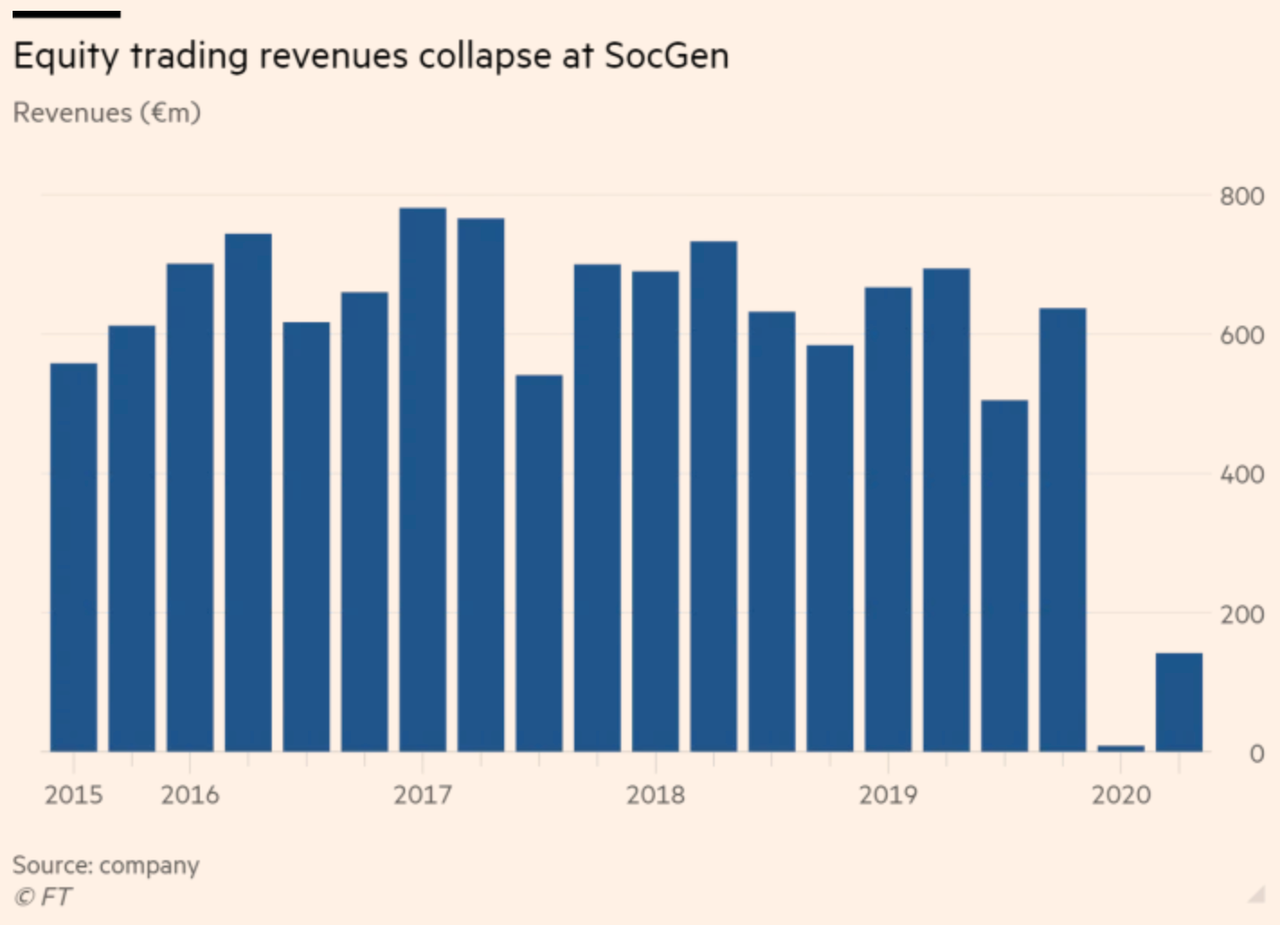

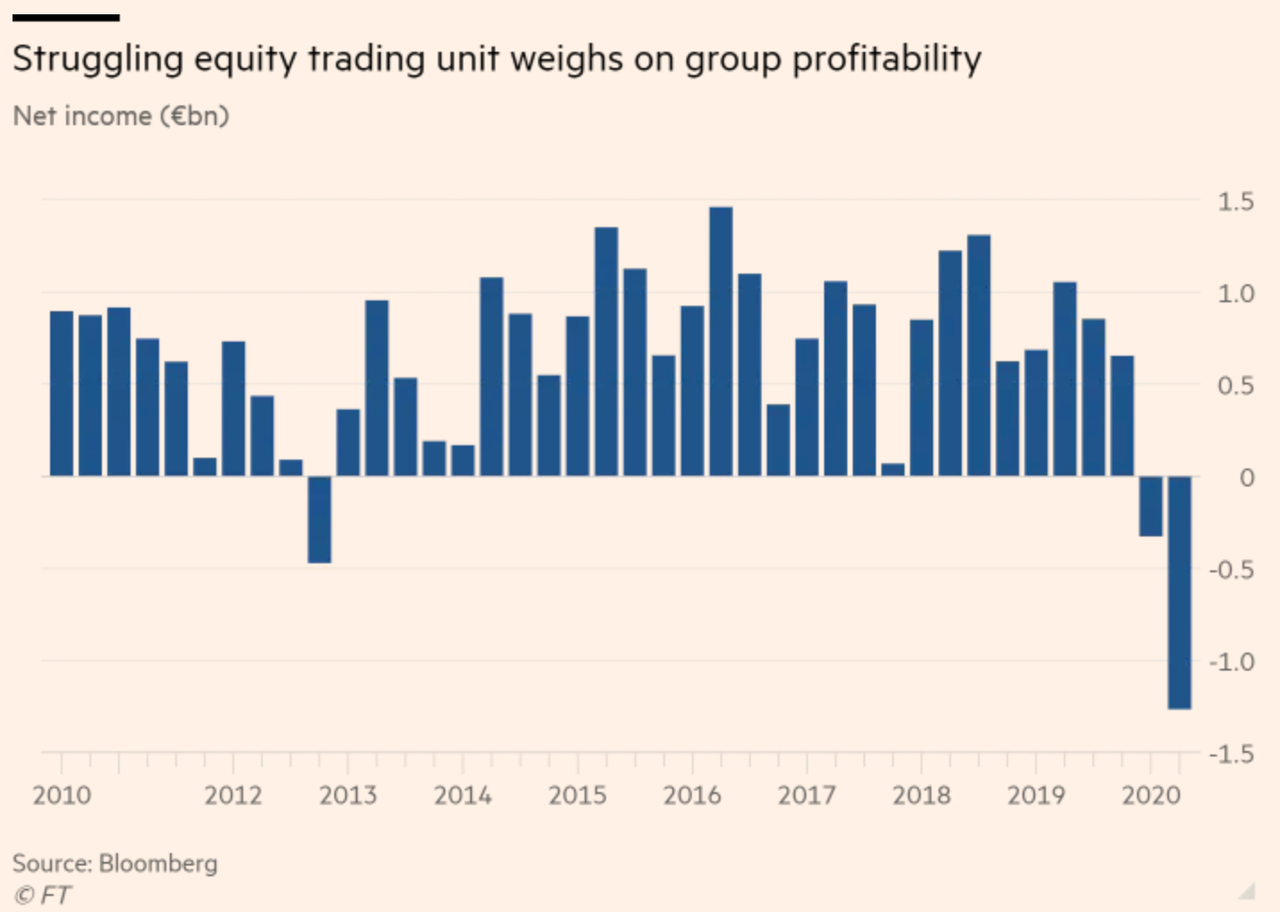

As the FT reminds us, the French bank fell to a shocking loss of €326 millions ($380 million) in the first quarter after revenue in its equity trading unit (long hailed as a key strength) collapsed almost 99% to just €9 million ($10.5 million) after the bank saw "the worst environment you can imagine" for its structured products business, CEO Frédéric Oudéa explained.

Another major loss was reported in August, after Q2 earnings were reported.

A loss that was attributed almost entirely to the group's

With shareholders revolting, Oudéa promised to cut back on the bank's structured products business, foregoing €250 million in revenue while targeting "cost savings" of €450 million ($523 million). The cuts are the biggest threat to a business line that set SocGen apart from its European peers, and helped establish the bank as a powerhouse in equity derivatives thanks to its 'structured products' business. These products, purchased by retail and institutional investors, charge relatively high fees, but purport to lock in moderate profits while smoothing out volatility.

30 years ago, however, the business was just the twinkle in the eye of a legendary French banker named Antoine Paille. 30 years ago, Paille was a 31-year-old software engineer with a big dream. He and a small team of engineers from a venerable French academy were bequeathed a basement office in downtown Paris, where they birthed the bank's structured products business. Here's the FT with more.

Thirty years ago, a group of maths and engineering graduates from Paris’s elite grandes écoles changed the direction of one of France’s oldest and most important banks.

Under Antoine Paille, a 31-year-old software engineer, the small team was given a basement office a few streets from the Palais Garnier opera house in Paris with instructions to build a new business for Société Générale, the lender founded in the 19th century.

Mr Paille believed that SocGen’s dive into options and equity derivatives, which would eventually be packaged up for professional and retail investors into so-called structured products, could provide the bank with an advantage over its larger global competitors. He proved to be right.

French banks, including SocGen, Natixis and BNP Paribas, eventually all became global leaders in these types of products, which encapsulated derivatives which promised to minimize volatility while maximizing the upside for clients. But in a world of low interest rates, and increasingly strenuous global competition, bankers were forced to make the products increasingly complex - and increasingly risky - just to keep up with the competition. "Correlation" offerings and "autocalls" soon dominated the landscape.

But the original products have changed, becoming increasingly complicated structures that tried to maintain returns in a world of low interest rates and copycat products. “Normally when we created a product, we’d have it to ourselves for about a year and a half, then others would start to copy it,” said one former member of the structured products team. Simple “plain vanilla” guaranteed return products morphed into correlation offerings based on baskets of stocks, and on to autocalls, which pay out a coupon similar to a bond as long as losses or gains are within a certain threshold.

One banker reminisced to the FT about SocGen's first slam-dunk structured product, called "Everest", which the banker described as "beautiful".

“Everest was beautiful,” another banker reminisced, remembering a correlation product that was sold to retail investors and named by Christophe Mianné, one of the leading lights in equity derivatives in the 1980s, after he saw a film about the mountain projected near SocGen’s Paris headquarters in La Défense.

Here's how it worked...

Everest had a duration of 10 years and guaranteed that clients’ capital would be returned. Additional returns were based on the performance of 10 or more stocks, with redemption based on the performance of the weakest member of that chosen basket.

...and - more importantly - here is the pitch:

"We told investors that if you invest 100 then after ten years we would give you 200, minus the performance of the worst stock you chose," said someone who used to sell the products. If the worst performing stock went to zero, then clients received only their capital back and if all the stocks performed well they got the upside. The risk that all the stocks would move in the same direction at the same time was the bank’s to wear.

Among the original group of bankers brought in to package and sell these products was Jean Pierre Mustier, who eventually rose to lead SocGen's investment bank, before being unceremoniously fired after the financial crisis, when regulators came down hard on SocGen's structured products business (he's now the CEO of UniCredit). Mustier's rise was almost as meteoric as the structured products business.

A steady stream of talented maths graduates churned out by French universities, along with a plan to build centralised teams and sell the products at scale, allowed SocGen to steal a march on rivals. Insiders say a “start-up culture” allowed them to beat US banks which were selling bespoke products to institutional clients. One ex-SocGen banker said the US banks were not as interested in structured products because they were making enough money elsewhere. By the early 2000s, SocGen’s equity derivatives unit employed close to 2,000 people and had grown into the bank’s profits engine, accounting for 95 per cent of its investment bank earnings.

Despite the business's tremendous success, the regulatory backlash was swift, and the bank was forced to retreat from riskier practices that were also - as it turns out - extremely lucrative.

Though the bank continued to invest in its structured products business, Mustier was eventually forced out of the investment bank as Oudéa ascended to the CEO role. This precipitated a shift away from investment-banking and market making as the bank's central focus, and led to a steep decline in the structured products business.

SocGen is not giving up on structured products, despite the hit from Covid-19 forcing it to pull back. Instead it is trying to walk a tightrope between reducing risk and remaining true to its core identity. It will do that, said Jean-François Grégoire, head of global markets at the bank, by trying to push new ranges of products that reduce the potentially large losses the bank faces in market turmoil, leaning once again on its ability to engineer. “The innovation that we’ve been pushing [this time] is completely different. It’s innovation that goes towards creating products that are easier to manage for us and that are still very profitable for the customers,” Mr Grégoire said.

Of course, any product that can't withstand intense market "ructions" - the FT's favorite word to describe the chaotic limit-up/limit-down swings seen in March - is bound to run into problems in a market universe where payment for order flow, algorithmic trading and uneven liquidity exacerbates volatility, creating new challenges for risk managers across Wall Street.

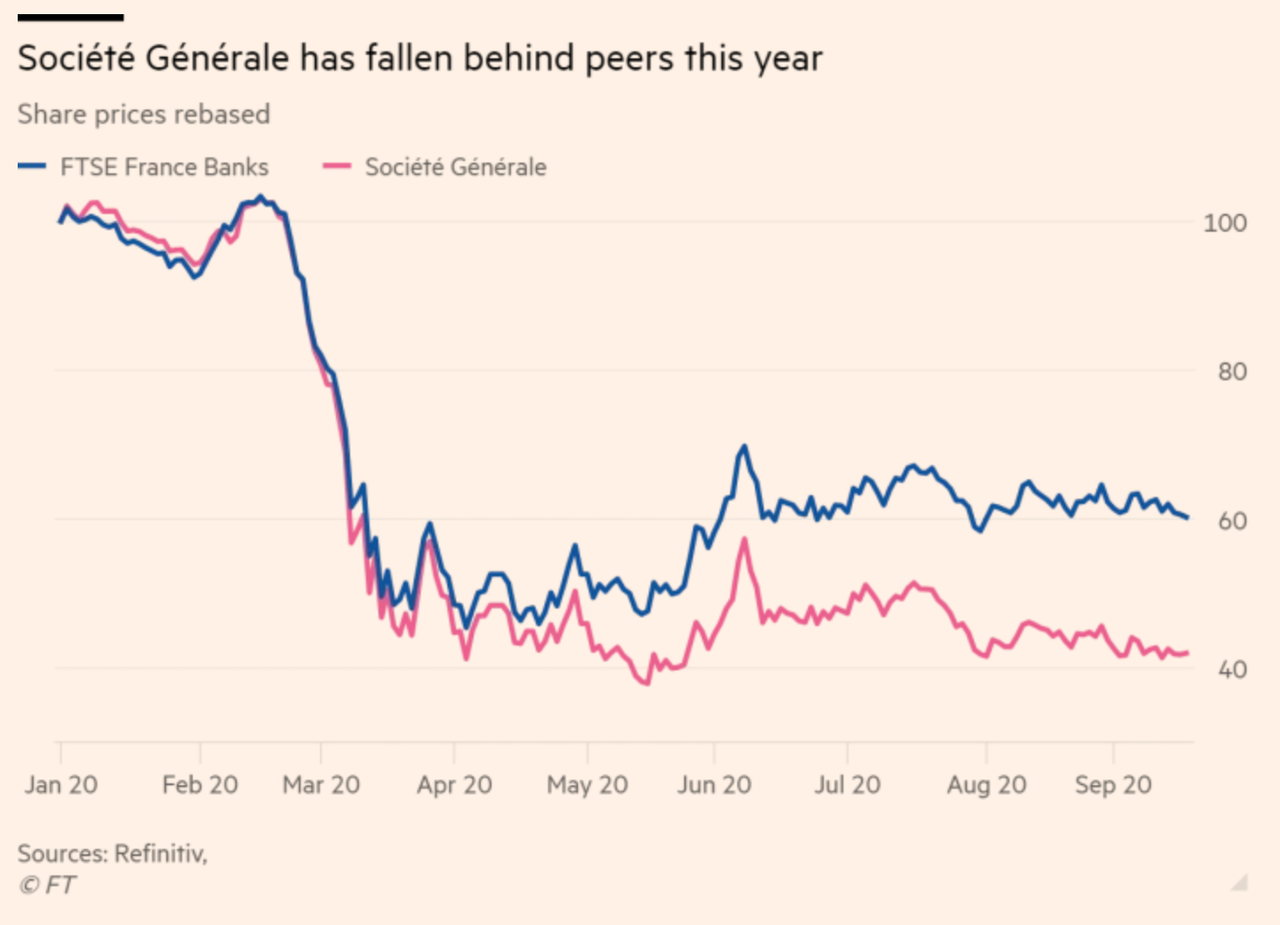

So far, the market reaction has placed SocGen behind the curve for 2020, as its shares lag French banks.

https://ift.tt/2GbPp45

from ZeroHedge News https://ift.tt/2GbPp45

via IFTTT

0 comments

Post a Comment