OPEC Meeting Begins: Full Preview Of What To Expect Tyler Durden Mon, 11/30/2020 - 08:24

Submitted by NewsSquawk

- OPEC and OPEC+ producers will meet November 30th and December 1st respectively, with Monday's meeting scheduled at 13:00GMT/08:00EST

- Over the weekend, OPEC+ failed to agree on a delay to output hikes, with UAE and Kazakhstan reportedly opposing extensions

- Market expectations are still leaning towards current cuts being extended following Sunday's meeting

- Some sources suggested a 2-3 month extension, others three and the most recent 3-4 months, with some officials not on board with the full "plan"

- OPEC+ failure to extend could trigger an oil price decline, whilst “buy the rumour, sell the fact” play cannot be dismissed

OVERVIEW:

OPEC and OPEC+ producers are meeting November 30th and December 1st respectively, to discuss and draft a potential tweak to the current Declaration of Cooperation (DoC), rolled out in light of the pandemic to recalibrate the demand /supply imbalance. Monday's meeting is slated for 13:00GMT, subject to delays. The current DoC is split into three phases:

- 9.7mln BPD total output reduction between May and July 2020.

- 7.7mln BPD total output reduction between July and December 2020.

- 5.7mln BPD total output reduction between January 2021 and April 2022 (subject to review in December 2021).

Market expectations are still leaning towards the second tranche (7.7mln BPD cuts) being extended through Q1 2021, a view which was also backed by Goldman Sachs, ING and UBS, despite positive vaccine developments and amid rising production in Libya. Recent sources also noted OPEC+ is still leaning towards a rollover of the current tranche notwithstanding the recent oil price rally, albeit with some sources suggesting by 2-3 months and some through Q1 whilst the most recent sources suggested 3-4 months- with Russia also likely to agree to the full quarter if necessary. However, enthusiasm for cuts is not universal - with some OPEC+ officials cited by EnergyIntel not on board with the full "plan" on Sunday. Russia is also said to insists on gradual monthly increases in output from January, sources stated.

SUNDAY JMMC MEETING

The informal consultation between the Russia, Saudi and JMMC heads was moved to Sunday ahead of the decision-making meeting. The panel of OPEC+ ministers could not reach an agreement on the extension of current cuts, with most participants reportedly supporting a delay of hikes through Q1 2021, but UAE and Kazakhstan opposing. Tass citing sources said the Russia and Saudi have reached consensus on extending the current level of cuts through the first months of next years, but the two producers still had to "coordinate 'certain details and the mechanism' of the extension". Meanwhile, sources cited via Argus Media on Sunday said "A rollover would most likely be for one quarter... This would avoid flooding the market in January-March - a period of typically slower demand."

NOVEMBER JMMC FALLOUT

The Joint Ministerial Monitoring Committee (JMMC) statement on November 17th gave no detail on its recommendations but said it will be provided on December 1st. The Committee reiterated the “critical importance of adhering to full conformity and compensating the overproduced volumes, in order to achieve the objective of market rebalancing and to avoid undue delay in the process.” There was also chatter that OPEC+ is mulling deeper production cuts, though this was dismissed by delegates on Sunday who suggested no talk of collective deeper cuts.

COMPLIANCE COMPLICATIONS

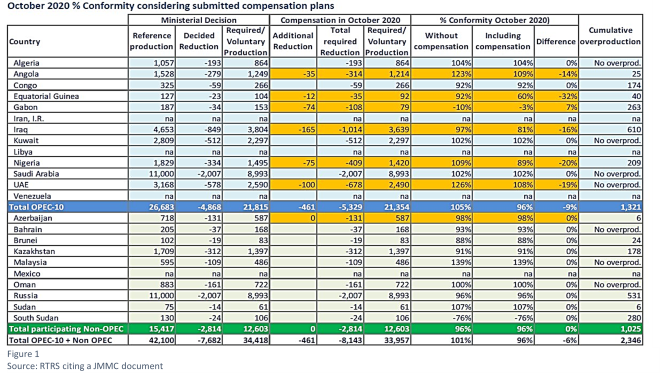

Compliance among producers remain an issue as the latest October figures from the JMMC suggest sub-par conformity, namely from UAE, Nigeria, Iraq, Gabon, Equatorial Guinea, Angola and Azerbaijan for a total group cumulative overproduction of 2.346mln BPD (see Figure 1).

Some sources suggested that OPEC+ compliance could still be an issue, however, EnergyIntel's Bakr noted that "The expectation among delegates is that the "'catch up cuts' plan will be extended into 2021 to allow a number of states to reach their quotas"

Desks did not expect these compliance difficulties to be a near-term risk given the “vigilant and proactive” stance signalled by OPEC+ in recent meetings, with the group likely to reaffirm its stance on full compliance and specifics likely to be ironed out in the coming months with further compensation quotas.

DEMAND AND OIL PRICE DEVELOPMENTS

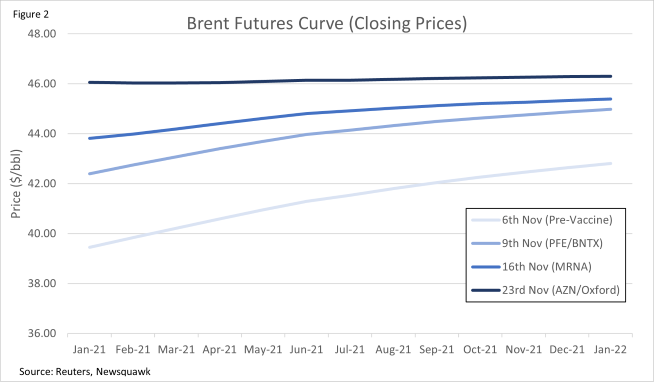

The positively received vaccine updates from Pfizer/BioNTech (PFE /BNTX), Moderna (MRNA), AstraZeneca (AZN/Oxford) and the Russian Direct Investment Fund (RDIF) have provided a rosier (or less dire) demand outlook for the complex due to the prospect of a recovery in activity and jet fuel demand. Still, re-emerging COVID-19 cases and uncertain timeframes for mass rollouts of approved vaccines continue to cloud near-term outlook. Analysts at Goldman Sachs indicate that this solidifies the argument for an extension of current cuts. Further, IEA’s November OMR also suggested “it is far too early to know how and when vaccines will allow normal life to resume. For now, our forecasts do not anticipate a significant impact in the first half of 2021.” Nonetheless, the vaccine fanfare this month has provided the crude market with a boost, resulting in the Brent curve edging back into backwardation (theoretically a near-term bullish signal) - Figure 2 below indicates the shallowing contango following the releases of each of the three major vaccine updates.

However, ING is sceptical about the recent Brent backwardation into early 2022 given the soft near-term demand outlook and fragile balance sheet over Q1 2021, whilst the WTI curve makes more sense, with timespreads in contango in the near term (reflecting weaker fundamentals) but with backwardation commencing from the May 2021 contract.

- PRICE RALLY: The recent rally has prompted some to question the eagerness of some members to get onboard with extended cuts. “Clearly, if the market continues to strengthen between now and then, there is the risk that a growing number of members of the deal will become increasingly reluctant to rollover cuts”, ING says, "the group would likely be more open to rolling over cuts if prices were trading around the US$40/bbl level, however with Brent quickly approaching US$50/bbl, there might be some opposition within the group to delay an easing in cuts." Hence, the bank sees risk skewed to the downside - "it is unlikely that OPEC+ surprise with a six-month rollover given the latest move in prices, while the three-month rollover is already largely priced in. So anything less than a three-month extension will likely be seen as bearish."

SUPPLY SITUATION

The oil producers will have to factor in supply side developments since the rollout of the DoC, events that were not foreseen nor assumed at the time:

- LIBYA: Libyan crude output has been on a steep upswing in the past couple of months following the lifting on blockades which saw exports from five key oil terminals halted in January, translating to an output slump to ~70k BPD vs ~1.1mln BPD pre-blockade, the latest Libyan production printed at ~1.2mln BPD. Libya is currently exempt from OPEC quotas, and the NOC head stated it will join the allocations once production reaches 1.7mln BPD. OPEC previously stated it will be keeping an eye on sustained production from Libya. On that note, an armed group attempted to break into the headquarters of Libya's NOC on November 23rd, in turn reigniting fears of the country’s fragile output.

- UAE: Some desks are also eyeing potential complications by UAE to raise its baseline quota, thus translating to higher output from the nation. However, this risk is unlikely to materialise as the country’s energy minister recently noted “that all Opec-plus members should achieve full compliance with the existing agreement before the current level of cuts can be extended into next year”, according to EnergyIntel, whilst Goldman Sachs also warns unilateral production hikes will likely trigger a price war.

- IRAN: A Biden administration has raised the likelihood of Iranian oil returning to the market as expectations are titled towards the Democrat unwinding some restrictions put in place by the Trump admin. That being said, this return is unlikely to take place until end-2021/22, ING believes, “by that stage, oil demand should have recovered enough for the market to be able to absorb additional supply”, contingent on COVID-19 and vaccine developments.

- NIGERIA: Desks note that Nigeria has been complicating matters as it has advocated the exclusion of output from its Agbami oil field from its quota on grounds that its output should be clasified as condensate as opposed to crude oil.

FORECASTS:

Analysts at GS forecast Brent to average USD 47/bbl in Q1 2021 assuming a three-month extension of current cuts, whilst an adherence to the current DoC (i.e. a 2mln BPD production increase) would warrant USD 42/bbl in the period. “This illustrates once again how short-term revenue maximization always comes through production cuts, as a 2 mb/d production increase but $5/bbl negative price impact would end up reducing core-OPEC and Russia’s 1Q21 fiscal revenues by more than $5 bn”, GS says. Meanwhile, UBS sees a Brent average of USD 45/bbl in Q1 next year (see Figure 3 below), with the assumption of a vaccine rollout in 2021. “A 3-month extension protects price downside as policy struggles to mitigate winter virus waves. 2021 is a year of price recovery and normalization”, the bank states.

The Newsquawk real-time social media OPEC monitoring tool is available here

https://ift.tt/3o8a9dp

from ZeroHedge News https://ift.tt/3o8a9dp

via IFTTT

0 comments

Post a Comment