China's "Lehman Moment" Approaching: Evergrande Warns Of Default Risk From Cash Crunch

When even George Soros cautions that China is about to face a major financial crisis, writing in an FT op-ed that China's property boom is coming to an end, and that Evergrande - the largest real estate company which it over $300 billion in debt has been quietly dubbed China's Lehman - "is over-indebted and in danger of default. This could cause a crash."

But it's not just Soros - overnight, the company itself, whose plight we have chronicled for the past 12 months while others have only recently woken up to its threat - warned that it risks defaulting on borrowings if its all-out effort to raise cash falls short, rattling bond investors in the world’s most indebted developer.

“The group has risks of defaults on borrowings and cases of litigation outside of its normal course of business,” the Shenzhen-based company said in an earnings statement on Tuesday. “Shareholders and potential investors are advised to exercise caution when dealing in the securities of the group.”

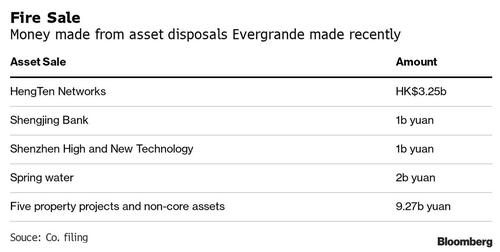

As previously reported, the cash-crunched company said it was exploring the sale of interests in its listed electric vehicle and property services units, as well as other assets, and seeking to bring in new investors and renew borrowings. But sharp discounts to swiftly offload apartments at a loss - the developer plans to sell its Hong Kong office tower HQ to Yuexiu Property Co. for just HK$10.5 billion ($1.3 billion), a third less than the HK$15.6 billion it sought - cut into margins, helping push net income down 29% to 10.5 billion yuan ($1.6 billion) in the first half of the year, in line with an earlier profit warning.

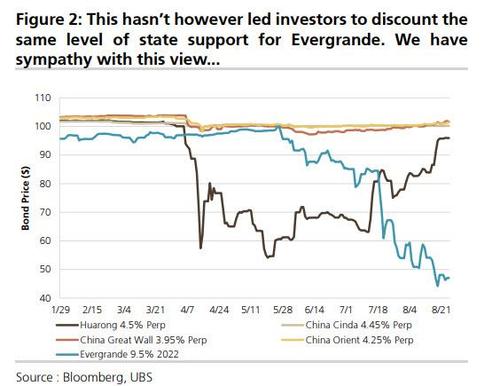

With Beijing refusing to come to the company's assistance (unlike the recent bailout of bad debt giant Huarong which two weeks ago finally got a state rescue after months of speculation as to its fate) Evergrande’s bonds sank toward fresh lows as investor confidence in its ability to repay debts has continued to erode.

“Evergrande’s gross margin could compress further on the potential fire sale of its properties,” said Bloomberg Intelligence analyst Lisa Zhou. The gauge of profitability is the lowest among major developers tracked by BI due to aggressive promotions and price cuts, Zhou wrote in a note.

And in another blow to the imploding real-estate conglomerate, even long-term allies are signaling they’ve had enough. Chan Hoi-wan, chief executive officer of Chinese Estates Holdings Ltd. and wife of Hong Kong billionaire Joseph Lau, made her first sale of Evergrande shares, cutting her holdings to 8.96% from 9.01%, a filing showed.

Evergrande’s 8.75% note due 2025 fell 1.5 cents on the dollar to 33.7 cents, according to Bloomberg-compiled data. Its shares earlier closed 0.7% lower in Hong Kong trading, taking this year’s decline to 71%.

Adding to the confusion, company executives refrained from commenting on the results (perhaps in response to the recent urging from Beijing that the company should keep its mouth shut), leaving investors and analysts to parse through the statement for guidance on its financial health.

Revenue recognized from projects delivered plunged 17% to 222 billion yuan, the lowest for the same period in four years. Gross margin almost halved to 12.9% from six months earlier, the lowest since at least 2008.

More troubling is that Evergrande said some property development payables were overdue - i.e., in technical default - leading to the suspension of work on some projects, but it added that the company is negotiating with suppliers and construction contractors to resume the work. “The group will do its utmost to continue its operations and endeavor to deliver properties to customers as scheduled,” it said.

For more details on the earnings, click here.

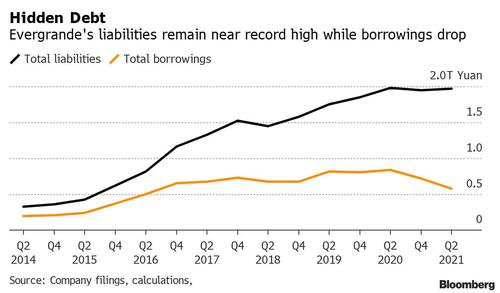

Additionally, while the company's borrowing fell, total liabilities that include bills owing to suppliers edged up to 1.97 trillion yuan, near a record high. Evergrande’s debt shrank to 572 billion yuan, the lowest in five years, according to Bloomberg calculations. That’s down 20% from 717 billion yuan at the end of last year and 15% from 674 billion yuan in March. But in what appears to just be a case of reshuffling liabilities, trade and other payables climbed 15% from six months earlier to a record 951.1 billion yuan.

Separately, the company still falls short on two of China’s so-called three red lines - metrics imposed by regulators on developers as part of a crackdown on leverage in the industry. It has pledged to meet all three by December 2022. One measure -- the ratio of cash to short-term borrowings, a gauge of liquidity -- worsened in the period to 36% from 47% at the end of last year, as its cash and equivalents plunged to the lowest in six years, Bloomberg calculations based on the results show.

With banks, suppliers and homebuyers exposed to the real estate giant, any collapse could roil China’s economy, raising questions over whether it might receive state support. Regulators urged Evergrande to resolve its debt woes in a rare public rebuke earlier this month. The problem - as is becoming obvious - is that Evergrande will not be able to resolve its "debt woes" without a bankruptcy or state bailout.

But will Beijing bail out the company if it realizes that there are no more options?

Addressing this question, UBS analyst Kamil Amin wrotes last week that "increased defaults coupled with above-average spread volatility in the Asia credit market throughout this year had led us to believe that the notion of "too big to fail" was diminishing. Instead, the Huarong rescue package illustrates to us that the notion does in fact still hold but be likely limited to higher quality SOE names, where spillover risks are much more profound."

Does Amin expect to see the same level for state support for Evergrande? "We are not yet convinced. Firstly, the issuer is a POE not an SOE and secondly, we expect the Chinese authorities to continue reigning in on excess leverage in the property sector and let defaults/restructurings drift higher. This view is consistent with the price action we have seen (Figure 2), with other higher quality SOE names across the financial sector having tightened post the Huarong news (China IG: -5bp), while China HY and Evergrande spreads have continued to trade >1150/5000bp."

Judging by the continued selling of both Evergrande bonds and stocks, consensus agrees. Yet when faced with the task of cleaning up after what would be a huge shock to the system - and at $300 billion, Evergrande is orders of magnitude bigger than Lehman ever was - will China blink, or will Soros be right?

https://ift.tt/3tb3Jy4

from ZeroHedge News https://ift.tt/3tb3Jy4

via IFTTT

0 comments

Post a Comment