Fed Says Taper Is Coming. Bulls Hear "No Taper Now"

Authored by Lance Roberts via RealInvestmentAdvice.com,

Market Rallies As Bullish Trend Remains

As discussed last week, the bullish bias remains as “dip buyers” jumped into the markets. As discussed in our Daily Market Commentary Friday morning:

“While the market continues its bullish advance (why not with $120b in QE), the divergences between price and other internal indicators continue to diverge. Another trip to the 50-dma would be a near 3% crash, and a decline in the 200-dma (which hasn’t happened for one of the longest spans in 40-years) would be a 10% disaster. (While I am sarcastic, the low volatility market experienced this year will make even normal corrections seem much worse than they are.)

For now, the ‘stair-step’ process continues with bounces off the 50-dma to slightly new highs before the next decline. At some point, investors will slip and fall down the stairs.”

The lack of a definite timeline on tapering from the Fed on Friday gave the “bulls” the boost of confidence they needed. As long as monetary policy and accommodative policy remain intact, there is a greater fear of “missing out” than of “losing money.”

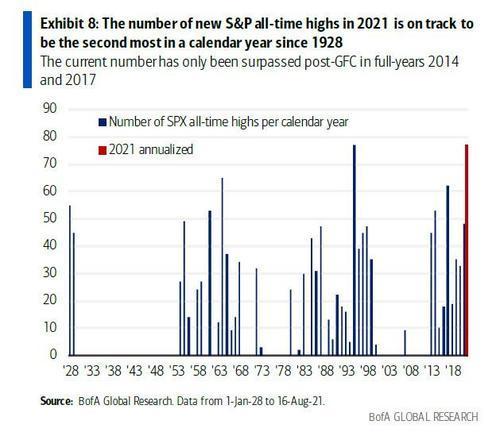

Nonetheless, the rally on Friday set the 52nd new high this year and the market is well on pace to set an all-time record of new highs this year. (Charts courtesy of Zerohedge.)

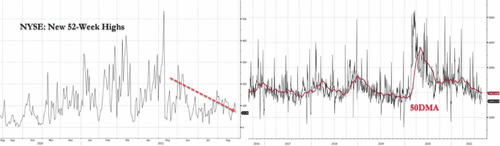

Interestingly though, while the markets are hitting new highs, a large number of stocks are not as volume continues to drop.

Of course, none of that is important as long as the “bullish bias” remains intact.

The only mistake investors make is believing the current trend will extend indefinitely. It can’t.

First Half Of The Full-Market Cycle

When you look at the long-term market cycles, there are oscillations between secular (long-term) bull and bear markets over time. Using long-term trendlines, we can make the case the first half of the current secular bull market began in 1980 following the crash of 1974. If we plot out the first half of the cycle, it currently intersects at 4500 on the S&P index (although 5000 is well within the margin of error.)

Whether or not you agree with cycle theory is mainly irrelevant. What is important is to note several things in the chart above.

-

Previously weekly 2-standard deviation extensions above the 200-week moving average resulted in signficant corrections.

-

The current 3-standard deviation above the 200-week moving average is a historical anomaly.

-

A correction back to the long-term bullish trendline would require a 68% decline.

-

A 50% correction would take you back to the March 2020 lows.

-

A 38.2% correction wipes out all the gains back to January 2018.

That information is not meant to be “bearish” or to scare you into selling into cash. However, not acknowledging that such a correction WILL eventually occur leaves you at risk of impairing a large chunk of your investment capital.

Without acknowledging risk, you are essentially driving a car blindfolded. It will work for a while. But, eventually, it won’t.

However, as noted above, as long as the Fed is engaged in QE, investors believe there is “no risk.“

But is that about to change?

Taper Is Coming, Bulls Hear “No Taper Now.”

On Thursday, Esther George, Robert Kaplan, and Jim Bullard suggested the Fed start tapering its balance sheet expansion and prepare for hiking rates. To wit:

“It would continue to be my view that when we get to the September meeting, we would be well served to announce a plan for adjusting purchases and begin to execute that plan in October or shortly thereafter.” – Robert Kaplan, CNBC

“We did say that we would allow inflation to run above target for some time, but not this much above target. So for that reason, I think we want to get going on tapering and get it finished by the end of the first quarter next year.” – Jim Bullard, CNBC

“When you look at the job gains we saw last month, the month before, you look at the level of inflation right now, I think it would suggest that the level of accommodation we’re providing right now is probably not needed in this scenario. So I would be ready to talk about taper sooner rather than later.” – Esther George, CNBC

While investors fretted the Jackson Hole symposium would result in a firm timetable for an aggressive tightening campaign beginning as early as September, such was not the case. As Powell’s comments show, the message delivered was a perfect combination of ambiguity, vagueness, and misdirection on timing and amounts of an eventual taper.

After Powell’s speech, Fed Governor Harker continued with vagueness around the taper, stating:

“The Fed has reached an agreement that tapering will begin this year.”

All the market heard was “No taper now,” which immediately translated into a panic bid to buy stocks.

Powell Emulates Greenspan

During the runup to the Dot.com crash, then-Fed Chairman Alan Greenspan became famous for “Greenspeak.” Such was his unique gift of saying much while saying nothing.

Chairman Powell’s speech, while greeted with market optimism, was his rendition of Greenspeak. While Powell said much, he said very little. As noted byZerohedge this morning:

“The bottom line, and the reason for the market’s dovish eruption: Powell provided no explicit taper signal, as he likely wants to see more jobs reports for accumulated evidence that ‘substantial further progress’ on the labor market is being made, while dismissing soaring inflation as transitory.”

As we noted for our RIAPro Subscribers this morning:

“In particular, the following line is assuring investors the Fed will not be aggressive with tapering QE. In regards to premature tightening Powell said: ‘Today, with substantial slack remaining in the labor market and the pandemic continuing, such a mistake could be particularly harmful.‘”

Below are two critical segments from his speech:

-

We have said that we would continue our asset purchases at the current pace until we see substantial further progress toward our maximum employment and price stability goals, measured since last December, when we first articulated this guidance. My view is that the “substantial further progress” test has been met for inflation. There has also been clear progress toward maximum employment. At the FOMC’s recent July meeting, I was of the view, as were most participants, that if the economy evolved broadly as anticipated, it could be appropriate to start reducing the pace of asset purchases this year.

-

The timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff, for which we have articulated a different and substantially more stringent test.

Keeping The Faith

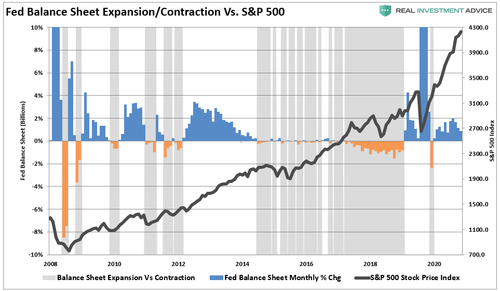

Don’t be mistaken; the Fed is going to start tapering this year. So while the bullish bias remains currently, with liquidity continuing, that will change. As shown last week, asset prices do not do well when balance sheet reductions begin.

For now, however, there is still plenty of monetary accommodation combined with “faith in the Fed.”

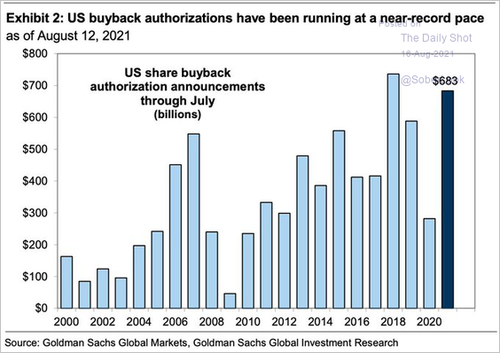

That “faith” and near-record levels of stock buybacks keep a continuous bid beneath stock prices. But, as we noted in our daily market commentary on Thursday:

“In the years before the COVID-19 pandemic, one of the biggest sources of buying power in the stock market were the companies themselves. As the economy has improved, the stock market has rallied, and corporate buyers returned as a force in the stock market. Via BofA:

‘Buybacks by corporate clients accelerated from the prior week to the highest level since mid-March, driven by Financials. Financials has now overtaken Tech as the sector with the largest dollar amount buybacks so far this year.’” – Yahoo

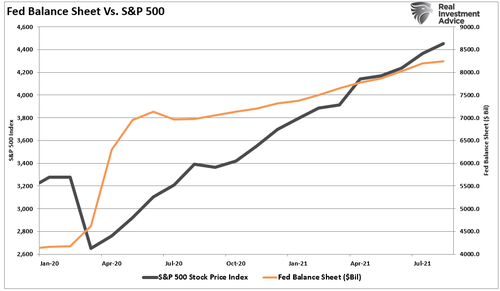

As discussed previously, the correlation between the Fed’s monetary interventions and the stock market is evident. The increase in the Fed’s balance sheet remains in near lockstep with the stock market’s climb.

To repeat from above, as long as investors “believe” monetary accommodation will remain, there is no reason to reduce speculative “risk-taking” endeavors.

Taper Timeline Announced

Interestingly, while the market surged on news of “no immediate taper,” such was already widely expected by the markets. It was also expected the Fed would “cautiously affirm” a tapering announcement for later this year.

What spurred the bulls was Powell’s affirmation that any tapering would be contingent upon economic outcomes continuing to meet expectations. In other words, any deviation from the baseline data could delay any potential action.

Furthermore, there was a clear distinction between tapering the current balance sheet expansion and hiking rates. Rate hikes will get predicated on inflationary pressures remaining above the 2% target longer than anticipated. This all sounds copasetic until you understand the Fed runs a high risk of getting caught in a stagflationary environment. Such an outcome will greatly reduce policy effectiveness. Via our daily market commentary:

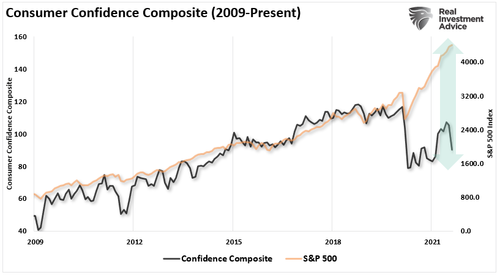

“The graph below from Arbor Research provides a clue for the recent decline in consumer confidence. Based on Google search data, the term stagflation is now the leading the “inflation” search word. Stagflation entails weak economic activity coupled with inflation. Stagflation results in higher unemployment and negative real wage growth.“

The most significant risk for the Fed is getting trapped between fighting rising inflation and keeping consumer confidence elevated through higher asset prices in such an environment. If they choose to hike rates, they will crash the stock market. However, a decision to try and support higher asset prices and the economy gets crushed by higher inflation.

It’s a “no-win” outcome and remains the most significant risk to investors betting on monetary policy.

The Problem Of Liquidity

On the “Real Investment Show,” I have spoken a few times about the collapse of liquidity in the market. The problem with the lack of liquidity is that when sellers show up in earnest, there will be a significant gap between the current price and the next buyer.

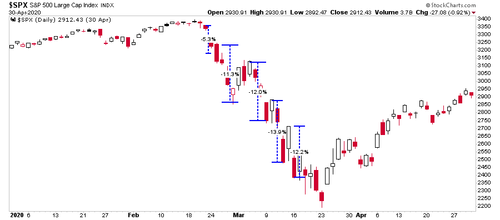

The chart below shows that the short-term sell-offs to the 50-dma saw sharp spikes in volume over the last several months. However, the subsequent rally of “buying” saw a collapse in volume.

That lack of “buying” volume leads to more significant negative divergences in the advance-decline volume indicator.

The critical thing to understand about liquidity, or lack thereof, is how it will manifest itself during the subsequent correction.

The Next Big One

There are two prevailing myths investors must be aware of concerning chasing markets in the current environment. The first is the “cash on the sidelines” meme, and the second is the “the greater fool” syndrome.

There is no “cash on the sidelines” as there is a buyer for every seller. The only thing that determines the underlying security price is the price at which the transaction occurs. Currently, given the extremely high levels of equity allocations, few investors are willing to “sell” at current prices for “fear of missing out” on further gains. Therefore, “buyers” must pay increasingly higher prices to get the transaction completed.

Such is also where the “greater fool syndrome” resides. The buyers who must pay higher prices to complete a transaction assume there will be someone willing to pay an even higher price in the future. Such may seem to be the case until it isn’t.

Much like an overly crowded theatre, eventually, someone will yell “fire.” It is at the point the few “buyers” that currently exist will disappear entirely. Sellers will be rushing towards a very narrow exit in the market only to find the price where they wished to sell has wholly vanished.

Such is precisely what happened in March of 2020 and why the market was dropping by double-digits between brief reflex rally attempts.

There is a straightforward truth to markets, always.

“Sellers live higher. Buyers live lower.”

Always make sure you are on the right side of the trade.

Portfolio Update

Heading into the Jackson Hole Summit meeting and not knowing how the market would react, we made some adjustments to our portfolios on Thursday. As we discussed with our RIAPRO subscribers, our goal is to reduce the “volatility” of the portfolio, thereby reducing risk without significantly sacrificing performance. So even though we took profits in stocks like WOOF and replaced FANG with XOM, we held equity allocations essentially flat at 50%.

We still hold a slightly higher cash balance in the equity sleeve (~10%) and the fixed income sleeve (~10%). W use the cash as a risk hedge against an equity draw and “shorten duration” in the bond allocation. While we were previously increasing the duration of our bond portfolio to capture the decline in rates, we are holding cash to add longer-duration bonds on upticks in rates.

Why Bonds?

If there is a risk-off event in the market, yields will drop to 1% or less providing a nice bump in appreciation in our bond portfolio. In the meantime, we are collecting a bit of income while holding the hedge.

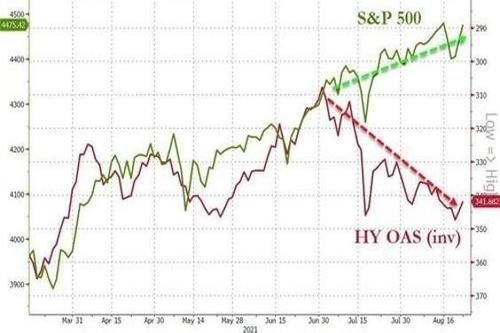

The distortions in the markets from excess accommodation continue to mount. Nowhere is this more clearly shown than in the spread between the market and CCC-rate junk bond yields.

Add to that, the collapse in consumer confidence will create a feedback look into weaker economic growth and eventually a disappointment of extremely lofty corporate earnings.

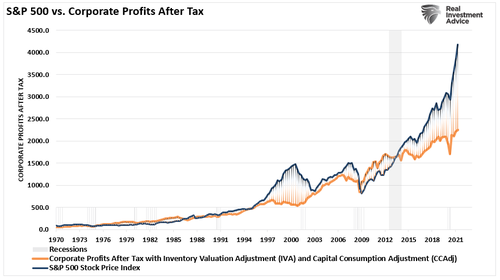

Such is highly problematic in a market that has become grossly detached from corporate profitability.

As you will note, we are indeed a tad bit more risk-averse currently, given a historically long market advance without a 5-10% correction.

While we would certainly like to be even more cautious, we still have a mandate to generate returns for clients to meet their financial goals. We realize that when the correction comes will give back some of our outperformance over our benchmark this year. However, given the current level of “irrational exuberance,” we will remain at the “back of theatre” to ensure we can get through the exit door when the time comes.

Have a great weekend.

https://ift.tt/3jrpgiF

from ZeroHedge News https://ift.tt/3jrpgiF

via IFTTT

0 comments

Post a Comment