"A More Difficult Backdrop Is Emerging": 5 Reasons Why Goldman Is Starting To Turn Bearish

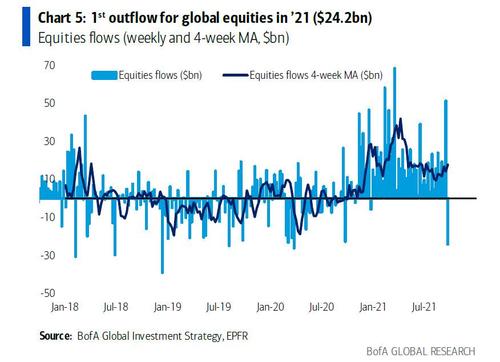

Last week's remarkable bounce in stocks from Monday's lows which, as a reminder, prompted the first outflow from equities in 2021...

... has sparked many questions among Wall Street's elite where even some of the biggest bulls are puzzled by the market's violent reversal (which, however, was predicted correctly by flow-tracking quants like Nomura's Charlie McElligott).

And it's not just the market's relentless ability to internalize any adverse market action and come out on top as a wave of BTFDers rushes in: as Goldman's strategist Chris Hussey wrote late on Friday, "one thing that is increasingly drawing our attention and was 'front and center' this week is how the economy, policy, and earnings growth appear to be rapidly transitioning away from the initial post-pandemic explosion of accommodation and activity and towards a slower pace as the brakes are pressed on a variety of key parts of the growth machine."

As Hussey further notes, growth is fine for now and even robust, with Goldman's economists forecasting over 4.5% GDP growth forecast to extend into 2022, but as he cautions "a developed economy like the US cannot grow at a 9% pace for very long --even as it catches up out of a pandemic."

Meanwhile, as he delineates below, a series of pieces may be falling into place to 'tap the brakes' on some of the torrid growth we have been seeing since vaccines were distributed earlier this year. Among these Goldman focuses on the impact of fading stimulus, supply chains, the virus, China, and even stock valuations which are "coalescing to create a more difficult backdrop for earnings growth and multiple expansion in the months, or at least years ahead."

Here are a few observations on all 5 of these potentially "braking" factors:

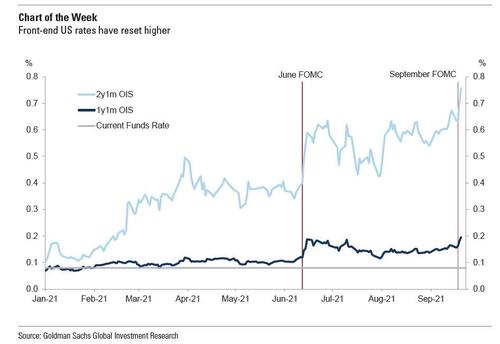

1. Stimulus. The FOMC indicated that tapering ‘may soon be warranted’ at this week’s meeting and on the back of the statement, yields on 10-year Treasuries have risen 15 bp to 1.45% while front-end rates have reset notably higher as shown in the chart below.

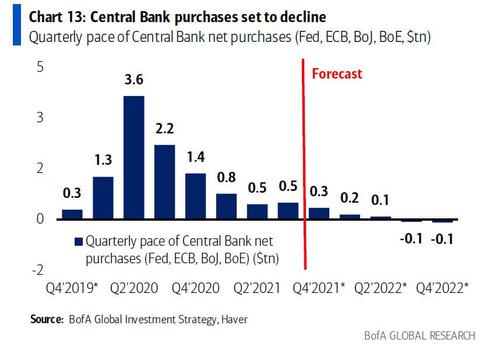

Interestingly, stocks also rose on the back of the Fed statement, consolidating the rebound from Monday's sell-off. And while the Fed has not done anything yet -- only suggested it is about to -- the wheels do seem to now be in place to wind down the central bank's latest QE program and to eventually start raising rates -- as soon as one year from now. Adding to this point, BofA's Michael Hartnett notes that global tapering has begun (ECB, BoE, BoC, RBA, Fed) which will see a sharp drop in global central liquidity which was $8.5 trillion in 2020, shrinks to $2.1trillion in 2021, and will be just $0.1 in 2022 (putting this in context, since the COVID outbreak central banks have bought $800MM of assets every hour, a number which shrinks to <$100MM in the second half of 2022).

And at the same time monetary policy appears to be shifting from the gas pedal to the brakes, fiscal policy may be as well. As we noted last week, Goldman's political economist wrote this week about the growing risks around the next US federal spending program and the debt limit extension in “Collision Course?” and “More Downside Risks from Washington.”

2. Supply Chains. The inability of companies to source parts, people, and commodities has been a major reason why we have warned about the slowing growth momentum we have observed in recent week. While Goldman is confidence that supply chain constraints are mainly a function of too rapid a recovery in demand, and so see it as a temporary problem, but for homebuilders, automobile manufacturers, and truckers it is all a supply problem today that is putting upward pressure on pricing and potentially downward pressure on margins (although margins have held up quite well so far). Case in point, on August 30 we warned that a slew of profit warnings are coming in the coming weeks, and between FedEx, Nike, PPG, and many others that's just what has happened.

If MS and BofA are right on slumping consumer demand and margin contraction we should start seeing Q3 earnings warnings in the next 2 weeks.

— zerohedge (@zerohedge) August 30, 2021

- Looking at the Homebuilders, Goldman highlights how DRI lowered its November quarter guidance due to an inability to get enough materials and labor while fellow builder LEN is also started fewer communities in the current environment.

- In Autos, the bank writes that September car sales are tracking about 25% below year-ago levels - that's versus September 2020 and the heart of the pandemic - as dealer inventories are at historically low levels. The good news for car makers: prices are strong -- although this may not be so good for inflation and Fed policy (see #1 above).

- And finally in Transports, FDX missed earnings this week as it is facing a shortage of truckers and shippers .

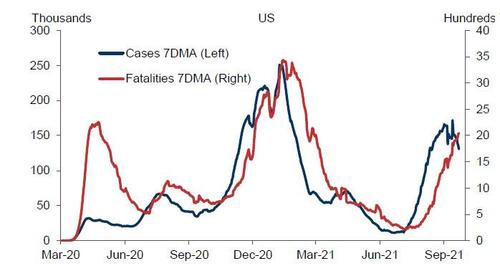

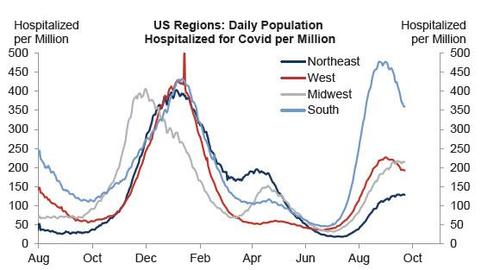

3. The virus. In addition to supply chain disruptions, Goldman previously cited the Delta variant as a reason for why they were seeing slower 3Q21 GDP growth when they lowered the bank's economic forecast back on Sep 6. Fast forward two weeks, and the summer wave of the virus does appear to have peaked...

... even in the US South -- as the chart below clearly shows.

Commenting on the chart above, Goldman said that "what we might have learned this summer is that the virus still has the ability to disrupt the pace of growth even among populations with high rates of vaccination. Growth does not appear to have been derailed this summer, but it does appear to be trending slower than most thought it would back on Memorial Day."

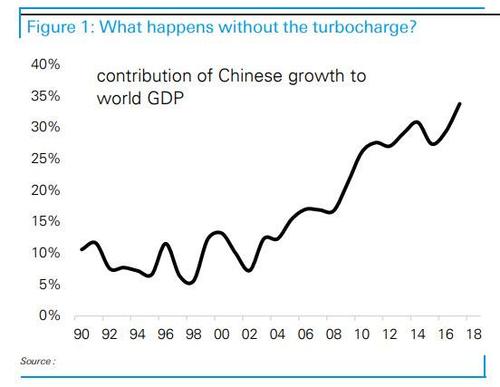

4. China. We entered this week with a lot being written about how issues surrounding China's property market are driving a global 'risk-off' sentiment shift. And we exit this week with no resolution to China's property market issues, yet the S&P 500 is UP on the week. But while it turned out that China did not derail the bull market this week, China's property market is still very big (see “The Housing Market Is Almost Frozen" - An Even Bigger Problem Emerges For China"). And uncertainties persist. Perhaps what we continue to discover is that China is no longer the sustained tailwind to global growth that it was back in the years following the Great Financial Crisis when the country was pushing double digit GDP growth rates (see "China Is Responsible For More Than A Third Of World GDP Growth - This Is A Problem".)

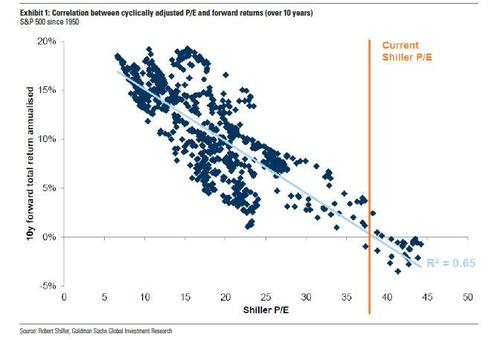

5. Valuation. According to Goldman's Hussey, "stock market valuations rarely break under their own weight" and it typically takes some other more fundamental catalyst to cause earnings to decline and investors to pay less for earnings. But as Goldman's Peter Oppenheimer highlighted in a fresh global strategy note this week, stock market returns are likely to be muted going forward relative to past cycles. Why? We are entering the current cycle with high valuations, ultra-low rates, and corporate margin headwinds from rising wages and regulation and the headwinds from de-globalization. And as the bank's chart of the week below illustrates, historically forward 10-year returns for equities have trended lower when they have started at our current elevated valuation.

Goldman's chart of the week: Valuation is not typically the cause of a bubble bursting and stocks can stay ‘expensive’ for a long time. But over a long time, the returns that you might expect to get from investing in equities tend to be far smaller when you buy stocks at high aluations than when you buy them when they are ‘cheap’.

https://ift.tt/3CR6fgx

from ZeroHedge News https://ift.tt/3CR6fgx

via IFTTT

0 comments

Post a Comment