Bank Buybacks Hit Record Propelling Stocks To All Time HIgh

One week ago, when the S&P was suddenly finding itself sliding lower, we reported that SpotGamma, Nomura and Morgan Stanley all warned that the S&P was on the verge of a very painful drawdown if stocks dipped below the key 4,350 support level, at which point a selling wave could quickly pull the S&P to 4,100 or lower. However that did not happen, preventing what could have been a very painful wipeout, as if some magical force lifted stocks higher on Thursday just as they were set to drop below they key critical.

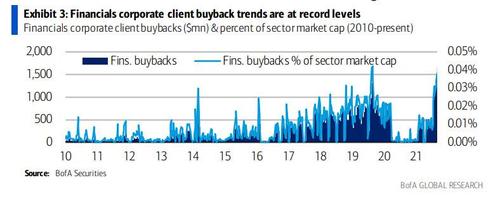

And, as we reported, we now know what that "force" was: according to Bank of America, just as the S&P was about to drop the abovementioned critical gamma level, "Financials’ weekly buybacks were the largest on record since 2010 (and near-record as a percent of market cap)."

And while buybacks saved the market last Friday, they have also done miracles in all of 2021 because as BofA adds, "YTD, trends are already the second highest level on record (since 2010) after 2019’s record, which was 16% higher than today’s."

Since that post, stocks have continued their merry meltup hitting a fresh all time high on Monday, and while many have been scratching their heads what was behind this relentless grind higher, we now may have an answer: the same catalyst that averted a painful slide on August 18: even more bank buybacks. Actually scratch that, make that record bank buybacks.

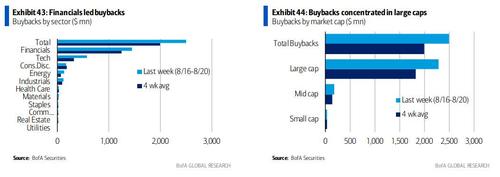

According to Bank of America's client flow strategists, while buybacks by corporate clients decelerated slightly vs.the prior week, Financials buybacks accelerated, hitting another record high.

While the implications are obvious, BofA's Jill Carey Hall reminds us that she noted last week that "the S&P 500 sector buying back the largest dollar amount in a given week has tended to outperform over the next several months with a >50% hit rate."

Expect even more buybacks ahead: as BofA calculates, YTD, corporate client buybacks across sectors are +54% y/y but are still far from

pre-COVID levels: -13% vs. 2019 at this time, and one of the weakest years postcrisis so far when normalized by market cap.

Translation: expect many more buyback-driven ramps every time stocks are about to dip below a key support level, as the banks do everything and anything to avoid a gamma wipeout.

https://ift.tt/3mVGkzC

from ZeroHedge News https://ift.tt/3mVGkzC

via IFTTT

0 comments

Post a Comment