Huarong Finally Got Its State-Backed Bailout, But Future Chinese Firms May Not Be So Lucky

Distressed Chinese asset manager China Huarong Asset Management is getting its bailout.

Citic Group, in conjunction with China's Ministry of Finance, has stepped in at the urging of the state to prevent the asset manager from becoming a massive Lehman-style blowup in China for the time being. Defaults have been avoided, according to a new Bloomberg article. While bondholders can breathe a sigh of relief, equity holders likely won't be as lucky.

The rescue of the company was announced on August 18th after months of the state trying to pin down exactly who would step in, where, to help the distressed entity.

“Beijing didn’t allow a systemically important financial institution directly owned by the central government to default on its debt, an event that had the potential to upend debt markets and possibly precipitate a financial crisis,” The Wall Street Journal wrote earlier this month.

The bailout took the form of a “recapitalization” with government funding, Forbes noted, calling it "a financial infusion (unspecified in form or amount) from a group of Chinese state-owned enterprises. It is a straight bailout, as per precedent (although many had feared precedent might not hold)."

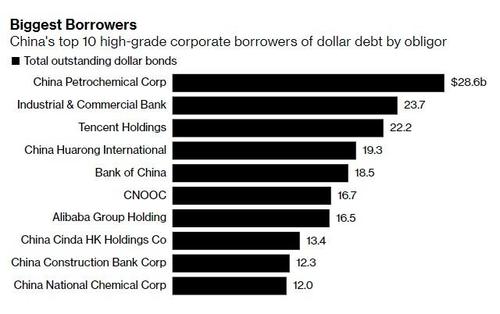

But the bailout comes against the backdrop of President Xi reining in China's major internet and tech companies with regulations that have collectively erased more than $1 trillion in shareholder value from names like Alibaba and Tencent.

Thanks to this shift in tone, Sergey Dergachev, a senior portfolio manager at Union Investment in Frankfurt, told Bloomberg he believes that after Huarong, the days of guaranteed bailouts are over: “This assumption is not valid anymore.”

Huarong borrowed extensively since the late 1990s to help it expand and safeguard other Chinese banks. The company's longtime chairman Lai Xiaomin eventually wound up being caught in a corruption scandal and finally left the asset manager this January. By the summer, it was obvious the asset manager needed help. From there, it became months of arguing and infighting amongst the state and private investors to try and organize a bailout.

Citic was eventually engaged, according to Bloomberg:

For nearly two months, a Citic team pored over the books at Huarong’s headquarters. Even at Citic, a Chinese company as connected as they come, the political nature of the task raised eyebrows. Huarong’s finances were so troubled and past dealings so fraught that some members of the Citic team worried they might be blamed for the mess. They wanted assurances that they wouldn’t be held responsible should higher ups take issue with any rescue plan later on, one of the people said.

The numbers, audited by Ernst & Young, were dire. Huarong had lost 102.9 billion yuan ($15.9 billion) in 2020, more than its combined profits since going public in 2015. It wrote off 107.8 billion yuan in bad investments.

Then, in August, the company's bailout was officially announced:

At last, terms were drawn up and the State Council, long silent about Huarong, gave its blessing to a rescue that combines a government bailout with a more market-driven recapitalization. Huarong will get about 50 billion yuan of fresh capital from a group of investors led by Citic, which will assume the Ministry of Finance’s controlling stake, people familiar have said. Huarong is expected to raise 50 billion yuan more by selling non-core financial assets. On August 18, Huarong went public with its huge losses and quickly followed up with news of its rescue.

Recall, in April we had noted that China's central bank was considering a plan to "assume more than 100 billion yuan ($15 billion) of assets from China Huarong Asset Management, helping the state-owned company clean up its balance sheet and refocus on its core business of managing distressed debt."

With Huarong out of the way, China Evergrande Group now becomes to the country's largest worry...

And for those who think these entities are all too big to fail, David Loevinger, a former senior coordinator for China affairs at the U.S. Treasury, concluded:

“Now, you cannot say that with 100% certainty,”

https://ift.tt/3BtwE3g

from ZeroHedge News https://ift.tt/3BtwE3g

via IFTTT

0 comments

Post a Comment